Region:North America

Author(s):Dev

Product Code:KRAA1645

Pages:99

Published On:August 2025

By Type:The contract manufacturing services market can be segmented into various types, including Electronics Manufacturing Services (EMS), Medical Device Contract Manufacturing, Pharmaceutical & Biopharmaceutical Contract Manufacturing (CMO/CDMO), Aerospace & Defense Manufacturing Services, Automotive & EV Components Manufacturing, Industrial & Robotics Equipment Manufacturing, and Consumer Products & Appliances Manufacturing. Among these, Electronics Manufacturing Services (EMS) is the leading segment due to the rapid growth of the electronics industry and the increasing demand for consumer electronics.

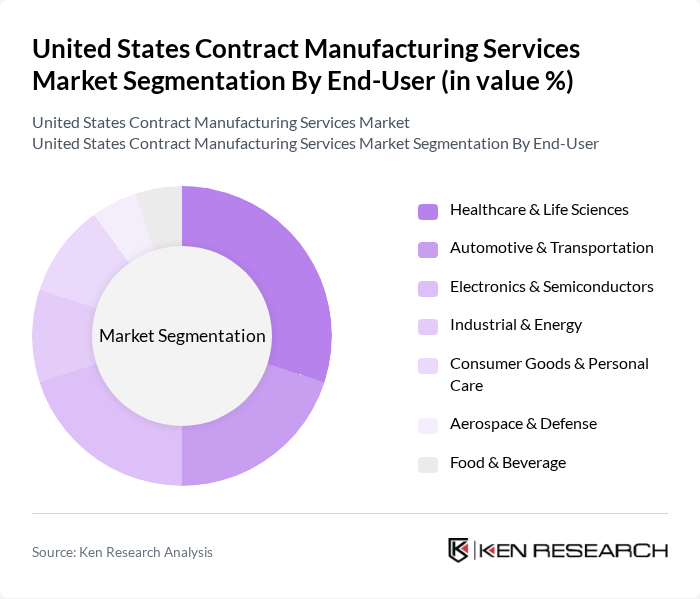

By End-User:The end-user segmentation of the contract manufacturing services market includes Healthcare & Life Sciences, Automotive & Transportation, Electronics & Semiconductors, Industrial & Energy, Consumer Goods & Personal Care, Aerospace & Defense, and Food & Beverage. The Healthcare & Life Sciences segment is currently the most significant due to the increasing demand for medical devices and pharmaceuticals, driven by an aging population and advancements in healthcare technology.

The United States Contract Manufacturing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Flex Ltd., Jabil Inc., Celestica Inc., Sanmina Corporation, Benchmark Electronics, Inc., Plexus Corp., Kimball Electronics, Inc., Nortech Systems Incorporated, Asteelflash (part of USI/ASE Group), Epec Engineered Technologies, Vexos, Axiom Electronics, Creation Technologies, West Pharmaceutical Services, Inc., Thermo Fisher Scientific (Patheon) – Pharma Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States contract manufacturing services market appears promising, driven by ongoing technological advancements and a shift towards more sustainable practices. As companies increasingly adopt automation and digital solutions, operational efficiencies are expected to improve significantly. Additionally, the growing emphasis on sustainability will likely lead to innovative manufacturing processes that reduce environmental impact. These trends will create a dynamic landscape, fostering collaboration and strategic partnerships among industry players to enhance competitiveness and responsiveness to market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronics Manufacturing Services (EMS) Medical Device Contract Manufacturing Pharmaceutical & Biopharmaceutical Contract Manufacturing (CMO/CDMO) Aerospace & Defense Manufacturing Services Automotive & EV Components Manufacturing Industrial & Robotics Equipment Manufacturing Consumer Products & Appliances Manufacturing |

| By End-User | Healthcare & Life Sciences Automotive & Transportation Electronics & Semiconductors Industrial & Energy Consumer Goods & Personal Care Aerospace & Defense Food & Beverage |

| By Service Type | Design & Engineering Prototyping & NPI (New Product Introduction) Contract Manufacturing & Fabrication Assembly & Integration Testing, Inspection & Quality Assurance Packaging, Sterilization & Fulfillment |

| By Production Volume | Low-Volume/High-Mix Mid-Volume High-Volume Custom/Prototype Make-to-Order/Configure-to-Order |

| By Geographic Focus | Domestic U.S. Manufacturing Export-Oriented Manufacturing Nearshoring/U.S.–Mexico–Canada (USMCA) Supply Dual Sourcing/China+1 Strategies |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time & Materials Contracts Build-to-Print/Build-to-Spec |

| By Industry Standards Compliance | ISO 9001/ISO 13485 FDA cGMP/21 CFR (Medical & Pharma) AS9100/ITAR (Aerospace & Defense) IATF 16949 (Automotive) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Contract Manufacturing | 100 | Production Managers, Quality Control Directors |

| Electronics Assembly Services | 80 | Operations Managers, Supply Chain Coordinators |

| Consumer Goods Manufacturing | 90 | Procurement Specialists, Product Development Managers |

| Aerospace Component Manufacturing | 70 | Engineering Managers, Compliance Officers |

| Automotive Parts Manufacturing | 85 | Logistics Managers, Quality Assurance Leads |

The United States Contract Manufacturing Services Market is valued at approximately USD 225 billion, reflecting a significant growth trend driven by outsourcing, technological advancements, and reshoring efforts to enhance supply chain resilience.