Region:Europe

Author(s):Dev

Product Code:KRAB0495

Pages:82

Published On:August 2025

By Type:The mutual funds market can be segmented into various types, including Equity Funds, Bond (Fixed Income) Funds, Mixed-Asset/Balanced Funds, Money Market Funds, Index/ETF Funds, Real Estate Funds (Publikumsfonds/Spezialfonds), Sustainable/ESG Funds, and Others (Commodity, Target-Date, Absolute Return). Among these, Equity Funds are currently the most dominant segment, driven by a growing appetite for higher returns and the increasing popularity of stock market investments among retail investors. The trend towards sustainable investing has also bolstered the performance of Sustainable/ESG Funds, reflecting a shift in consumer preferences towards socially responsible investment options.

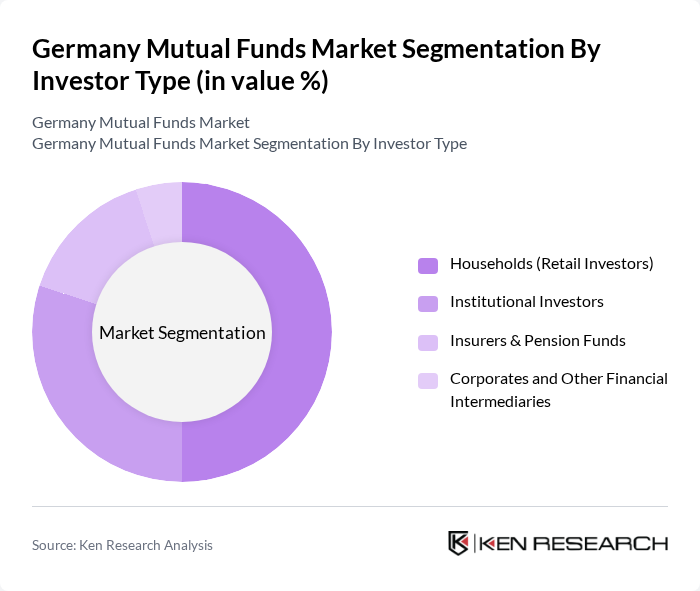

By Investor Type:The investor type segmentation includes Households (Retail Investors), Institutional Investors, Insurers & Pension Funds, and Corporates and Other Financial Intermediaries. Households represent the largest segment, as more individuals are turning to mutual funds for retirement savings and wealth accumulation. Institutional Investors also play a significant role, with pension funds and insurance companies increasingly allocating assets to mutual funds to achieve diversification and manage risk effectively.

The Germany Mutual Funds Market is characterized by a dynamic mix of regional and international players. Leading participants such as DWS Group GmbH & Co. KGaA, Allianz Global Investors GmbH, Union Investment Privatfonds GmbH, Deka Investment GmbH, Commerz Real AG, Deutsche Bank AG (Asset Management and Wealth Management), BlackRock Asset Management Deutschland AG, Amundi Deutschland GmbH, J.P. Morgan Asset Management (Europe) S.à r.l., Germany Branch, Invesco Asset Management Deutschland GmbH, Fidelity International (FIL Investment Services GmbH), Schroder Investment Management (Europe) S.A., German Branch, State Street Global Advisors (Ireland) Limited, Germany Branch, BNP Paribas Asset Management Germany GmbH, AXA Investment Managers Deutschland GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the German mutual funds market appears promising, driven by a combination of technological innovation and evolving investor preferences. As digital platforms continue to expand, more investors are expected to engage with mutual funds, particularly younger demographics. Additionally, the growing emphasis on sustainable investing will likely lead to increased demand for ESG-focused funds, aligning with global investment trends. These factors are anticipated to create a more dynamic and resilient market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Funds Bond (Fixed Income) Funds Mixed-Asset/Balanced Funds Money Market Funds Index/ETF Funds Real Estate Funds (Publikumsfonds/Spezialfonds) Sustainable/ESG Funds Others (Commodity, Target-Date, Absolute Return) |

| By Investor Type | Households (Retail Investors) Institutional Investors Insurers & Pension Funds Corporates and Other Financial Intermediaries |

| By Distribution Channel | Banks and Savings Banks (Filialvertrieb) Independent Financial Advisors (IFAs) Online Platforms/Robo-Advisors Direct Sales from Fund Companies |

| By Fund Size | Small Funds (<€500 million AUM) Mid-Sized Funds (€500 million–€2 billion AUM) Large Funds (>€2 billion AUM) |

| By Investment Strategy | Active Management Passive Management Factor/Smart Beta |

| By Risk Profile | Low Risk Medium Risk High Risk |

| By Performance Benchmark | Local Benchmarks (e.g., DAX, MDAX, REX) Global Benchmarks (e.g., MSCI World/Europe, Bloomberg Global Aggregate) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Investors, Retail Financial Advisors |

| Institutional Fund Management | 120 | Portfolio Managers, Institutional Investors |

| Regulatory Compliance Perspectives | 80 | Compliance Officers, Legal Advisors |

| Market Trends and Innovations | 70 | Financial Analysts, Market Researchers |

| Investment Strategy Development | 90 | Wealth Managers, Investment Strategists |

The Germany Mutual Funds Market is valued at approximately USD 3.9 billion, reflecting a significant growth trend driven by increasing investor interest in diversified investment options and a supportive regulatory framework.