Region:Europe

Author(s):Rebecca

Product Code:KRAA0365

Pages:92

Published On:August 2025

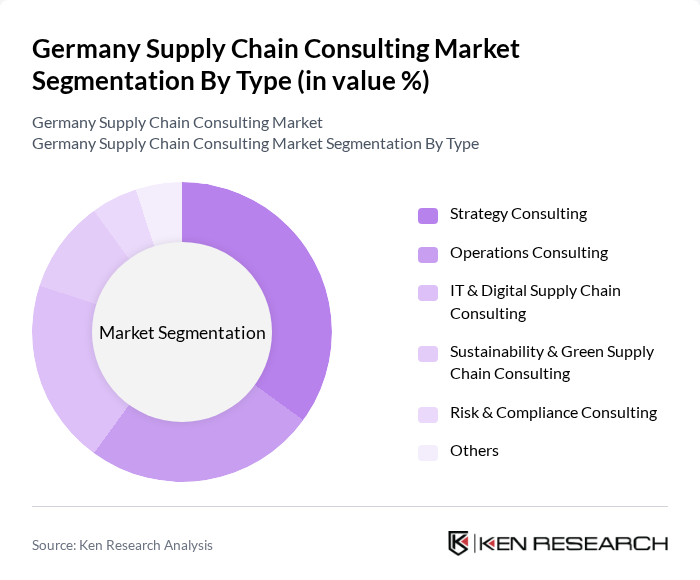

By Type:The market is segmented into Strategy Consulting, Operations Consulting, IT & Digital Supply Chain Consulting, Sustainability & Green Supply Chain Consulting, Risk & Compliance Consulting, and Others. Strategy Consulting remains the most prominent segment, as organizations prioritize aligning supply chain strategies with broader corporate objectives and navigating complex regulatory landscapes. Operations Consulting is also significant, focusing on process optimization, cost reduction, and supply chain resilience. IT & Digital Supply Chain Consulting is gaining traction, reflecting the surge in demand for digital transformation, automation, and advanced analytics in supply chain operations .

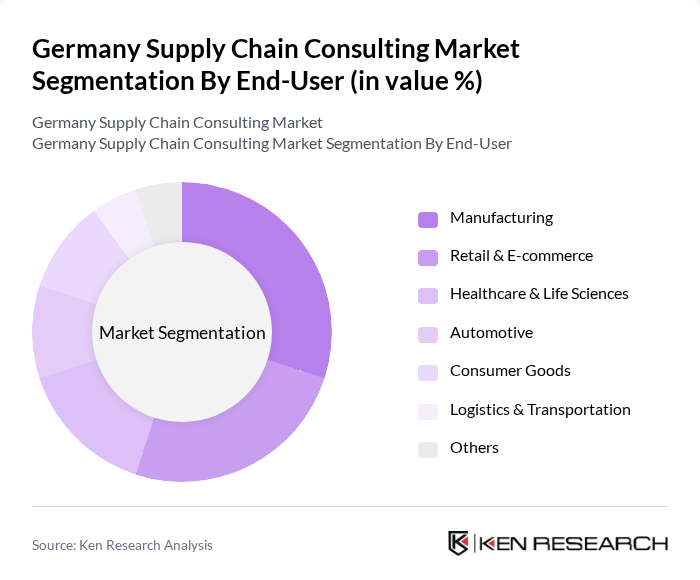

By End-User:The end-user segmentation includes Manufacturing, Retail & E-commerce, Healthcare & Life Sciences, Automotive, Consumer Goods, Logistics & Transportation, and Others. Manufacturing is the largest end-user segment, as companies seek to streamline production processes, improve supply chain visibility, and enhance risk management. Retail & E-commerce is also significant, driven by the rapid growth of online shopping, omnichannel logistics, and the need for agile inventory management. Healthcare & Life Sciences, Automotive, and Consumer Goods sectors are increasingly investing in supply chain consulting to address regulatory compliance, sustainability, and digital transformation challenges .

The Germany Supply Chain Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Deloitte Consulting, PwC Advisory Services, Accenture, KPMG, EY Advisory, Roland Berger, Capgemini Invent, Oliver Wyman, Kearney (formerly A.T. Kearney), BearingPoint, L.E.K. Consulting, Barkawi Management Consultants (a Genpact company), Miebach Consulting, Camelot Management Consultants, Zühlke Group, and ZS Associates contribute to innovation, geographic expansion, and service delivery in this space.

The future of the supply chain consulting market in Germany appears promising, driven by ongoing digital transformation and sustainability initiatives. As companies increasingly prioritize agile supply chains, the demand for consulting services that facilitate this transition is expected to rise. Furthermore, the integration of advanced technologies such as AI and data analytics will enhance decision-making processes, allowing firms to respond swiftly to market changes. This evolving landscape presents significant opportunities for growth and innovation in the consulting sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategy Consulting Operations Consulting IT & Digital Supply Chain Consulting Sustainability & Green Supply Chain Consulting Risk & Compliance Consulting Others |

| By End-User | Manufacturing Retail & E-commerce Healthcare & Life Sciences Automotive Consumer Goods Logistics & Transportation Others |

| By Service Offering | Supply Chain Strategy Development Process Optimization & Lean Management Digital Transformation & Technology Implementation Network Design & Footprint Optimization Change Management & Training Sustainability & ESG Consulting Risk Management & Compliance Others |

| By Industry Vertical | Automotive Consumer Goods Pharmaceuticals & Healthcare Electronics & High-Tech Aerospace & Defense Food & Beverage Others |

| By Geographic Presence | North Germany South Germany East Germany West Germany |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| By Consulting Model | Project-Based Consulting Retainer-Based Consulting On-Demand Consulting Hybrid/Managed Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Optimization | 100 | Supply Chain Managers, Operations Directors |

| Logistics Service Provider Insights | 80 | Business Development Managers, Logistics Coordinators |

| Pharmaceutical Distribution Challenges | 50 | Regulatory Affairs Managers, Supply Chain Analysts |

| Consumer Goods Supply Chain Trends | 70 | Product Managers, Retail Supply Chain Executives |

| Technology Adoption in Supply Chains | 40 | IT Managers, Digital Transformation Leads |

The Germany Supply Chain Consulting Market is valued at approximately USD 1.4 billion, reflecting a five-year historical analysis. This market is driven by the increasing complexity of supply chains and the demand for optimization and sustainability among businesses.