Region:Europe

Author(s):Dev

Product Code:KRAC0462

Pages:85

Published On:August 2025

By Type:The market is segmented into various types of pesticides, including herbicides, fungicides, insecticides, molluscicides, nematicides, bio-pesticides, plant growth regulators, and others. Among these, herbicides and insecticides are the most widely used due to their effectiveness in controlling weeds and pests, which are significant threats to crop yields. The increasing adoption of herbicides is driven by the need for efficient weed management in large-scale farming operations, while fungicides remain critical in Spain’s fruit, vegetable, and vineyard segments due to high disease pressure in intensive horticulture.

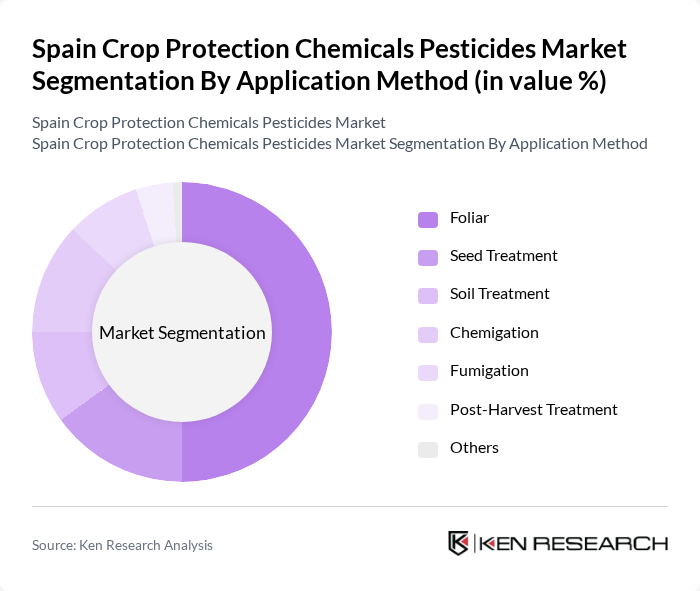

By Application Method:The application methods for pesticides include foliar, seed treatment, soil treatment, chemigation, fumigation, post-harvest treatment, and others. Foliar application is the most common method due to its direct impact on the target pests and ease of use. The trend towards precision agriculture is also driving the adoption of chemigation, where pesticides are applied through irrigation systems, enhancing efficiency and reducing waste; Spain’s extensive drip irrigation and greenhouse cultivation further support chemigation and targeted soil/fertigation-based applications.

The Spain Crop Protection Chemicals Pesticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Bayer AG, Syngenta Group, Corteva Agriscience, FMC Corporation, ADAMA Ltd., Nufarm Limited, UPL Limited, Sumitomo Chemical Co., Ltd., Mitsui Chemicals Agro, Inc. (including legacy Isagro portfolio), Arysta LifeScience (now part of UPL), Albaugh LLC, Cheminova A/S (now part of FMC), Belchim Crop Protection NV/SA, Probelte S.A.U., Seipasa S.A., Kenogard, S.A. (Itochu/Mitsui-affiliated), Tradecorp (Rovensa Group), Sipcam Iberia, S.A., Certis Belchim contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain crop protection chemicals pesticides market is poised for transformation, driven by technological advancements and a shift towards sustainable practices. As farmers increasingly adopt precision agriculture technologies, the demand for innovative pesticide formulations will rise. Additionally, collaborations between agricultural research institutions and industry players are expected to foster the development of eco-friendly solutions. These trends will likely enhance the market's resilience against challenges while promoting sustainable agricultural practices across Spain.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Fungicides Insecticides Molluscicides Nematicides Bio-pesticides Plant Growth Regulators Others |

| By Application Method | Foliar Seed Treatment Soil Treatment Chemigation Fumigation Post-Harvest Treatment Others |

| By Crop Type | Grains and Cereals Pulses and Oilseeds Fruits and Vegetables Commercial Crops Turf and Ornamental Crops Others |

| By Distribution Channel | Direct Sales Agri-retail/Cooperatives Online Sales Distributors/Wholesalers Others |

| By Formulation Type | Liquid (EC, SC, SL) Granular (GR, WG) Powder (WP, DP) Others (OD, CS, SE) |

| By Origin | Synthetic Bio-based |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| By Price Range | Premium Mid-range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Protection | 120 | Agronomists, Crop Managers |

| Fruit and Vegetable Pesticide Usage | 100 | Farm Owners, Agricultural Advisors |

| Herbicide Application Practices | 80 | Field Technicians, Crop Consultants |

| Insecticide Market Insights | 110 | Retailers, Supply Chain Managers |

| Fungicide Adoption Trends | 70 | Research Scientists, Product Development Managers |

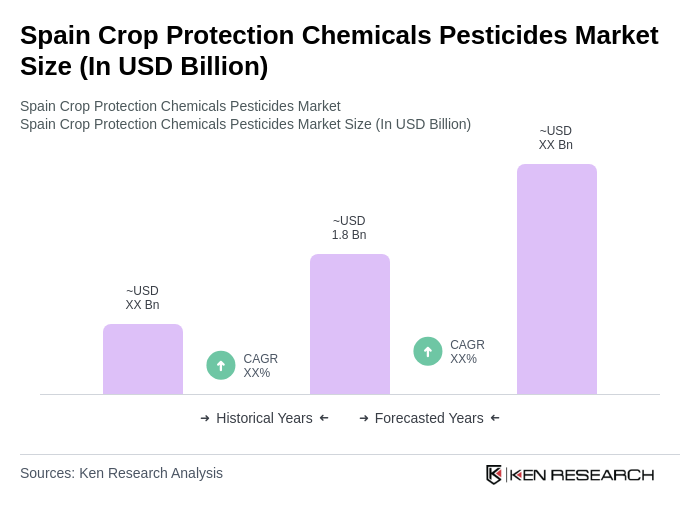

The Spain Crop Protection Chemicals Pesticides Market is valued at approximately USD 1.8 billion, reflecting a steady growth driven by increasing agricultural productivity demands and the need for effective pest control solutions.