Region:Asia

Author(s):Rebecca

Product Code:KRAA6063

Pages:85

Published On:September 2025

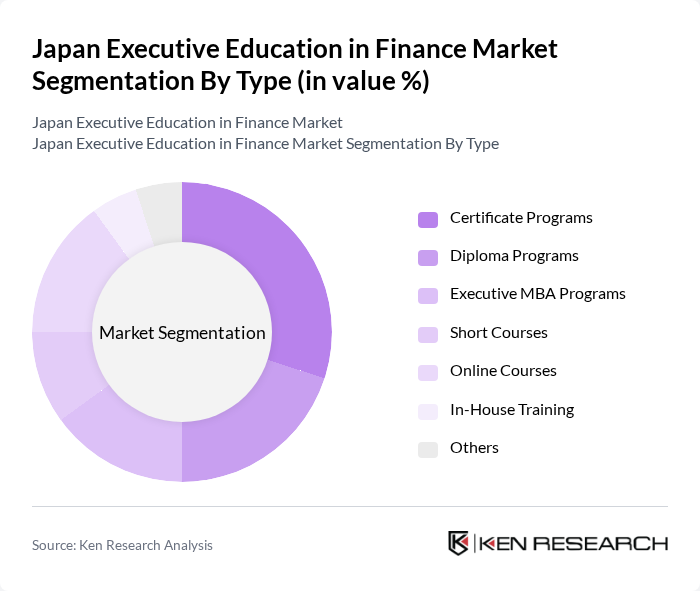

By Type:The market is segmented into various types of educational offerings, including Certificate Programs, Diploma Programs, Executive MBA Programs, Short Courses, Online Courses, In-House Training, and Others. Among these, Certificate Programs are particularly popular due to their flexibility and shorter duration, catering to professionals seeking quick upskilling. Online Courses have also gained traction, especially post-pandemic, as they offer convenience and accessibility to a broader audience.

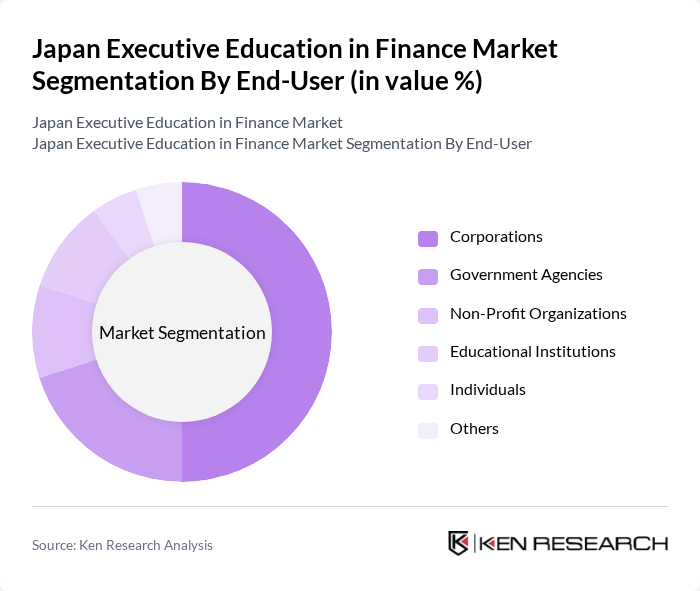

By End-User:The end-users of executive education programs include Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporations are the leading end-users, as they invest significantly in employee development to enhance skills and drive organizational performance. Government Agencies also play a crucial role, seeking to improve public sector financial management through targeted training programs.

The Japan Executive Education in Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hitotsubashi University Business School, Waseda Business School, Keio Business School, Nagoya University of Commerce and Business, Rikkyo University Graduate School of Business, Osaka University Graduate School of Economics, Tokyo Institute of Technology, International University of Japan, GLOBIS University, Aoyama Gakuin University, Doshisha University, Chuo University, Kyoto University Graduate School of Management, Shibaura Institute of Technology, and Yokohama National University contribute to innovation, geographic expansion, and service delivery in this space.

The future of executive education in finance in Japan appears promising, driven by the increasing emphasis on digital transformation and the need for specialized skills. As organizations prioritize financial literacy and adaptability, educational institutions are likely to innovate their offerings. The integration of technology in learning, coupled with a focus on sustainability and ethical finance, will shape the curriculum. Additionally, partnerships with global institutions may enhance program credibility and attract a diverse student base, fostering a more robust educational ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Certificate Programs Diploma Programs Executive MBA Programs Short Courses Online Courses In-House Training Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Classes Online Learning Blended Learning Workshops and Seminars Others |

| By Duration | Short-Term (Less than 3 months) Medium-Term (3 to 6 months) Long-Term (More than 6 months) Others |

| By Industry Focus | Banking and Finance Insurance Real Estate Investment Management Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Industry-Specific Certifications Others |

| By Price Range | Low-End (Under ¥100,000) Mid-Range (¥100,000 - ¥500,000) High-End (Above ¥500,000) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Finance Executives | 100 | CFOs, Finance Directors, Corporate Trainers |

| Alumni of Executive Finance Programs | 80 | Program Graduates, Career Development Managers |

| HR Managers in Financial Services | 70 | HR Directors, Learning & Development Managers |

| Academic Leaders in Finance Education | 60 | Deans, Program Coordinators, Faculty Members |

| Corporate Training Decision Makers | 90 | Training Managers, Organizational Development Specialists |

The Japan Executive Education in Finance Market is valued at approximately USD 1.2 billion, reflecting a significant investment by organizations in enhancing financial skills among professionals to remain competitive in a complex economic landscape.