Germany Digital Media & Advertising Tech Market Overview

- The Germany Digital Media & Advertising Tech Market is valued at approximately USD 32 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet, the rise of mobile devices, and the growing demand for targeted advertising solutions. The market has seen a significant shift towards digital platforms, with businesses investing heavily in online advertising to reach their target audiences effectively. Recent trends highlight the integration of artificial intelligence and big data for enhanced targeting and personalization, as well as a pronounced shift toward mobile and video content, reflecting changing consumer media consumption habits.

- Key players in this market include major cities like Berlin, Munich, and Frankfurt, which serve as hubs for technology and innovation. These cities dominate due to their robust infrastructure, access to a skilled workforce, and a vibrant startup ecosystem that fosters creativity and technological advancements in digital media and advertising.

- In 2023, the German government implemented Regulation (EU) 2022/2065, known as the Digital Services Act (DSA), issued by the European Parliament and the Council of the European Union. The DSA imposes obligations on online platforms, including transparency requirements for digital advertising, mandatory disclosure of algorithmic processes, and clear communication on how user data is utilized. Platforms with more than 45 million monthly active users in the EU must comply with these rules, which are enforced by the German Federal Network Agency (Bundesnetzagentur) in coordination with the European Commission. The regulation aims to promote accountability, consumer trust, and fair competition in digital advertising.

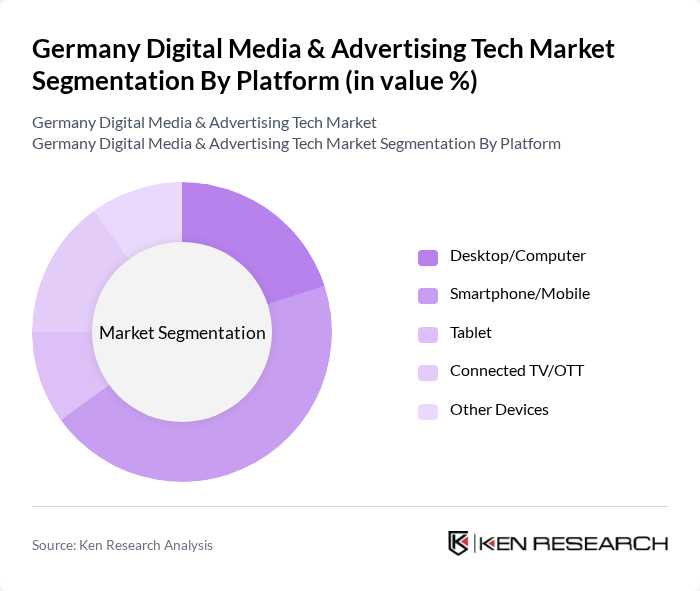

Germany Digital Media & Advertising Tech Market Segmentation

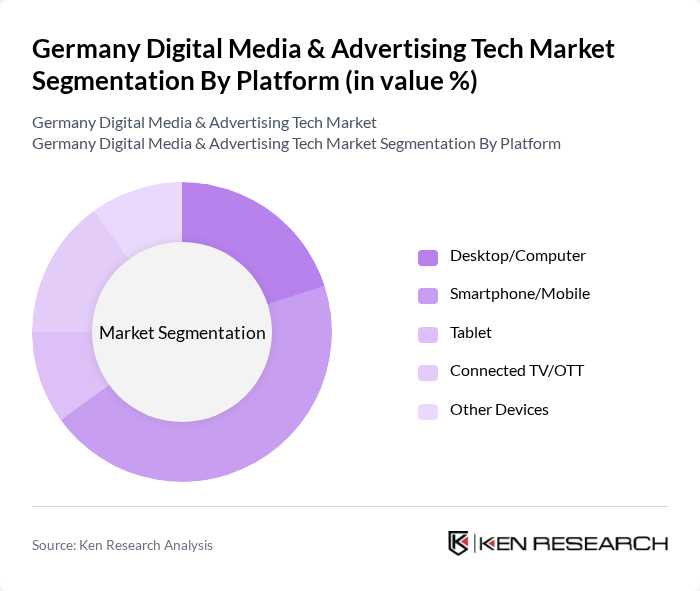

By Platform:The segmentation by platform includes various devices through which digital media and advertising are delivered. The subsegments are Desktop/Computer, Smartphone/Mobile, Tablet, Connected TV/OTT, and Other Devices. The Smartphone/Mobile segment is currently dominating the market due to the increasing use of mobile devices for internet access and social media engagement. Consumers are increasingly using their smartphones for shopping, entertainment, and social interactions, leading to a surge in mobile advertising.

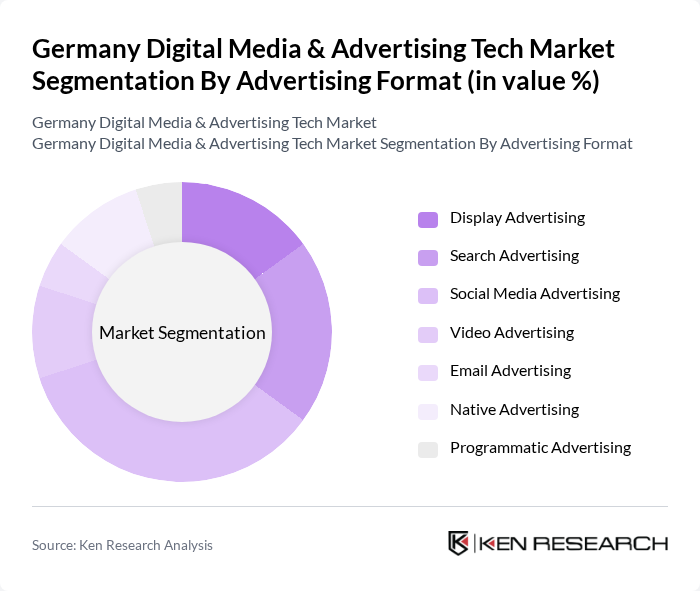

By Advertising Format:The advertising format segmentation includes Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Email Advertising, Native Advertising, and Programmatic Advertising. Among these, Social Media Advertising is leading the market, driven by the growing popularity of platforms like Facebook, Instagram, and TikTok. Brands are increasingly leveraging social media to engage with consumers directly, resulting in higher conversion rates and brand loyalty. Innovations such as interactive and shoppable posts are further boosting engagement on these platforms. Video advertising is also gaining traction, supported by the rise of streaming and video-on-demand services.

Germany Digital Media & Advertising Tech Market Competitive Landscape

The Germany Digital Media & Advertising Tech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google Germany GmbH, Meta Platforms Germany GmbH, Amazon Advertising Germany, Microsoft Deutschland GmbH, Ströer SE & Co. KGaA, Zalando SE, The Trade Desk Germany GmbH, Criteo GmbH, Adobe Systems GmbH, Dentsu Germany GmbH, GroupM Germany GmbH, Publicis Media Germany, Havas Media Germany, Xandr Germany GmbH, Taboola Germany GmbH contribute to innovation, geographic expansion, and service delivery in this space.

Germany Digital Media & Advertising Tech Market Industry Analysis

Growth Drivers

- Increasing Digital Advertising Spend:In future, Germany's digital advertising expenditure is projected to reach approximately €13.5 billion, reflecting a significant increase from €12.1 billion previously. This growth is driven by businesses reallocating budgets from traditional media to digital platforms, as digital channels offer better targeting and measurable results. The rise in online consumer engagement, with over 89% of the population actively using the internet, further fuels this trend, making digital advertising a priority for brands seeking effective outreach.

- Rise of Mobile Advertising:Mobile advertising in Germany is expected to account for around €7 billion in future, up from €6.2 billion previously. This surge is attributed to the increasing smartphone penetration, which stands at 94% among the population. As consumers increasingly engage with brands via mobile devices, advertisers are investing more in mobile-optimized content and ads. The growing use of mobile payment solutions also enhances the effectiveness of mobile advertising, driving higher conversion rates for businesses.

- Growth in E-commerce:The German e-commerce market is projected to reach €105 billion in future, up from €90 billion previously. This growth is supported by a robust online shopping culture, with 77% of consumers purchasing goods online. The expansion of e-commerce platforms has led to increased digital advertising efforts, as brands seek to capture the attention of online shoppers. Additionally, the integration of advanced analytics tools allows businesses to tailor their marketing strategies effectively, enhancing customer engagement and sales.

Market Challenges

- Data Privacy Regulations:The implementation of the General Data Protection Regulation (GDPR) has significantly impacted digital advertising practices in Germany. Companies face stringent compliance requirements, with fines reaching up to €22 million or 4% of global turnover for violations. This regulatory environment complicates data collection and usage, limiting advertisers' ability to target consumers effectively. As a result, businesses must invest in compliance measures, which can divert resources from marketing initiatives and hinder growth.

- High Competition:The digital advertising landscape in Germany is characterized by intense competition, with over 28,000 active agencies vying for market share. This saturation leads to increased costs for advertising placements and necessitates innovative strategies to stand out. Companies must continuously adapt to changing consumer preferences and technological advancements, which can strain resources. The competitive pressure also drives the need for differentiation, compelling businesses to invest heavily in creative and data-driven marketing solutions.

Germany Digital Media & Advertising Tech Market Future Outlook

The future of the digital media and advertising tech market in Germany appears promising, driven by ongoing technological advancements and evolving consumer behaviors. As brands increasingly adopt omnichannel marketing strategies, the integration of AI and data analytics will enhance targeting and personalization efforts. Furthermore, the growing emphasis on sustainability in advertising practices is likely to shape brand strategies, appealing to environmentally conscious consumers. These trends indicate a dynamic market landscape, fostering innovation and new opportunities for growth in the coming years.

Market Opportunities

- Expansion of Programmatic Advertising:The programmatic advertising sector in Germany is expected to grow significantly, with spending projected to reach €4.3 billion in future. This growth is driven by the increasing demand for automated ad buying, which enhances efficiency and targeting precision. As more advertisers recognize the benefits of programmatic solutions, this segment presents a lucrative opportunity for tech providers and agencies to innovate and capture market share.

- Growth of Influencer Marketing:Influencer marketing in Germany is anticipated to reach €1.3 billion in future, reflecting a growing trend among brands to leverage social media influencers for authentic engagement. With over 68% of consumers trusting influencer recommendations, this channel offers significant potential for brands to connect with target audiences. As the influencer landscape evolves, businesses can explore partnerships with micro and nano influencers to enhance their marketing strategies and drive conversions.