Region:Middle East

Author(s):Shubham

Product Code:KRAB4970

Pages:96

Published On:October 2025

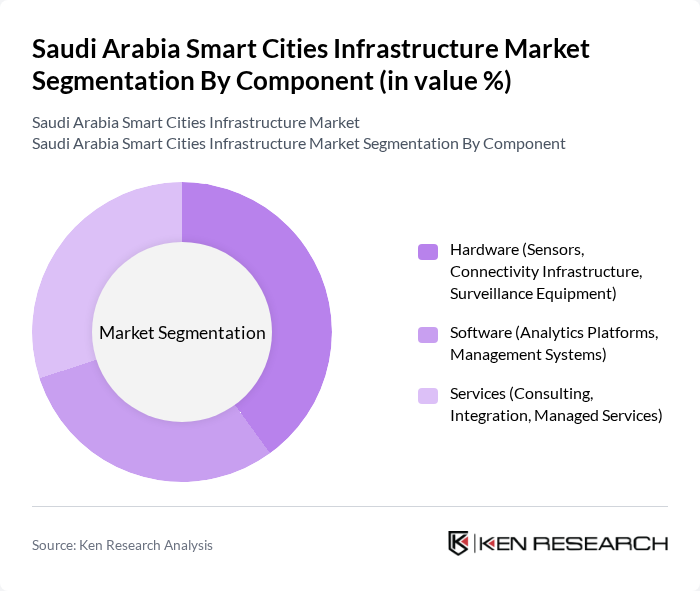

By Component:The market is segmented into three main components: Hardware, Software, and Services. Hardware includes sensors, connectivity infrastructure, and surveillance equipment, which are essential for data collection and monitoring. Software encompasses analytics platforms and management systems that process and analyze data for decision-making. Services involve consulting, integration, and managed services that support the implementation and maintenance of smart city solutions. Hardware remains the largest segment, driven by the deployment of IoT devices and sensors as the backbone of smart city infrastructure .

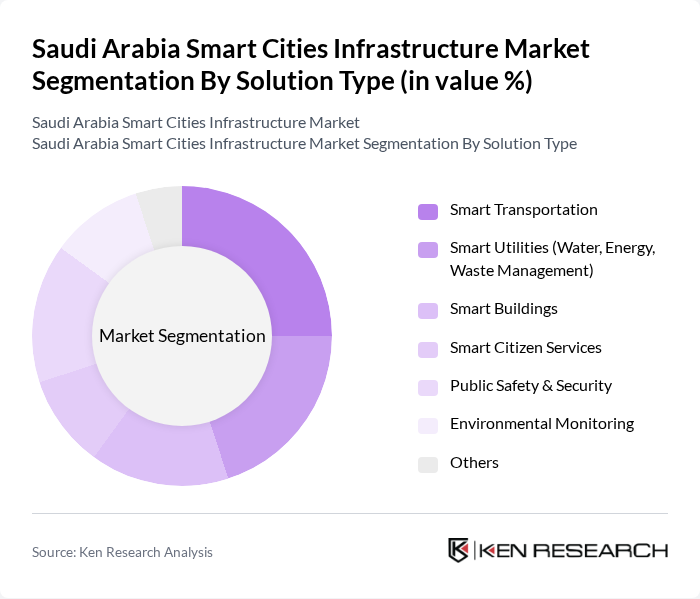

By Solution Type:The market is categorized into various solution types, including Smart Transportation, Smart Utilities, Smart Buildings, Smart Citizen Services, Public Safety & Security, Environmental Monitoring, and Others. Smart Transportation focuses on enhancing mobility through intelligent traffic management systems. Smart Utilities aim to optimize resource usage in water, energy, and waste management. Smart Buildings integrate technology for energy efficiency and occupant comfort, while Public Safety & Security solutions enhance urban safety through surveillance and emergency response systems. Environmental Monitoring is gaining traction due to sustainability mandates and climate resilience initiatives .

The Saudi Arabia Smart Cities Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Telecom Company (STC), NEOM, Saudi Electricity Company (SEC), Aramco, Mobily, Elm Company, Siemens AG, Cisco Systems, Inc., IBM Corporation, Schneider Electric, Honeywell International Inc., Huawei Technologies Co., Ltd., Oracle Corporation, Microsoft Corporation, Ericsson, Accenture, Alfanar, Advanced Electronics Company (AEC), Thales Group, Obeikan Digital Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of Saudi Arabia's smart cities infrastructure market appears promising, driven by ongoing urbanization and government support. The integration of renewable energy sources and smart technologies is expected to enhance urban living standards significantly in future. As public-private partnerships become more prevalent, collaboration will foster innovation and accelerate project delivery. Moreover, the increasing focus on sustainability will likely lead to the development of eco-friendly smart city solutions, positioning Saudi Arabia as a leader in smart urban development in the region.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Sensors, Connectivity Infrastructure, Surveillance Equipment) Software (Analytics Platforms, Management Systems) Services (Consulting, Integration, Managed Services) |

| By Solution Type | Smart Transportation Smart Utilities (Water, Energy, Waste Management) Smart Buildings Smart Citizen Services Public Safety & Security Environmental Monitoring Others |

| By End-User | Government & Municipalities Commercial Industrial Residential |

| By Technology | Internet of Things (IoT) Artificial Intelligence (AI) & Machine Learning (ML) Cloud Computing G & Connectivity Blockchain |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Urban Planning Traffic Management Energy Management Public Safety Environmental Monitoring Others |

| By Distribution Mode | Direct Sales Online Sales Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Transportation Solutions | 60 | City Transportation Planners, Smart Mobility Experts |

| Smart Energy Management Systems | 45 | Energy Managers, Sustainability Coordinators |

| Urban Data Analytics Platforms | 40 | Data Scientists, Urban Analysts |

| Smart Waste Management Technologies | 42 | Waste Management Directors, Environmental Engineers |

| Public Safety and Security Solutions | 50 | Public Safety Officials, Security Technology Providers |

The Saudi Arabia Smart Cities Infrastructure Market is valued at approximately USD 13 billion, driven by government initiatives like Vision 2030, which focuses on urban development, technological integration, and sustainability.