Region:Middle East

Author(s):Dev

Product Code:KRAC3430

Pages:91

Published On:October 2025

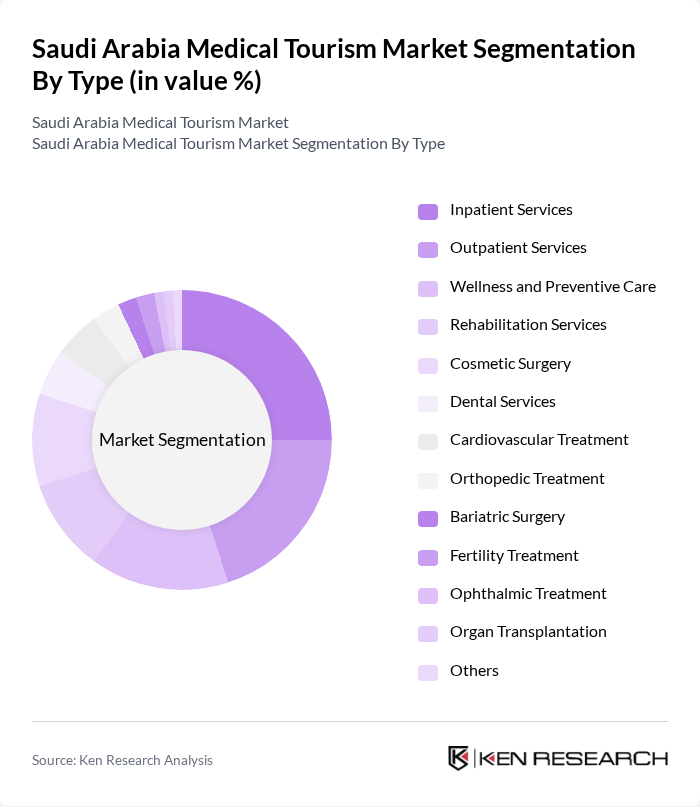

By Type:The market is segmented into various types of medical services, including Inpatient Services, Outpatient Services, Wellness and Preventive Care, Rehabilitation Services, Cosmetic Surgery, Dental Services, Cardiovascular Treatment, Orthopedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Organ Transplantation, and Others. Each of these segments caters to specific patient needs and preferences, reflecting the diverse nature of medical tourism .

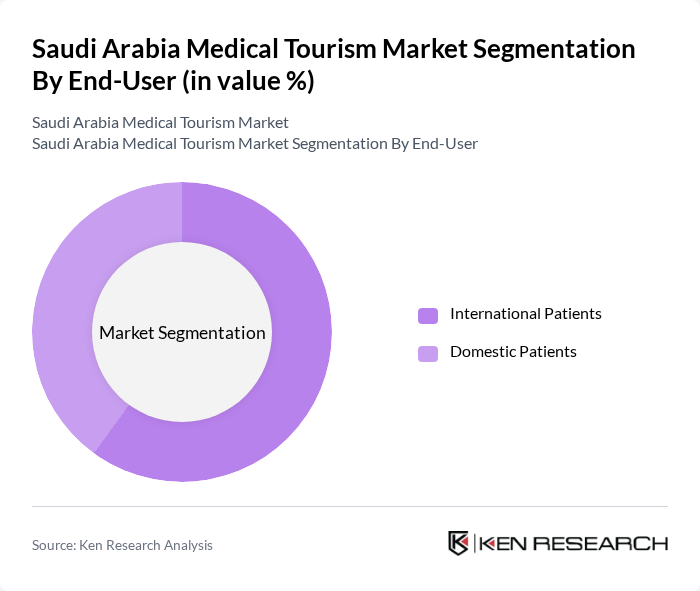

By End-User:The market is segmented into International Patients and Domestic Patients. International patients are increasingly seeking medical services in Saudi Arabia due to the high quality of care and competitive pricing. Domestic patients also contribute significantly to the market, as they often prefer local healthcare facilities for convenience and accessibility .

The Saudi Arabia Medical Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as King Faisal Specialist Hospital & Research Centre, Saudi German Hospital, Dallah Hospital, Dr. Sulaiman Al Habib Medical Group, International Medical Center, Al Noor Specialist Hospital, Riyadh Care Hospital, Al Mouwasat Hospital, Al Jazeera Hospital, Al Qassim National Hospital, Al Mufeed Hospital, Al Ameen Medical Center, King Abdulaziz Medical City, King Fahad Medical City, King Saud Medical City contribute to innovation, geographic expansion, and service delivery in this space.

The future of Saudi Arabia's medical tourism market appears promising, driven by ongoing investments in healthcare infrastructure and a growing emphasis on patient-centric services. As the country enhances its international marketing efforts, it is likely to attract a more diverse patient demographic. Additionally, the integration of advanced technologies, such as telemedicine, will facilitate better patient engagement and accessibility, further solidifying Saudi Arabia's position as a leading medical tourism destination in the Middle East.

| Segment | Sub-Segments |

|---|---|

| By Type | Inpatient Services Outpatient Services Wellness and Preventive Care Rehabilitation Services Cosmetic Surgery Dental Services Cardiovascular Treatment Orthopedic Treatment Bariatric Surgery Fertility Treatment Ophthalmic Treatment Organ Transplantation Others |

| By End-User | International Patients Domestic Patients |

| By Service Provider | Private Hospitals Public Hospitals Specialty Clinics Wellness Centers |

| By Destination | Major Cities (Riyadh, Jeddah, Dammam) Northern & Central Regions Rural Healthcare Facilities |

| By Payment Method | Insurance Coverage Out-of-Pocket Payments Medical Tourism Packages |

| By Duration of Stay | Short-term Visits Long-term Stays |

| By Age Group | Children Adults Seniors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| International Patient Experiences | 100 | Patients who traveled for elective surgeries, cosmetic procedures |

| Healthcare Provider Insights | 60 | Hospital Administrators, Medical Directors |

| Medical Tourism Facilitators | 50 | Travel Agents, Medical Tourism Coordinators |

| Government Policy Impact | 40 | Healthcare Policy Makers, Regulatory Officials |

| Market Trends and Challenges | 45 | Healthcare Economists, Industry Analysts |

The Saudi Arabia Medical Tourism Market is valued at approximately USD 1.3 billion, driven by significant investments in healthcare infrastructure and advanced medical technologies, attracting international patients seeking high-quality and affordable medical services.