Region:Asia

Author(s):Dev

Product Code:KRAA1646

Pages:94

Published On:August 2025

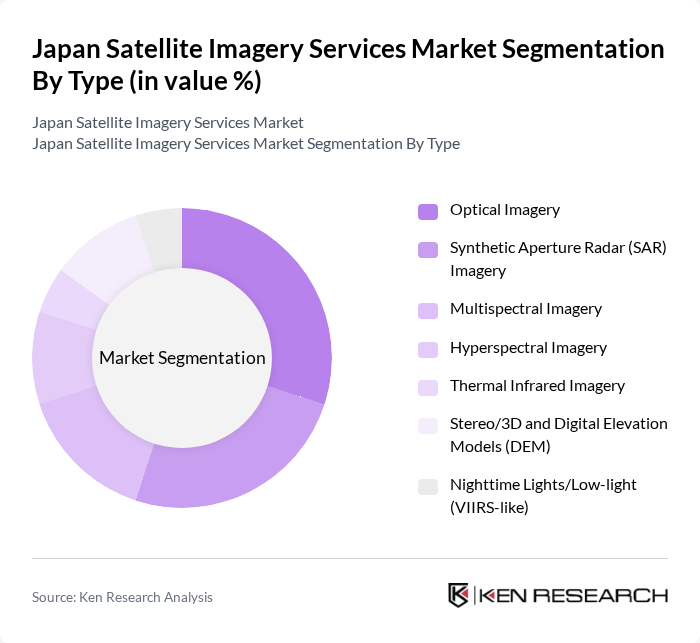

By Type:The market is segmented into various types of satellite imagery, including Optical Imagery, Synthetic Aperture Radar (SAR) Imagery, Multispectral Imagery, Hyperspectral Imagery, Thermal Infrared Imagery, Stereo/3D and Digital Elevation Models (DEM), and Nighttime Lights/Low-light (VIIRS-like). Each type serves distinct applications, with Optical Imagery widely used for urban planning, land administration, and environmental monitoring given the availability of very-high-resolution tasking and large smallsat constellations. SAR Imagery is gaining traction for all-weather, day–night monitoring, critical for disaster response, maritime domain awareness, and crop/forestry monitoring in Japan’s cloudy and typhoon-prone climate.

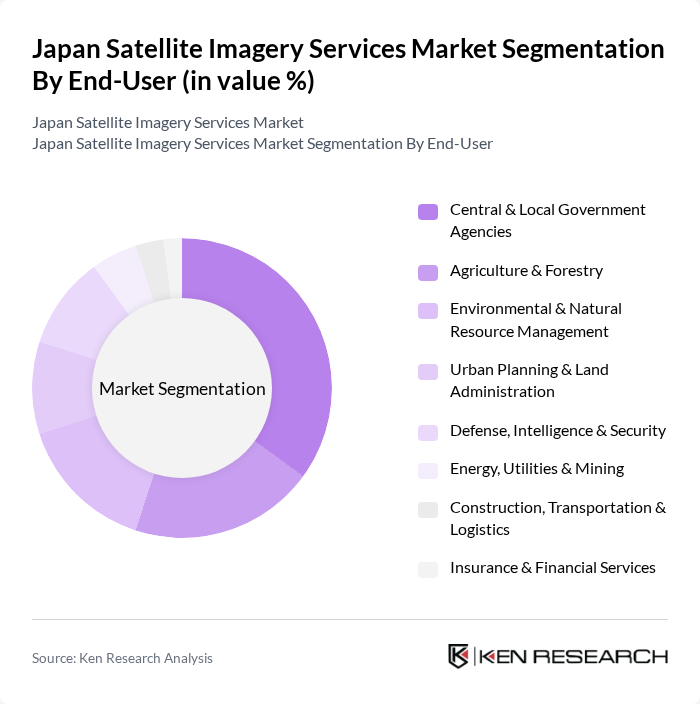

By End-User:The end-user segmentation includes Central & Local Government Agencies, Agriculture & Forestry, Environmental & Natural Resource Management, Urban Planning & Land Administration, Defense, Intelligence & Security, Energy, Utilities & Mining, Construction, Transportation & Logistics, and Insurance & Financial Services. Government users are significant consumers of imagery and analytics for urban planning, base mapping, and disaster response and recovery. Agriculture and forestry increasingly leverage satellite data for crop vigor assessment, yield estimation, forest health, and land-use monitoring; infrastructure, energy/utilities, and transportation use imagery for asset inspection and project monitoring.

The Japan Satellite Imagery Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maxar Technologies, Airbus Defence and Space, Planet Labs PBC, BlackSky Technology Inc., MDA Ltd. (formerly MacDonald, Dettwiler and Associates), Japan Space Imaging Co., Ltd. (JSI), Pasco Corporation, Kokusai Kogyo Co., Ltd., Mitsubishi Electric Corporation, NEC Corporation, NTT DATA Corporation, Hitachi, Ltd., Synspective Inc., Axelspace Corporation, Japan Aerospace Exploration Agency (JAXA) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the satellite imagery services market in Japan appears promising, driven by technological advancements and increasing applications across various sectors. The integration of artificial intelligence and machine learning into satellite data analysis is expected to enhance data processing capabilities, making insights more actionable. Additionally, as climate change concerns grow, the demand for satellite imagery for environmental monitoring will likely increase, further propelling market growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Optical Imagery Synthetic Aperture Radar (SAR) Imagery Multispectral Imagery Hyperspectral Imagery Thermal Infrared Imagery Stereo/3D and Digital Elevation Models (DEM) Nighttime Lights/Low-light (VIIRS-like) |

| By End-User | Central & Local Government Agencies Agriculture & Forestry Environmental & Natural Resource Management Urban Planning & Land Administration Defense, Intelligence & Security Energy, Utilities & Mining Construction, Transportation & Logistics Insurance & Financial Services |

| By Application | Disaster Management & Emergency Response Geospatial Mapping & Land Use/Land Cover (LULC) Infrastructure & Asset Monitoring Environmental Monitoring & Climate Services Maritime Domain Awareness & Fisheries Defense Reconnaissance & Border Monitoring Precision Agriculture & Forestry Coastal & Disaster Risk (flood, landslide, tsunami) |

| By Data Resolution | Very High Resolution (?0.5 m) High Resolution (>0.5–2 m) Medium Resolution (>2–10 m) Low Resolution (>10 m) |

| By Delivery Mode | Web Portal/Direct Download API/Programmatic Access Managed Services & Analytics-as-a-Service On-Premises Delivery for Secure Workflows |

| By Pricing Model | Pay-per-Scene/Tasking Subscription & Data-as-a-Service Enterprise Licensing (Volume/Seat-based) Government Framework & Multi-year Contracts |

| By Geographic Coverage | National Coverage (Japan-wide) Regional Coverage (Prefecture/Block) Global Coverage Cross-border & Maritime EEZ Coverage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Satellite Data Users | 100 | Agronomists, Farm Managers |

| Urban Planning and Development | 80 | City Planners, Environmental Consultants |

| Disaster Management Agencies | 70 | Emergency Response Coordinators, Policy Makers |

| Forestry and Land Use Monitoring | 60 | Forestry Managers, Conservation Officers |

| Infrastructure and Construction Sector | 90 | Project Managers, Surveyors |

The Japan Satellite Imagery Services Market is valued at approximately USD 450 million, reflecting a five-year historical analysis. This growth is driven by advancements in satellite technology and increasing demand for geospatial data across various sectors.