Region:Europe

Author(s):Rebecca

Product Code:KRAB3563

Pages:96

Published On:October 2025

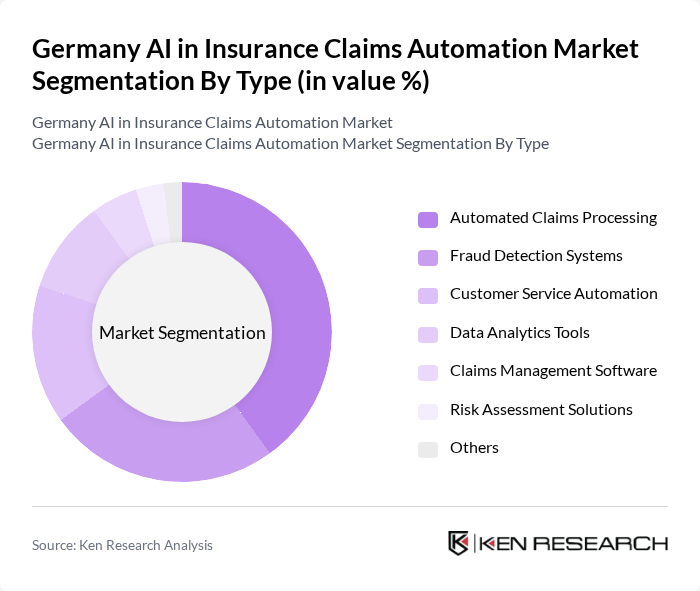

By Type:The market is segmented into various types, including Automated Claims Processing, Fraud Detection Systems, Customer Service Automation, Data Analytics Tools, Claims Management Software, Risk Assessment Solutions, and Others. Among these, Automated Claims Processing is the leading sub-segment, driven by the need for efficiency and speed in handling claims. The increasing complexity of claims and the demand for quick resolutions have made automation a priority for insurers.

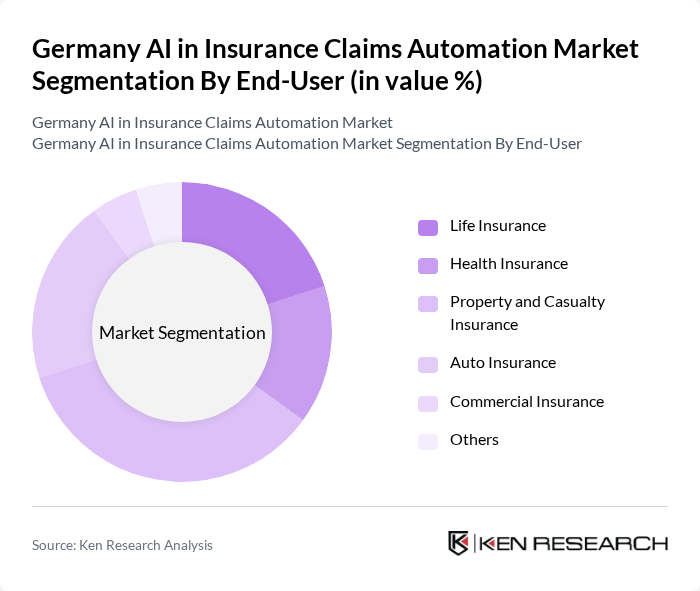

By End-User:The end-user segmentation includes Life Insurance, Health Insurance, Property and Casualty Insurance, Auto Insurance, Commercial Insurance, and Others. The Property and Casualty Insurance segment is currently the most significant, as it encompasses a wide range of claims that require efficient processing and fraud detection, making it a prime candidate for AI-driven solutions.

The Germany AI in Insurance Claims Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz SE, Munich Re, AXA Germany, ERGO Group AG, Talanx AG, Generali Deutschland AG, Zurich Insurance Group, HDI Global SE, Wüstenrot & Württembergische AG, R+V Versicherung AG, Signal Iduna Group, Baloise Holding AG, Aegon N.V., Chubb Limited, and Hannover Re contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in insurance claims automation in Germany appears promising, driven by technological advancements and evolving consumer expectations. As insurers increasingly adopt AI solutions, the focus will shift towards enhancing customer experiences and operational efficiencies. The integration of AI with emerging technologies like blockchain and IoT will further streamline claims processes. Additionally, regulatory frameworks will likely evolve to support innovation while ensuring consumer protection, fostering a conducive environment for growth in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Claims Processing Fraud Detection Systems Customer Service Automation Data Analytics Tools Claims Management Software Risk Assessment Solutions Others |

| By End-User | Life Insurance Health Insurance Property and Casualty Insurance Auto Insurance Commercial Insurance Others |

| By Application | Claims Processing Customer Support Risk Management Fraud Prevention Compliance Monitoring Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Online Sales Distributors Partners and Alliances |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Policy Support | Subsidies for AI Adoption Tax Incentives for Digital Transformation Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Claims Automation | 100 | Claims Managers, IT Directors |

| Auto Insurance Claims Processing | 80 | Claims Adjusters, Operations Managers |

| Property Insurance AI Solutions | 70 | Product Managers, Technology Officers |

| Fraud Detection in Claims | 60 | Fraud Analysts, Risk Management Executives |

| Customer Experience in Claims Handling | 90 | Customer Service Managers, UX Designers |

The Germany AI in Insurance Claims Automation Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of AI technologies aimed at enhancing operational efficiency and customer experience in the insurance sector.