Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3706

Pages:93

Published On:October 2025

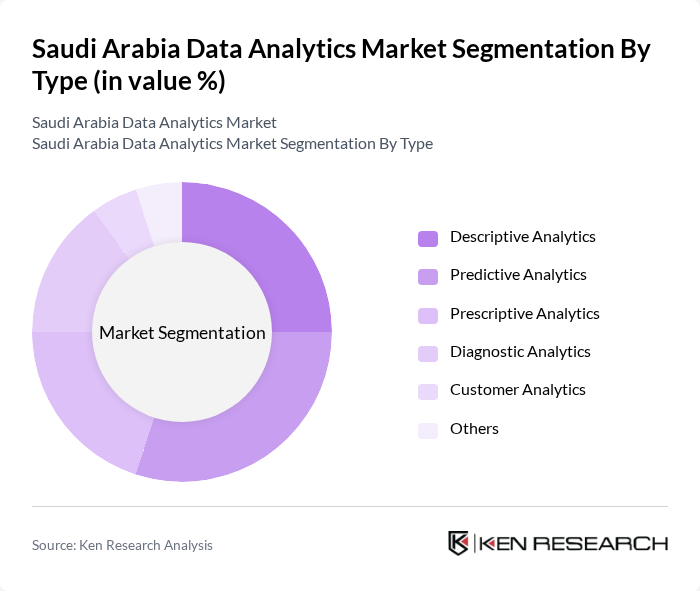

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Diagnostic Analytics, Customer Analytics, and Others. Each type serves distinct purposes, from understanding historical data to forecasting future trends and optimizing decision-making processes. The segmentation reflects the growing demand for predictive and prescriptive analytics, which are increasingly adopted for forecasting and optimization in sectors such as finance, retail, and healthcare .

The Predictive Analytics segment is currently dominating the market due to its ability to forecast future trends and behaviors, which is crucial for businesses aiming to stay competitive. Organizations are increasingly investing in predictive models to enhance customer experiences and optimize operations. The growing availability of data and advancements in machine learning technologies are further propelling this segment's growth, making it a key focus for many enterprises .

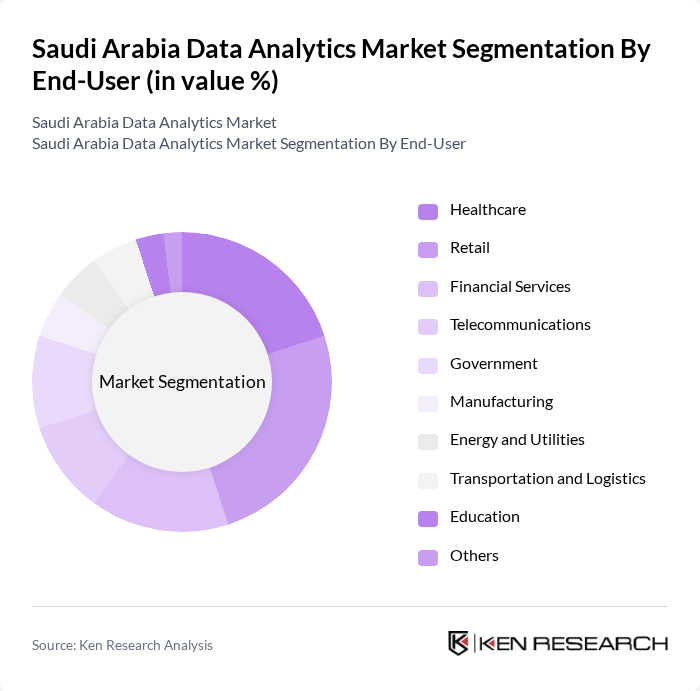

By End-User:The market is segmented by end-users, including Healthcare, Retail, Financial Services, Telecommunications, Government, Manufacturing, Energy and Utilities, Transportation and Logistics, Education, and Others. Each sector utilizes data analytics to improve efficiency, customer satisfaction, and decision-making. The segmentation reflects the widespread adoption of analytics across both public and private sectors, with retail and healthcare leading in terms of investment and innovation .

The Retail sector is leading the market as businesses increasingly leverage data analytics to understand consumer behavior, optimize inventory, and enhance customer engagement. The rise of e-commerce and the need for personalized marketing strategies are driving retailers to adopt advanced analytics solutions, making this segment a significant contributor to the overall market growth .

The Saudi Arabia Data Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, SAP SE, Oracle Corporation, SAS Institute Inc., Tableau Software, LLC, QlikTech International AB, Teradata Corporation, Alteryx, Inc., MicroStrategy Incorporated, TIBCO Software Inc., Domo, Inc., Sisense Inc., ThoughtSpot, Inc., Looker (part of Google Cloud), HData Systems, Quant Data & Analytics, Comprehensive Technology Company (CompTechCo), SEIDOR, Sadeem Knowledge, Environmental Systems Research Institute, Inc. (ESRI), Midis Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia data analytics market appears promising, driven by technological advancements and increasing digitalization across industries. As organizations prioritize real-time analytics and predictive capabilities, the integration of artificial intelligence and machine learning will become more prevalent. Additionally, the collaboration between local firms and international technology companies is expected to enhance innovation and knowledge transfer, further propelling the market's growth trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics Customer Analytics Others |

| By End-User | Healthcare Retail Financial Services Telecommunications Government Manufacturing Energy and Utilities Transportation and Logistics Education Others |

| By Application | Customer Analytics Operational Analytics Marketing Analytics Risk Analytics Supply Chain Analytics Fraud Detection & Prevention Human Resource Analytics Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Industry Vertical | Manufacturing Energy and Utilities Transportation and Logistics Education Retail Financial Services Healthcare Government Others |

| By Data Source | Structured Data Unstructured Data Semi-Structured Data |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Data Analytics | 100 | Healthcare IT Managers, Data Analysts |

| Financial Services Analytics | 60 | Risk Managers, Financial Analysts |

| Retail Analytics Solutions | 80 | Marketing Managers, Business Intelligence Analysts |

| Government Data Initiatives | 50 | Policy Makers, Data Governance Officers |

| Telecommunications Analytics | 55 | Network Analysts, Customer Experience Managers |

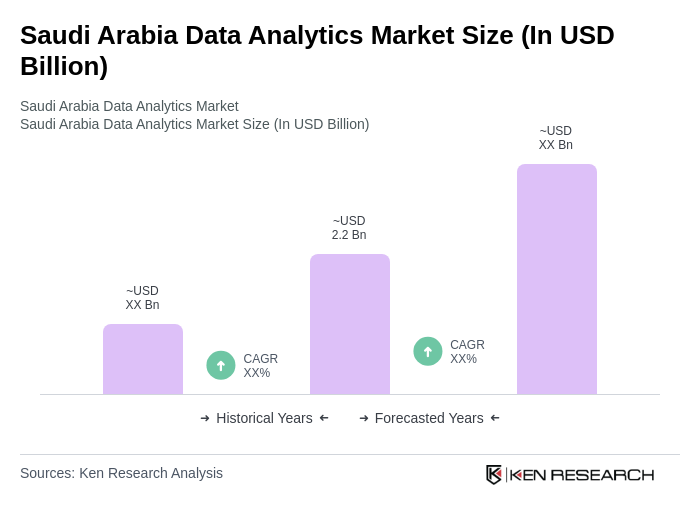

The Saudi Arabia Data Analytics Market is valued at approximately USD 2.2 billion, driven by the increasing adoption of advanced analytics technologies across various sectors, including healthcare, finance, and retail, as organizations seek to enhance decision-making and operational efficiency.