Region:Africa

Author(s):Geetanshi

Product Code:KRAB3417

Pages:87

Published On:October 2025

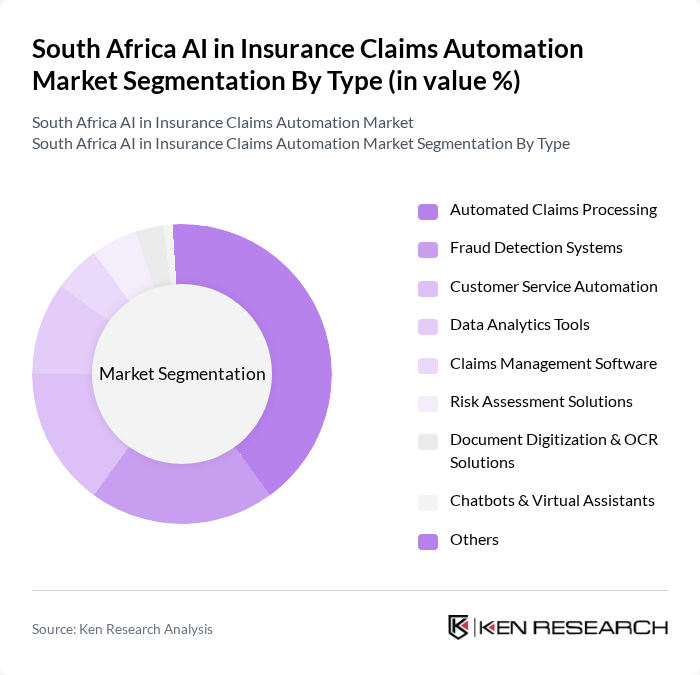

By Type:The market is segmented into various types of AI solutions that cater to different aspects of claims automation. The leading sub-segment is Automated Claims Processing, which is gaining traction due to its ability to significantly reduce processing times and improve accuracy. Other notable segments include Fraud Detection Systems and Customer Service Automation, which are increasingly being adopted to enhance operational efficiency and customer satisfaction. Machine learning technologies dominate the AI implementation landscape, with natural language processing and predictive analytics transforming core insurance functions.

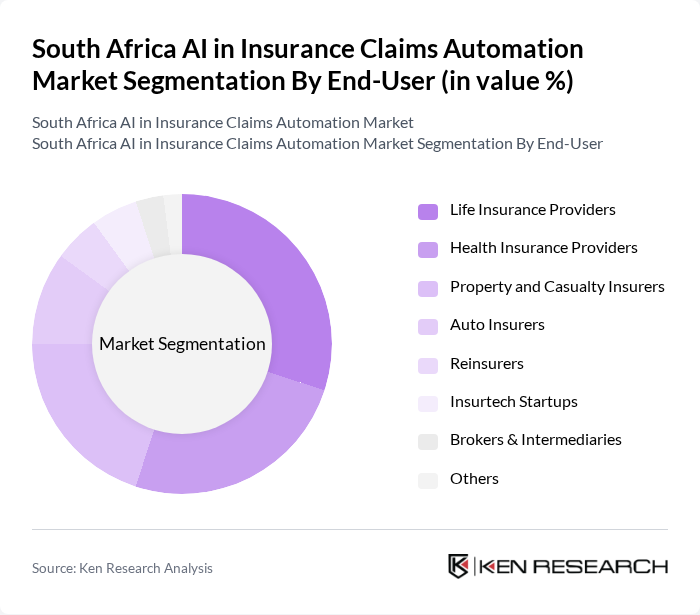

By End-User:The end-user segmentation includes various types of insurance providers that utilize AI in their claims processes. Life Insurance Providers and Health Insurance Providers are the dominant segments, driven by the need for efficient claims processing and customer service. Property and Casualty Insurers also represent a significant portion of the market, as they increasingly adopt AI solutions to manage claims more effectively. The life and health insurance segment particularly benefits from AI-driven personalization and risk assessment capabilities.

The South Africa AI in Insurance Claims Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Discovery Limited, Old Mutual Limited, Santam Limited, Hollard Insurance, Momentum Metropolitan Holdings, Liberty Holdings Limited, OUTsurance Holdings Limited, Telesure Investment Holdings, Guardrisk Insurance Company Limited, MiWay Insurance Limited, King Price Insurance, Lemonade Inc., Shift Technology, PolicyBazaar South Africa, Pineapple Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African AI in insurance claims automation market appears promising, driven by technological advancements and increasing consumer expectations. As insurers continue to embrace digital transformation, the integration of AI with IoT technologies is expected to enhance data collection and analysis capabilities. Furthermore, the focus on customer-centric models will likely lead to the development of tailored insurance products, fostering innovation and competition within the industry. Overall, the market is poised for significant evolution in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Claims Processing Fraud Detection Systems Customer Service Automation Data Analytics Tools Claims Management Software Risk Assessment Solutions Document Digitization & OCR Solutions Chatbots & Virtual Assistants Others |

| By End-User | Life Insurance Providers Health Insurance Providers Property and Casualty Insurers Auto Insurers Reinsurers Insurtech Startups Brokers & Intermediaries Others |

| By Application | Claims Processing Automation Customer Support Automation Fraud Detection & Prevention Risk Management & Underwriting Compliance Monitoring & Reporting Policy Administration Others |

| By Distribution Channel | Direct Insurer Sales Online Platforms & Aggregators Insurance Brokers Partnerships with Technology Providers Bancassurance Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Company Size | Large Enterprises Medium Enterprises Small Enterprises Insurtech Startups Others |

| By Policy Support | Subsidies for AI Adoption Tax Incentives for Technology Investments Grants for Research and Development Regulatory Sandboxes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Claims Automation | 50 | Claims Managers, IT Directors |

| Auto Insurance Claims Processing | 60 | Operations Managers, Customer Experience Leads |

| Property Insurance Claims Management | 50 | Underwriters, Risk Assessment Officers |

| Insurance Technology Adoption | 70 | Chief Technology Officers, Innovation Managers |

| Consumer Experience with Claims Automation | 50 | Policyholders, Customer Service Representatives |

The South Africa AI in Insurance Claims Automation Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the adoption of AI technologies aimed at enhancing operational efficiency and customer experience in the insurance sector.