Region:Middle East

Author(s):Shubham

Product Code:KRAD5436

Pages:92

Published On:December 2025

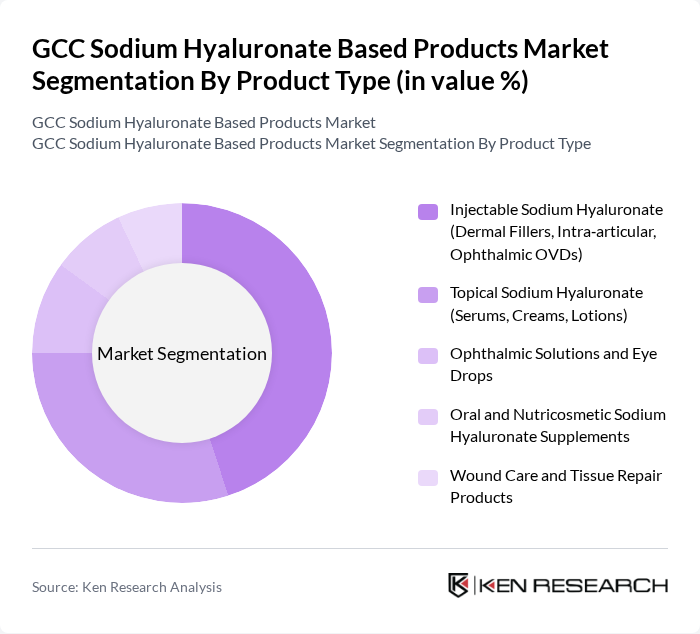

By Product Type:The product type segmentation includes various forms of sodium hyaluronate products, each catering to specific consumer needs and preferences. Injectable sodium hyaluronate, particularly in the form of dermal fillers and intra?articular injections, has gained significant traction due to its effectiveness in aesthetic facial rejuvenation and joint pain management. Topical products, such as serums and creams, are also popular for their hydration, barrier-support, and anti?aging benefits, and represent the largest global segment by revenue. The market is witnessing a growing trend towards oral nutricosmetic supplements and advanced wound care or tissue repair products incorporating sodium hyaluronate, driven by rising consumer interest in holistic beauty?from?within, healthy aging, and chronic wound management.

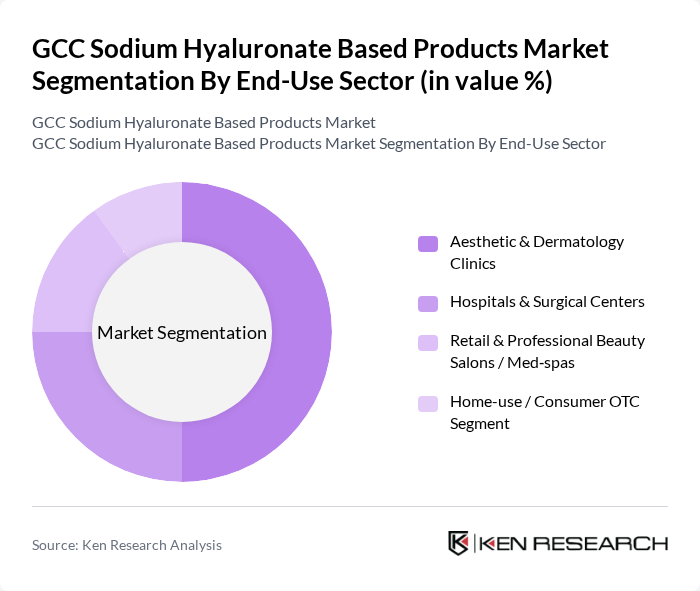

By End-Use Sector:The end-use sector segmentation highlights the various applications of sodium hyaluronate products across different industries. Aesthetic and dermatology clinics are the leading consumers of injectable products, supported by the rising popularity of non-surgical cosmetic procedures such as dermal fillers and skin boosters. Hospitals and surgical centers utilize sodium hyaluronate for therapeutic applications, particularly viscosupplementation in orthopedics and as ophthalmic viscoelastic devices in cataract and refractive surgeries. Retail and professional beauty salons or med?spas are increasingly adopting topical formulations and professional-use products featuring sodium hyaluronate for intensive hydration and anti?aging treatments, while the home?use segment is expanding with over?the?counter serums, eye drops, and oral supplements aligned with the broader self?care and wellness trend.

The GCC Sodium Hyaluronate Based Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allergan Aesthetics, an AbbVie Company, Galderma S.A., Merz Aesthetics GmbH, TEOXANE Laboratories, LG Chem Ltd. (YVOIRE), Bloomage Biotechnology Corporation Limited, Fidia Farmaceutici S.p.A., Croma-Pharma GmbH, Prollenium Medical Technologies Inc., Laboratoires Vivacy SAS, Medytox Inc., Revitacare SAS, Sinclair Pharma Ltd., Hyaltech Ltd., AMI Healthcare / Regional Distributors of Sodium Hyaluronate Products in GCC contribute to innovation, geographic expansion, differentiated product portfolios (injectables, topicals, ophthalmic solutions), and service delivery in this space.

The future of the GCC sodium hyaluronate-based products market appears promising, driven by increasing consumer demand for innovative skincare solutions. As the market evolves, companies are likely to focus on developing advanced formulations that cater to specific skin concerns. Additionally, the rise of e-commerce platforms is expected to enhance product accessibility, allowing brands to reach a broader audience. This shift towards digital sales channels will likely reshape the competitive landscape, fostering growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Injectable Sodium Hyaluronate (Dermal Fillers, Intra?articular, Ophthalmic OVDs) Topical Sodium Hyaluronate (Serums, Creams, Lotions) Ophthalmic Solutions and Eye Drops Oral and Nutricosmetic Sodium Hyaluronate Supplements Wound Care and Tissue Repair Products |

| By End-Use Sector | Aesthetic & Dermatology Clinics Hospitals & Surgical Centers Retail & Professional Beauty Salons / Med?spas Home-use / Consumer OTC Segment |

| By Distribution Channel | Hospital & Clinic Pharmacies Retail Pharmacies & Drug Stores Online Pharmacies & E?commerce Platforms Direct-to-Consumer (D2C) / Professional Distributors |

| By Application | Aesthetic & Cosmetic Dermatology (Fillers, Skin Rejuvenation) Orthopedics & Rheumatology (Viscosupplementation) Ophthalmology (Dry Eye, OVDs) Wound Care, Tissue Engineering & Drug Delivery Personal Care & Cosmetics (Hydration, Anti?aging) |

| By Country | United Arab Emirates (UAE) Kingdom of Saudi Arabia Qatar Kuwait Oman Bahrain |

| By Formulation | Single-crosslinked Gel Formulations Biphasic and Monophasic Dermal Filler Gels Multi?molecular Weight Liquid Solutions Sustained-release and Combination Formulations |

| By Packaging Type | Pre?filled Syringes & Injection Kits Vials, Ampoules & Bottles Tubes, Airless Pumps & Sachets Single?dose Units & Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetic Product Manufacturers | 95 | Product Development Managers, Marketing Directors |

| Pharmaceutical Companies | 75 | Regulatory Affairs Specialists, R&D Managers |

| Healthcare Professionals | 110 | Dermatologists, Plastic Surgeons |

| Retailers of Beauty Products | 85 | Store Managers, Category Buyers |

| End-Consumers of Sodium Hyaluronate Products | 140 | Beauty Enthusiasts, Regular Users of Skincare Products |

The GCC Sodium Hyaluronate Based Products Market is valued at approximately USD 1.1 billion, reflecting a significant growth trajectory influenced by rising demand for aesthetic procedures and advancements in medical technology.