Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5959

Pages:82

Published On:December 2025

By Type:The market is segmented into four types of sterile tubing welders: Automatic Sterile Tubing Welders, Manual Sterile Tubing Welders, Battery-Operated / Portable Sterile Tubing Welders, and Benchtop Sterile Tubing Welders. Among these, Automatic Sterile Tubing Welders are leading the market due to their efficiency, precision, ability to handle high volumes of production, consistent weld quality, reduced manual intervention, and minimized operator error in cleanroom manufacturing settings. The increasing demand for automation in healthcare processes is driving the adoption of these systems, as they reduce human error and enhance productivity.

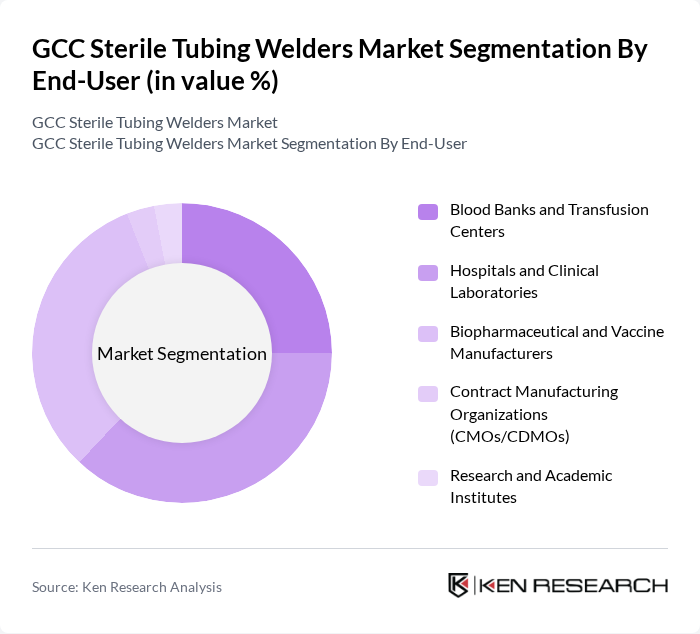

By End-User:The end-user segmentation includes Blood Banks and Transfusion Centers, Hospitals and Clinical Laboratories, Biopharmaceutical and Vaccine Manufacturers, Contract Manufacturing Organizations (CMOs/CDMOs), and Research and Academic Institutes. The Biopharmaceutical and Vaccine Manufacturers segment is currently dominating the market due to the increasing focus on vaccine production, biologics, cell-based therapies, and the need for sterile processing in biopharmaceutical manufacturing. This trend is further fueled by the global health crisis, which has heightened the demand for efficient and reliable sterile tubing solutions.

The GCC Sterile Tubing Welders Market is characterized by a dynamic mix of regional and international players. Leading participants such as Terumo Blood and Cell Technologies, Sartorius Stedim Biotech S.A., Cytiva (Danaher Corporation), Entegris, Inc. (Including Formerly Nordson Medical / Value Plastics Assets Where Applicable), Pall Corporation (A Danaher Company), GE Healthcare Technologies Inc., Eppendorf SE, Parker Hannifin Corporation, Saint?Gobain Life Sciences, Merck KGaA (MilliporeSigma Life Science), Thermo Fisher Scientific Inc., OriGen Biomedical, Inc., Vante Biopharm / SEBRA (Part of Nordson Corporation), MGA Technologies, Flexonics / Other Regional OEM and System Integrators Active in GCC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC sterile tubing welders market appears promising, driven by technological advancements and increasing healthcare investments. As the region continues to prioritize healthcare infrastructure, the demand for efficient and reliable sterile solutions is expected to rise. Additionally, the integration of automation and IoT technologies in production processes will enhance operational efficiency, further propelling market growth. Companies that adapt to these trends will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Automatic Sterile Tubing Welders Manual Sterile Tubing Welders Battery-Operated / Portable Sterile Tubing Welders Benchtop Sterile Tubing Welders |

| By End-User | Blood Banks and Transfusion Centers Hospitals and Clinical Laboratories Biopharmaceutical and Vaccine Manufacturers Contract Manufacturing Organizations (CMOs/CDMOs) Research and Academic Institutes |

| By Application | Blood and Blood Component Processing Biopharmaceutical and Cell Therapy Manufacturing Vaccine and Plasma Fractionation Single?Use System Assembly and Changeover |

| By Material Type | PVC and EVA Tubing Polyolefin and TPE Tubing Silicone and Thermoplastic Elastomer Tubing Others |

| By Region | Saudi Arabia UAE Qatar Kuwait Oman Bahrain |

| By Distribution Channel | Direct Sales by OEMs Regional Distributors and System Integrators Online / E?Procurement Platforms Group Purchasing Organizations (GPOs) and Tender-Based Sales |

| By Technology | Heat Sealing / Thermal Welding Automatic Rotary Welding Infrared / Laser-Based Sterile Welding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Device Manufacturers | 100 | Production Managers, R&D Directors |

| Healthcare Facilities | 80 | Procurement Officers, Facility Managers |

| Regulatory Bodies | 40 | Compliance Officers, Policy Makers |

| Research Institutions | 60 | Research Scientists, Lab Managers |

| Industry Experts and Consultants | 40 | Market Analysts, Technical Consultants |

The GCC Sterile Tubing Welders Market is valued at approximately USD 25 million, driven by the increasing demand for sterile medical devices and advancements in healthcare infrastructure across the region.