Region:Global

Author(s):Geetanshi

Product Code:KRAD4120

Pages:94

Published On:December 2025

By Communication Type:

The communication type segmentation includes Enhanced Mobile Broadband (eMBB), Fixed Wireless Access (FWA), Ultra-Reliable Low-Latency Communications (URLLC), and Massive Machine-Type Communications (mMTC). Among these, Enhanced Mobile Broadband (eMBB) is the leading sub-segment, driven by the increasing demand for high-speed internet and mobile data services, and currently represents the bulk of commercial 5G traffic and revenue. The rise in video streaming, online gaming, remote and hybrid work, and cloud?based consumer applications has significantly contributed to the growth of eMBB, making it a critical component of the 5G ecosystem, while FWA is emerging as a fast?growing use case for residential and small?business broadband in markets such as the United States and parts of Europe.

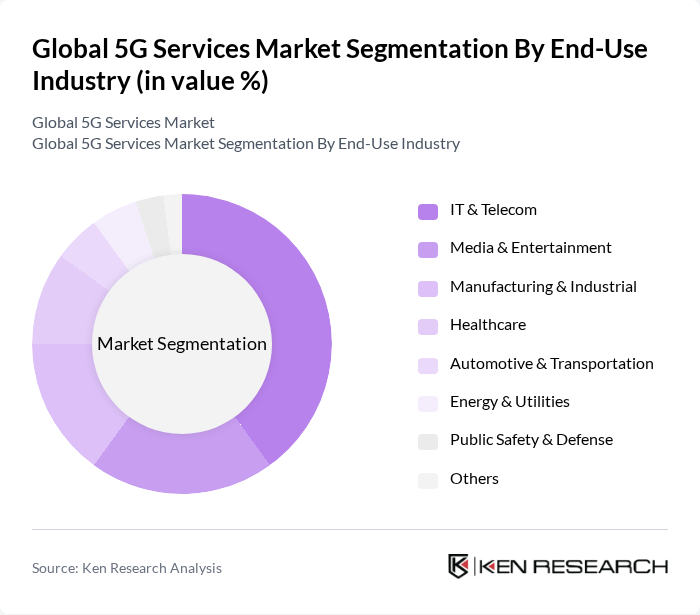

By End-Use Industry:

This segmentation includes IT & Telecom, Media & Entertainment, Manufacturing & Industrial, Healthcare, Automotive & Transportation, Energy & Utilities, Public Safety & Defense, and Others. The IT & Telecom sector is the dominant sub-segment, as it encompasses the primary service providers and infrastructure developers for 5G networks and captures most direct 5G service revenues from consumer and enterprise connectivity. The increasing reliance on digital communication and data services in various industries, together with early adoption of private and campus 5G networks in manufacturing, logistics, and healthcare, has further solidified the IT & Telecom sector's leadership in the 5G market, while also driving growing demand in media, industrial automation, and connected vehicle ecosystems.

The Global 5G Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Verizon Communications Inc., AT&T Inc., T-Mobile US, Inc., Telefonaktiebolaget LM Ericsson, Nokia Corporation, Huawei Technologies Co., Ltd., Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., Cisco Systems, Inc., ZTE Corporation, BT Group plc, Vodafone Group plc, Intel Corporation, SK Telecom Co., Ltd., China Mobile Limited contribute to innovation, geographic expansion, and service delivery in this space through investments in 5G radio and core networks, spectrum holdings, and ecosystem partnerships with device, cloud, and application providers. Many of these companies are also active in private 5G, network slicing, and edge computing, working with enterprises in manufacturing, logistics, healthcare, and media to develop new revenue streams beyond traditional consumer mobile broadband.

The future of the 5G services market appears promising, driven by technological advancements and increasing consumer expectations. As more industries adopt 5G technology, the demand for enhanced mobile broadband and low-latency applications will rise. Furthermore, the integration of AI and machine learning into network management is expected to optimize performance and reduce operational costs. This evolution will likely lead to a more interconnected world, where 5G plays a pivotal role in enabling innovations across various sectors, including healthcare, transportation, and entertainment.

| Segment | Sub-Segments |

|---|---|

| By Communication Type | Enhanced Mobile Broadband (eMBB) Fixed Wireless Access (FWA) Ultra-Reliable Low-Latency Communications (URLLC) Massive Machine-Type Communications (mMTC) |

| By End-Use Industry | IT & Telecom Media & Entertainment Manufacturing & Industrial Healthcare Automotive & Transportation Energy & Utilities Public Safety & Defense Others |

| By Use Case Category | Consumer Mobile Broadband Enterprise 5G (Campus & Private Networks) Industrial Automation & Smart Manufacturing Smart Cities & Infrastructure Mission-Critical Communications IoT Connectivity Services Others |

| By Deployment Model | Public 5G Networks Private 5G Networks Hybrid (Public–Private) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Service Model | Connectivity & Data Services Managed 5G Services Network Slicing as a Service Edge Computing Services Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go / Usage-Based Tiered / Speed- and SLA-Based Pricing Enterprise Contract & Customized Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators | 120 | Network Managers, Business Development Executives |

| Enterprise 5G Users | 90 | IT Managers, Operations Directors |

| 5G Infrastructure Providers | 70 | Product Managers, Technical Sales Representatives |

| Regulatory Bodies | 60 | Policy Analysts, Regulatory Affairs Managers |

| Consumer Insights | 100 | End Users, Technology Enthusiasts |

The Global 5G Services Market is valued at approximately USD 165 billion as of 2024, driven by the increasing demand for high-speed internet, IoT device proliferation, and advancements in mobile technology.