Region:Middle East

Author(s):Shubham

Product Code:KRAD0991

Pages:98

Published On:November 2025

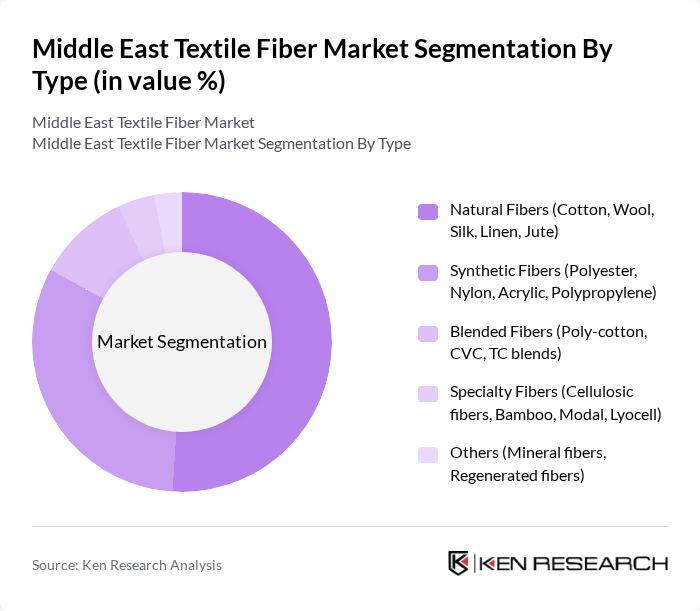

By Type:The textile fiber market is segmented into natural fibers, synthetic fibers, blended fibers, specialty fibers, and others. Natural fibers such as cotton and wool are preferred for their comfort, breathability, and sustainability, while synthetic fibers like polyester and nylon are valued for their durability, versatility, and cost efficiency. Blended fibers combine the performance attributes of both, meeting diverse consumer and industrial requirements. Specialty fibers, including cellulosic and bamboo, are gaining traction for their eco-friendly properties and technical applications.

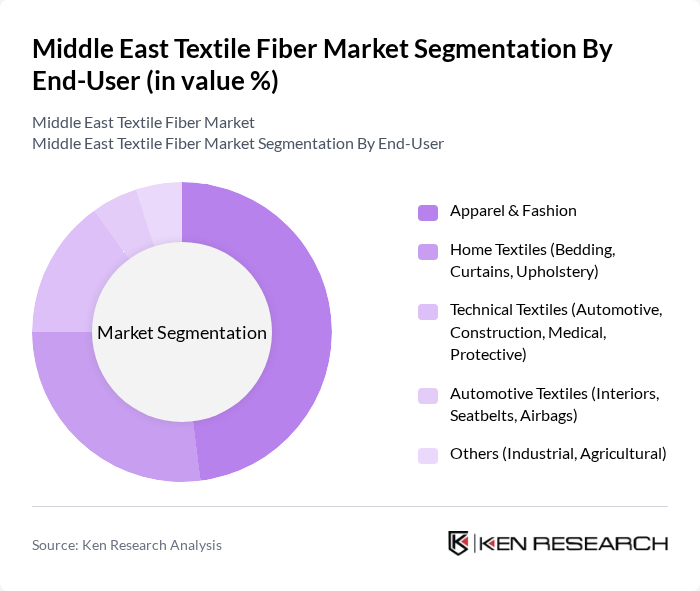

By End-User:The end-user segmentation of the textile fiber market includes apparel & fashion, home textiles, technical textiles, automotive textiles, and others. Apparel and fashion remain the largest segment, driven by evolving consumer preferences, rising disposable incomes, and the proliferation of fast fashion. Home textiles are significant, with robust demand for bedding, curtains, and upholstery. Technical textiles are expanding due to applications in construction, healthcare, and protective equipment, while automotive textiles are increasingly used for interiors and safety components.

The Middle East Textile Fiber Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alok Industries, Arvind Limited, Gulf Fibers, Al-Hazaa Investment Group, National Spinning Company, Al-Mansoori Specialized Engineering, Al-Futtaim Group, Al-Ahlia Group, Al-Jazeera Group, Al-Muhaidib Group, Al-Qatami Global for General Trading, Al-Suwaidi Industrial Services, Al-Tamimi Group, Al-Watania for Industries, Zamil Group Holding Company, Noman Group (Bangladesh/UAE), Nakheel Textiles, Tefron Ltd. (Israel), Istanbul Textile and Apparel Exporters’ Association (Turkey), Mepco Gulf (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East textile fiber market is poised for transformative growth, driven by increasing consumer awareness of sustainability and technological advancements. As the demand for eco-friendly textiles rises, manufacturers are likely to invest in innovative production methods. Additionally, the expansion of e-commerce platforms will facilitate broader market access, enabling companies to reach diverse consumer bases. This evolving landscape presents opportunities for collaboration with fashion brands, fostering the development of unique, sustainable textile solutions that cater to changing consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Fibers (Cotton, Wool, Silk, Linen, Jute) Synthetic Fibers (Polyester, Nylon, Acrylic, Polypropylene) Blended Fibers (Poly-cotton, CVC, TC blends) Specialty Fibers (Cellulosic fibers, Bamboo, Modal, Lyocell) Others (Mineral fibers, Regenerated fibers) |

| By End-User | Apparel & Fashion Home Textiles (Bedding, Curtains, Upholstery) Technical Textiles (Automotive, Construction, Medical, Protective) Automotive Textiles (Interiors, Seatbelts, Airbags) Others (Industrial, Agricultural) |

| By Application | Fashion and Apparel Industrial Applications (Filtration, Geotextiles, Packaging) Medical Textiles (Wound care, Surgical gowns, Face masks) Home Furnishings Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales (B2B) Wholesale Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant Region (Jordan, Lebanon, Syria, Iraq, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Others (Turkey, Iran, Israel) |

| By Fiber Source | Organic Sources (Organic cotton, Organic wool) Conventional Sources Recycled Sources (rPET, recycled cotton, recycled polyester) Others |

| By Sustainability Level | Eco-Friendly Fibers (Organic, recycled, biodegradable) Conventional Fibers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Manufacturing Sector | 120 | Production Managers, Operations Directors |

| Fiber Supply Chain Management | 60 | Supply Chain Managers, Procurement Specialists |

| Retail Textile Sales | 50 | Retail Managers, Merchandising Directors |

| Textile Export and Import Analysis | 40 | Trade Compliance Officers, Export Managers |

| Sustainability Initiatives in Textiles | 40 | Sustainability Managers, Product Development Leads |

The Middle East Textile Fiber Market is valued at approximately USD 1.6 billion, driven by increasing demand for both natural and synthetic fibers, particularly in the fashion, home textiles, and technical textile industries.