Region:Global

Author(s):Rebecca

Product Code:KRAD4985

Pages:98

Published On:December 2025

By Product Type:The product type segmentation includes various categories such as Food Preparation & Filter Papers, Medical & Specialty Papers, Currency & Security Papers, Industrial & Technical Papers, and Others. Each of these subsegments serves distinct applications across different industries, with food and beverage filtration and specialty technical papers recognized as the largest consumption areas for abaca-based pulp.

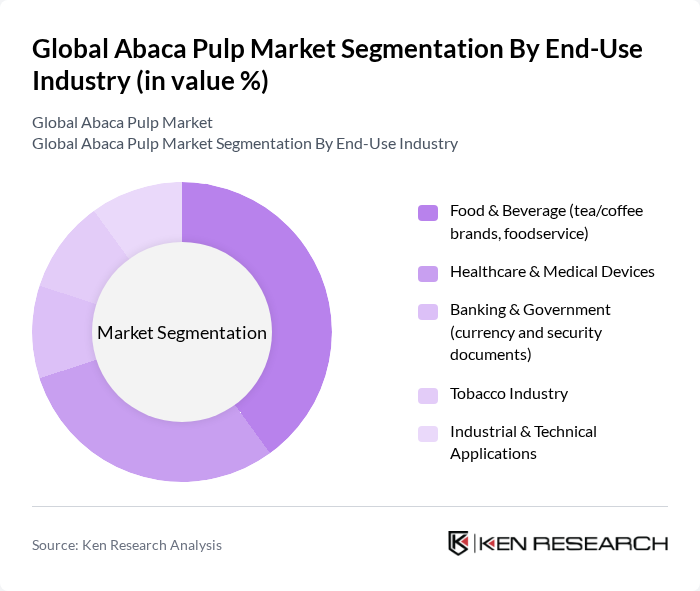

By End-Use Industry:The end-use industry segmentation encompasses various sectors including Food & Beverage, Healthcare & Medical Devices, Banking & Government, Tobacco Industry, Industrial & Technical Applications, and Others. Each sector utilizes abaca pulp for its unique properties and benefits, with the paper and pulp value chain for tea bags, coffee filters, and medical filtration media identified as the most intensive end-use for abaca fibers and pulp.

The Global Abaca Pulp Market is characterized by a dynamic mix of regional and international players. Leading participants such as Specialty Pulp Manufacturing, Inc., ALINDECO (Albay Agro-Industrial Development Corporation), Pulp Specialties Philippines, Inc., Newtech Pulp, Inc., Abacell, Royale Fibers, CELESA (Celulosa de Levante S.A.), Ahlstrom, Terranova Papers, Glatfelter Corporation, Wigglesworth & Co. Ltd., University Products, Inc., Preservation Equipment Ltd, Other Regional Abaca Pulp Producers, Emerging Local Producers in the Philippines and Ecuador contribute to innovation, geographic expansion, and service delivery in this space.

The future of the abaca pulp market appears promising, driven by increasing consumer awareness of sustainability and the growing demand for eco-friendly products. Innovations in processing technologies are expected to enhance the quality and efficiency of abaca fiber extraction, making it more competitive against synthetic alternatives. Additionally, as global regulations tighten around environmental practices, the shift towards natural fibers will likely accelerate, positioning abaca pulp as a key player in sustainable manufacturing across various industries.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Food Preparation & Filter Papers (tea bags, coffee filters, food wrap) Medical & Specialty Papers (medical filter papers, mask media, laboratory papers) Currency & Security Papers Industrial & Technical Papers (tobacco paper, capacitor paper, stencil and other technical grades) Others |

| By End-Use Industry | Food & Beverage (tea/coffee brands, foodservice) Healthcare & Medical Devices Banking & Government (currency and security documents) Tobacco Industry Industrial & Technical Applications Others |

| By Application | Tea Bags Coffee Filters Medical & Laboratory Filter Media Mask & Air Filtration Media Currency & Security Paper Base Specialty & Technical Paper Others |

| By Processing / Pulping Method | Chemical Pulping (e.g., sulphate/kraft) Mechanical / Chemi-mechanical Pulping Bleached Abaca Pulp Unbleached Abaca Pulp Others |

| By Geographic Distribution | Asia-Pacific Europe North America Central & South America Middle East & Africa |

| By Product Form | Bales Wet-Lap Pulp Dry Pulp Sheets Others |

| By Supply Chain Structure | Direct Supply to Paper Mills & Converters Through Trading Houses / Aggregators Through Distributors & Agents Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Abaca Pulp Manufacturers | 100 | Production Managers, Operations Directors |

| Textile Industry Users | 80 | Procurement Managers, Product Development Heads |

| Paper Industry Stakeholders | 90 | Supply Chain Managers, Quality Control Officers |

| Research Institutions | 50 | Research Analysts, Environmental Scientists |

| Government Regulatory Bodies | 60 | Policy Makers, Agricultural Officers |

The Global Abaca Pulp Market is valued at approximately USD 450 million, driven by the increasing demand for sustainable and biodegradable materials across various industries, including food packaging and medical applications.