Region:Middle East

Author(s):Dev

Product Code:KRAC4055

Pages:100

Published On:October 2025

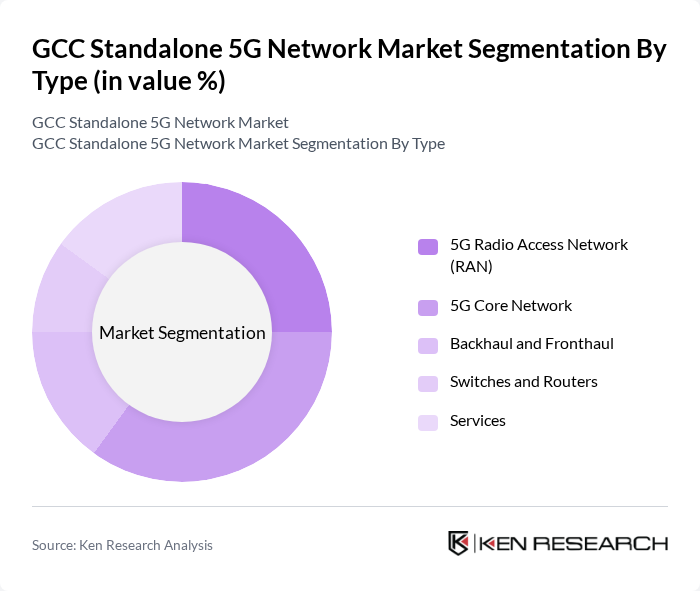

By Type:The market is segmented into 5G Radio Access Network (RAN), 5G Core Network, Backhaul and Fronthaul, Switches and Routers, and Services. The 5G Core Network currently dominates the market due to its essential role in managing data traffic, network slicing, and enabling advanced services such as ultra-reliable low-latency communications (URLLC). The rising demand for low-latency applications, real-time data processing, and enhanced mobile broadband is driving the adoption of core network solutions, particularly among telecom operators and enterprise clients seeking robust digital transformation.

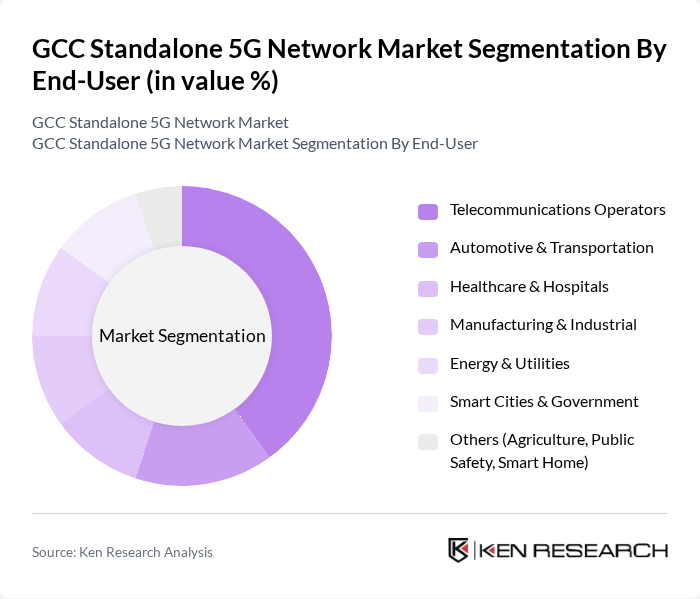

By End-User:The end-user segmentation includes Telecommunications Operators, Automotive & Transportation, Healthcare & Hospitals, Manufacturing & Industrial, Energy & Utilities, Smart Cities & Government, and Others. Telecommunications Operators are the leading end-users, driven by the need to enhance network capabilities, support massive IoT deployments, and provide superior services to consumers. The growing demand for mobile data, expansion of 5G-enabled industrial automation, and integration of 5G in critical infrastructure sectors are key factors contributing to their dominance.

The GCC Standalone 5G Network Market is characterized by a dynamic mix of regional and international players. Leading participants such as Etisalat Group, STC Group (Saudi Telecom Company), Ooredoo Group, du (Emirates Integrated Telecommunications Company), Zain Group, Vodafone Qatar, Batelco (Bahrain Telecommunications Company), Mobily (Etihad Etisalat Company), Huawei Technologies Co., Ltd., Ericsson, Nokia Corporation, Samsung Electronics Co., Ltd., Cisco Systems, Inc., Qualcomm Technologies, Inc., Oracle Corporation, NEC Corporation, Juniper Networks, Inc., Affirmed Networks (Microsoft), Mavenir Systems, Inc., Amdocs Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC standalone 5G network market appears promising, driven by technological advancements and increasing consumer demand. As governments continue to invest in digital infrastructure, the region is likely to see enhanced connectivity and the proliferation of smart technologies. The integration of AI and machine learning into network management will optimize performance and reduce operational costs. Additionally, the focus on sustainability will encourage the adoption of energy-efficient technologies, further supporting the growth of the 5G ecosystem in the GCC.

| Segment | Sub-Segments |

|---|---|

| By Type | G Radio Access Network (RAN) G Core Network Backhaul and Fronthaul Switches and Routers Services |

| By End-User | Telecommunications Operators Automotive & Transportation Healthcare & Hospitals Manufacturing & Industrial Energy & Utilities Smart Cities & Government Others (Agriculture, Public Safety, Smart Home) |

| By Application | Smart Cities Industrial Automation Remote Healthcare Autonomous Vehicles Entertainment and Media Others |

| By Component | Hardware Software Services |

| By Spectrum | Sub-6 GHz mmWave |

| By Network Type | Public Private |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators | 100 | Network Engineers, Operations Managers |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| Enterprise Users of 5G | 70 | IT Managers, Business Development Executives |

| Consumer Insights | 120 | General Consumers, Tech Enthusiasts |

| Industry Analysts | 40 | Market Researchers, Telecom Analysts |

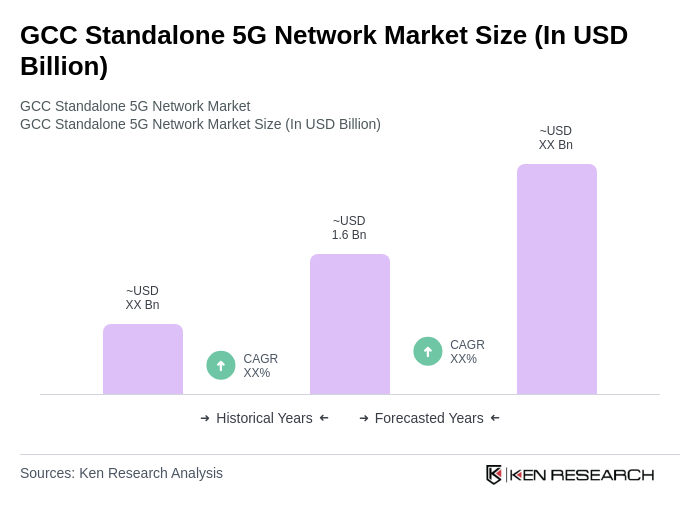

The GCC Standalone 5G Network Market is valued at approximately USD 1.6 billion, reflecting significant growth driven by high-speed internet demand, IoT proliferation, and government investments in telecommunications infrastructure.