Region:Europe

Author(s):Dev

Product Code:KRAA5151

Pages:84

Published On:September 2025

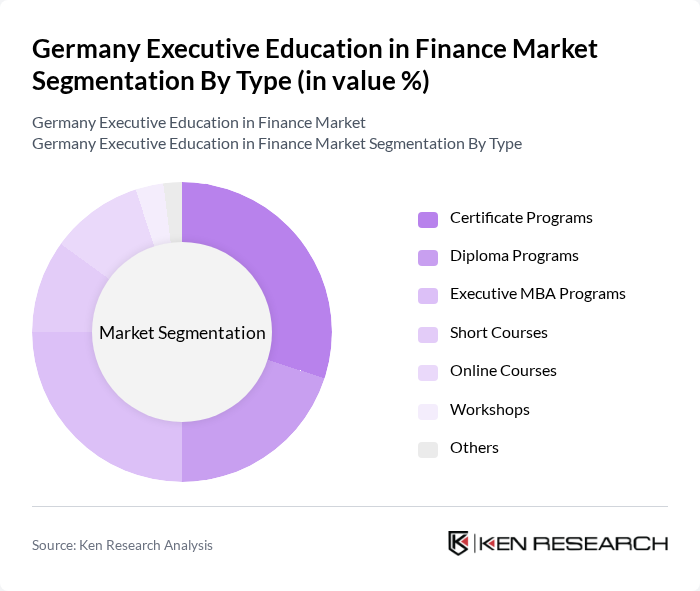

By Type:The market is segmented into various types of educational offerings, including Certificate Programs, Diploma Programs, Executive MBA Programs, Short Courses, Online Courses, Workshops, and Others. Among these, Certificate Programs are particularly popular due to their flexibility and targeted approach, allowing professionals to quickly gain specific skills relevant to their roles. The demand for Online Courses has also surged, driven by the convenience of remote learning and the need for continuous professional development.

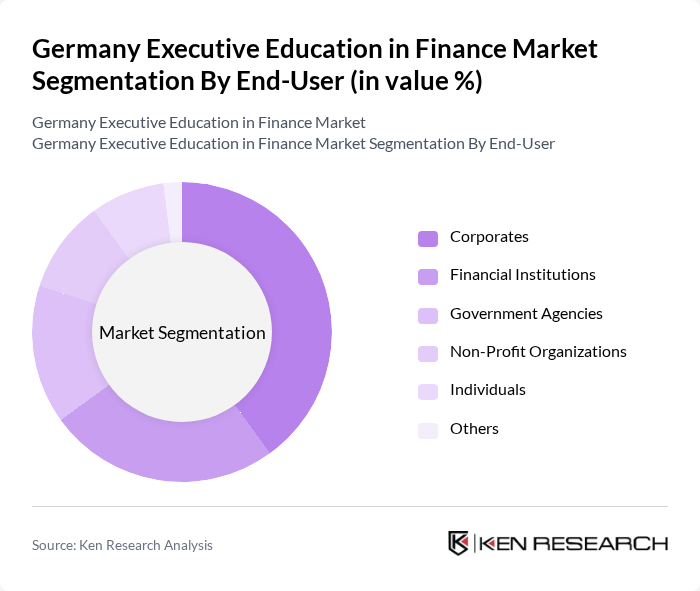

By End-User:The market is further segmented by end-users, including Corporates, Financial Institutions, Government Agencies, Non-Profit Organizations, Individuals, and Others. Corporates represent the largest segment, as companies increasingly invest in the professional development of their employees to stay competitive in the fast-evolving financial landscape. Financial Institutions also play a significant role, seeking specialized training for their staff to navigate complex regulatory environments and enhance service delivery.

The Germany Executive Education in Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Frankfurt School of Finance & Management, WHU - Otto Beisheim School of Management, Mannheim Business School, ESMT Berlin, HHL Leipzig Graduate School of Management, University of Mannheim, University of Cologne, ESCP Business School, Leipzig Graduate School of Management, Munich Business School, International School of Management (ISM), Hochschule für Wirtschaft und Umwelt Nürtingen-Geislingen, Hochschule für Technik und Wirtschaft Berlin, Hochschule für angewandte Wissenschaften München, FOM University of Applied Sciences contribute to innovation, geographic expansion, and service delivery in this space.

The future of the executive education market in finance in Germany appears promising, driven by the increasing integration of technology and a shift towards personalized learning experiences. As organizations recognize the importance of continuous education, the demand for tailored finance programs is expected to rise. Furthermore, the emphasis on sustainability in finance education will likely shape curriculum development, aligning with global trends and regulatory requirements. Institutions that adapt to these changes will be well-positioned to thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Certificate Programs Diploma Programs Executive MBA Programs Short Courses Online Courses Workshops Others |

| By End-User | Corporates Financial Institutions Government Agencies Non-Profit Organizations Individuals Others |

| By Delivery Mode | In-Person Training Online Learning Hybrid Learning Corporate Training Sessions Others |

| By Duration | Short-Term (Less than 3 months) Medium-Term (3 to 6 months) Long-Term (More than 6 months) Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Industry-Specific Certifications Others |

| By Target Audience | Senior Executives Mid-Level Managers Entry-Level Professionals Entrepreneurs Others |

| By Pricing Tier | Premium Programs Mid-Range Programs Budget Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 150 | Program Directors, Corporate Trainers |

| Finance Professionals Seeking Upskilling | 100 | Finance Managers, Analysts |

| Alumni of Executive Finance Programs | 80 | Graduates, Career Development Officers |

| HR Managers in Large Corporations | 70 | HR Directors, Learning & Development Managers |

| Industry Experts in Finance Education | 60 | Consultants, Academic Researchers |

The Germany Executive Education in Finance Market is valued at approximately USD 2.5 billion, reflecting a growing demand for advanced financial skills among professionals and organizations aiming to enhance their financial acumen and strategic decision-making capabilities.