Region:Europe

Author(s):Geetanshi

Product Code:KRAD0117

Pages:87

Published On:August 2025

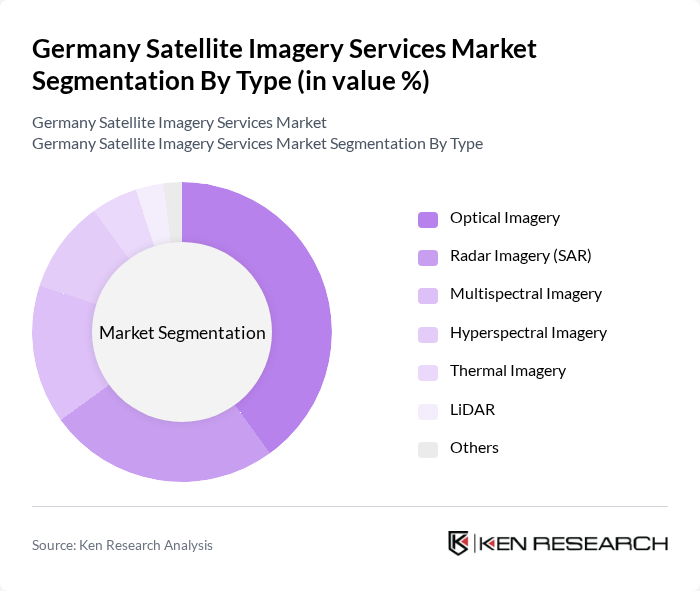

By Type:The market is segmented into various types of satellite imagery services, including Optical Imagery, Radar Imagery (SAR), Multispectral Imagery, Hyperspectral Imagery, Thermal Imagery, LiDAR, and Others. Optical Imagery remains the most widely used segment, attributed to its high-resolution capabilities and broad applicability in sectors such as agriculture, urban planning, and environmental monitoring. The demand for Optical Imagery is driven by its effectiveness in capturing detailed visual information, making it a preferred choice for many end-users .

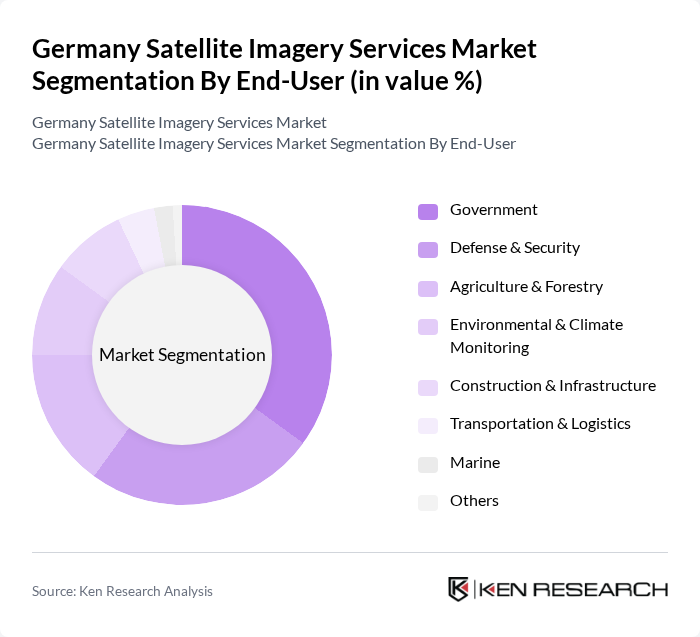

By End-User:The end-user segmentation includes Government, Defense & Security, Agriculture & Forestry, Environmental & Climate Monitoring, Construction & Infrastructure, Transportation & Logistics, Marine, and Others. The Government sector is the leading end-user, leveraging satellite imagery for national security, urban planning, and environmental management. Increasing reliance on satellite data for policy-making, infrastructure modernization, and resource management has solidified the Government's position as the dominant consumer in the market .

The Germany Satellite Imagery Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbus Defence and Space, Maxar Technologies, Planet Labs PBC, European Space Imaging, BlackSky Global, Satellogic, Hexagon AB (Leica Geosystems), Esri, Remote Sensing Solutions GmbH, OHB SE, GeoVille GmbH, Telespazio VEGA Deutschland GmbH, Capella Space, ICEYE, Synspective contribute to innovation, geographic expansion, and service delivery in this space.

The future of the satellite imagery services market in Germany appears promising, driven by technological advancements and increasing applications across various sectors. The integration of artificial intelligence and machine learning into data analysis is expected to enhance the capabilities of satellite imagery, providing more accurate insights. Additionally, the growing emphasis on sustainability and environmental monitoring will likely lead to increased investments in satellite infrastructure, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Optical Imagery Radar Imagery (SAR) Multispectral Imagery Hyperspectral Imagery Thermal Imagery LiDAR Others |

| By End-User | Government Defense & Security Agriculture & Forestry Environmental & Climate Monitoring Construction & Infrastructure Transportation & Logistics Marine Others |

| By Application | Geospatial Data Acquisition & Mapping Natural Resource Management Surveillance & Security Conservation & Research Disaster Management Intelligence Land Use Planning Infrastructure Development Climate Change Studies Transportation Monitoring Others |

| By Data Delivery Method | On-Demand Services Subscription-Based Services Pay-Per-Use Services Bulk Data Sales Others |

| By Geographic Coverage | National Coverage Regional Coverage Global Coverage Others |

| By Resolution | High Resolution (<1m) Medium Resolution (1–10m) Low Resolution (>10m) Others |

| By Pricing Model | Tiered Pricing Flat Rate Pricing Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Satellite Services | 100 | Agronomists, Farm Managers |

| Urban Planning Applications | 80 | City Planners, Urban Development Officers |

| Environmental Monitoring Solutions | 70 | Environmental Scientists, Policy Makers |

| Disaster Management Services | 50 | Emergency Response Coordinators, Risk Assessment Analysts |

| Infrastructure Development Projects | 60 | Project Managers, Civil Engineers |

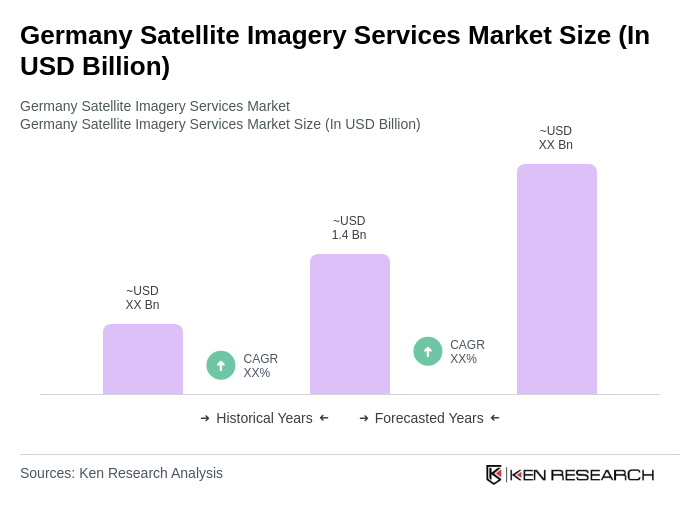

The Germany Satellite Imagery Services Market is valued at approximately USD 1.4 billion, reflecting significant growth driven by advancements in satellite technology and increasing demand for high-resolution geospatial data across various sectors.