Region:Europe

Author(s):Geetanshi

Product Code:KRAD0056

Pages:88

Published On:August 2025

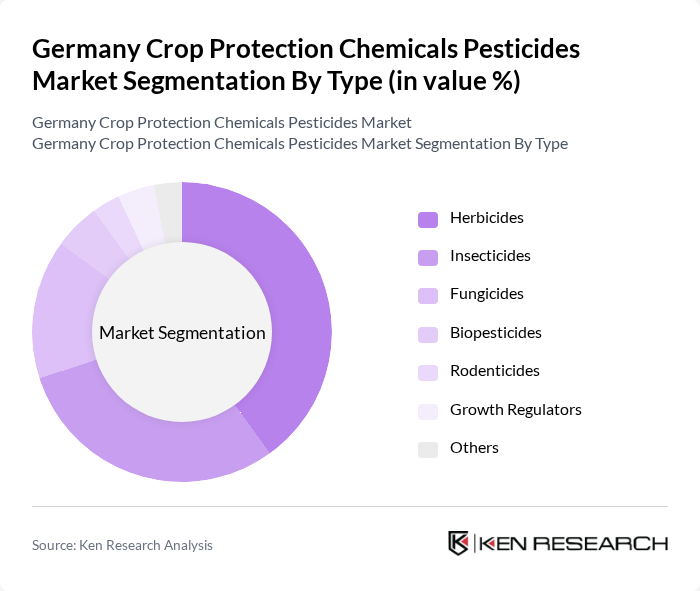

By Type:The market is segmented into various types of crop protection chemicals, including herbicides, insecticides, fungicides, biopesticides, rodenticides, growth regulators, and others. Herbicides and insecticides are the most widely used due to their effectiveness in controlling weeds and pests, which are critical for maintaining crop health and productivity. The increasing focus on sustainable agriculture is also driving the growth of biopesticides, which are gaining popularity for their lower environmental impact .

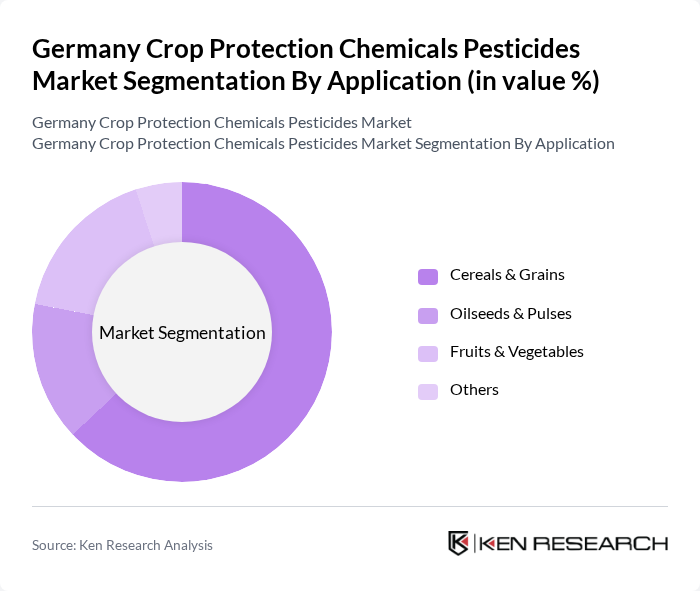

By Application:The application of crop protection chemicals is categorized into cereals & grains, oilseeds & pulses, fruits & vegetables, and others. Cereals and grains dominate the market due to their significant contribution to food production and the high prevalence of pests affecting these crops. The increasing demand for oilseeds and pulses, driven by health trends and dietary changes, is also contributing to the growth of this segment. Fruits and vegetables are the fastest-growing segment, driven by rising demand for fresh produce and the need to address crop losses from pests and diseases .

The Germany Crop Protection Chemicals Pesticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer AG, BASF SE, Syngenta Group, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions Ltd., UPL Limited, Nufarm Limited, Sumitomo Chemical Co., Ltd., PI Industries, Wynca Group (Wynca Chemicals), Belchim Crop Protection, Albaugh LLC, Cheminova A/S, Isagro S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany crop protection chemicals pesticides market is poised for transformation, driven by a strong emphasis on sustainability and technological innovation. As farmers increasingly adopt integrated pest management and precision agriculture techniques, the demand for advanced, eco-friendly pesticides will rise. Additionally, the ongoing development of biopesticides and organic solutions will create new avenues for growth, aligning with regulatory trends and consumer preferences for sustainable agricultural practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Insecticides Fungicides Biopesticides Rodenticides Growth Regulators Others |

| By Application | Cereals & Grains Oilseeds & Pulses Fruits & Vegetables Others |

| By End-User | Agriculture Horticulture Forestry Others |

| By Distribution Channel | Direct Sales Retail Online Sales Distributors Others |

| By Formulation Type | Liquid Granular Powder Others |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Herbicide Usage in Cereal Crops | 120 | Farmers, Agronomists |

| Insecticide Application in Fruit Cultivation | 90 | Fruit Growers, Agricultural Advisors |

| Fungicide Trends in Vegetable Production | 60 | Vegetable Farmers, Crop Protection Specialists |

| Market Insights on Biopesticides | 50 | Research Scientists, Organic Farmers |

| Regulatory Compliance and Pesticide Registration | 40 | Regulatory Affairs Managers, Compliance Officers |

The Germany Crop Protection Chemicals Pesticides Market is valued at approximately USD 3.2 billion, reflecting a five-year historical analysis. This valuation highlights the market's growth driven by food security demands and advancements in agricultural technology.