Region:Middle East

Author(s):Shubham

Product Code:KRAD5480

Pages:87

Published On:December 2025

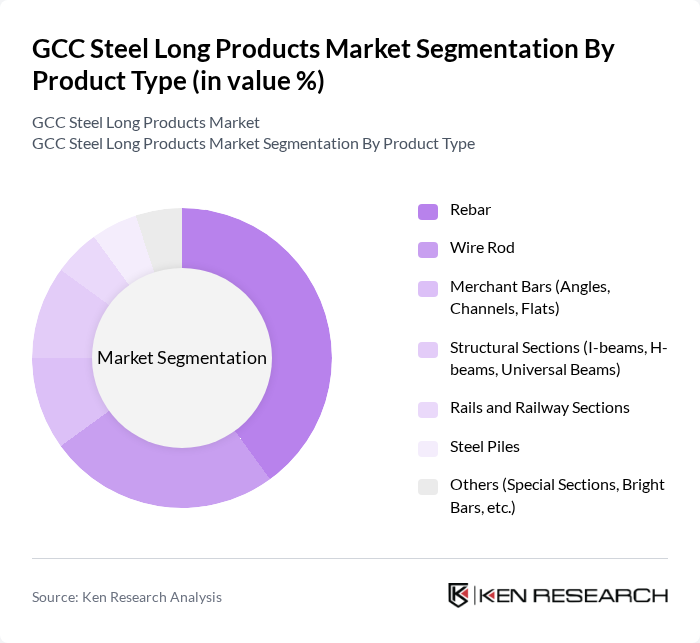

By Product Type:The product type segmentation includes various categories such as Rebar, Wire Rod, Merchant Bars (Angles, Channels, Flats), Structural Sections (I-beams, H-beams, Universal Beams), Rails and Railway Sections, Steel Piles, and Others (Special Sections, Bright Bars, etc.). This structure is consistent with the way long steel products are categorized globally. Among these, Rebar is the leading subsegment due to its extensive use in residential, commercial, and infrastructure construction, particularly for reinforced concrete structures across GCC building and civil works. The Wire Rod segment also shows significant growth, primarily used in manufacturing of mesh, fasteners, welding electrodes, and in construction applications such as reinforcing wire and prestressed concrete strands.

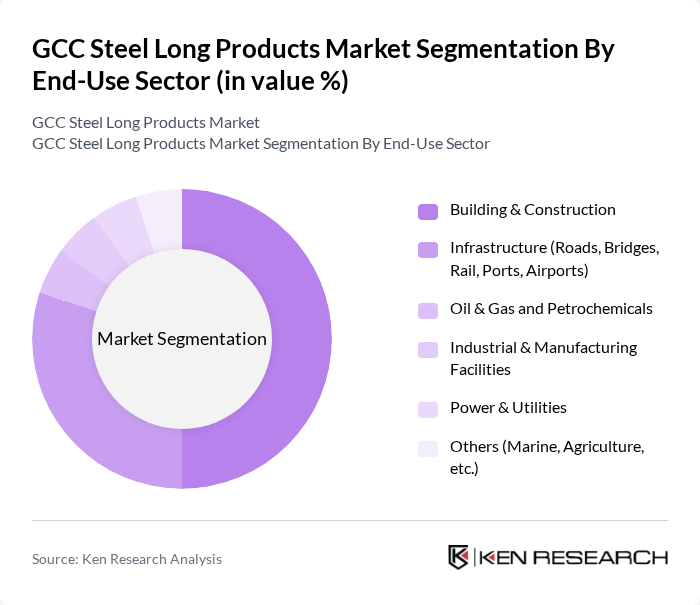

By End-Use Sector:The end-use sector segmentation includes Building & Construction, Infrastructure (Roads, Bridges, Rail, Ports, Airports), Oil & Gas and Petrochemicals, Industrial & Manufacturing Facilities, Power & Utilities, and Others (Marine, Agriculture, etc.). This segmentation aligns with the primary demand centers for long steel products globally and in the Middle East. The Building & Construction sector is the dominant segment, driven by ongoing urbanization, housing programs, commercial real estate, and mixed-use developments across GCC cities. The Infrastructure sector also plays a crucial role, with significant investments in highways, bridges, metros, rail, ports, airports, and utility corridors enhancing the demand for rebar, structural sections, and piles in long products.

The GCC Steel Long Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Steel Arkan (UAE), Qatar Steel Company (Qatar), Saudi Iron and Steel Company (Hadeed) – SABIC (Saudi Arabia), Al Ittefaq Steel Products Co. (ISPC) (Saudi Arabia), Jindal Shadeed Iron & Steel LLC (Oman), SULB Company B.S.C. (Bahrain), Al Rajhi Steel Industries Co. (Saudi Arabia), United Steel Company (Foulath Holding) (Bahrain), Oman United Steel Industries LLC (Oman), Gulf Steel Industries Co. LLC (UAE), Al Jazeera Steel Products Co. SAOG (Oman), Union Iron & Steel Company LLC (UAE), Al Yamamah Steel Industries Co. (Saudi Arabia), Al Ghurair Iron & Steel LLC (UAE), Qatar National Aluminum & Steel Factory (Qatar) contribute to innovation, geographic expansion, and service delivery in this space.

The GCC steel long products market is poised for significant transformation, driven by a focus on sustainability and technological advancements. As governments push for greener manufacturing practices, the adoption of eco-friendly steel production methods is expected to rise. Additionally, the integration of automation and AI in production processes will enhance efficiency and reduce costs. These trends will likely shape the market landscape, fostering innovation and attracting investments in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Rebar Wire Rod Merchant Bars (Angles, Channels, Flats) Structural Sections (I-beams, H-beams, Universal Beams) Rails and Railway Sections Steel Piles Others (Special Sections, Bright Bars, etc.) |

| By End-Use Sector | Building & Construction Infrastructure (Roads, Bridges, Rail, Ports, Airports) Oil & Gas and Petrochemicals Industrial & Manufacturing Facilities Power & Utilities Others (Marine, Agriculture, etc.) |

| By Application | Reinforced Concrete (Foundations, Slabs, Columns) Structural Steel Frames Precast & Prefabricated Elements Steel for Infrastructure Projects (Bridges, Rail, Ports) Fabricated Steel Components & Engineering Uses Others |

| By Sales Channel | Direct Sales to EPC Contractors & End-Users Sales via Steel Service Centers & Stockists Sales via Distributors & Traders Export Sales within GCC and to Neighboring Regions Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Production Route | Electric Arc Furnace (EAF) Basic Oxygen Furnace (BOF) Induction Furnace Others (Hybrid/Integrated Routes) |

| By Raw Material Source | Scrap-Based Steel DRI/HBI-Based Steel Mixed/Other Sources |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Steel Usage | 120 | Project Managers, Procurement Officers |

| Manufacturing Industry Steel Demand | 100 | Operations Managers, Supply Chain Directors |

| Retail Distribution of Long Steel Products | 80 | Sales Managers, Retail Buyers |

| Infrastructure Development Projects | 70 | Government Officials, Urban Planners |

| Steel Recycling and Sustainability Initiatives | 60 | Sustainability Managers, Environmental Consultants |

The GCC Steel Long Products Market is valued at approximately USD 6 billion, driven by increasing demand for construction and infrastructure development across the region, particularly due to initiatives like Saudi Arabias Vision 2030 and Qatars post-World Cup projects.