Region:Global

Author(s):Shubham

Product Code:KRAC0847

Pages:88

Published On:August 2025

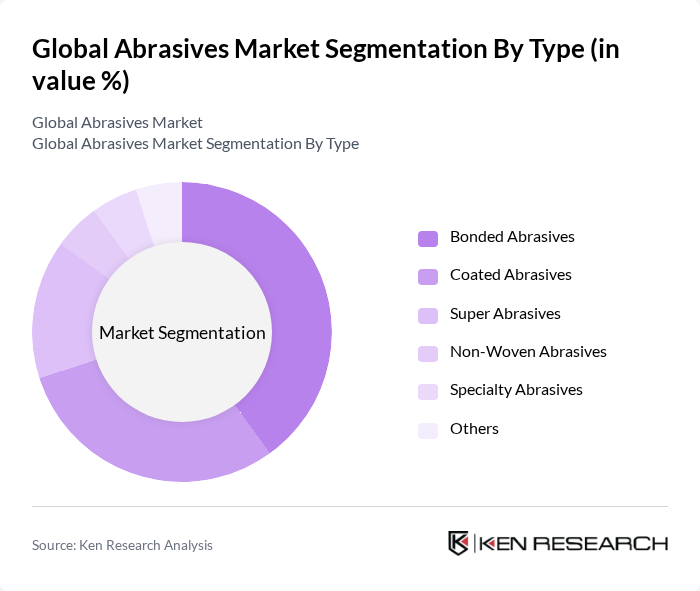

By Type:The abrasives market is segmented into bonded abrasives, coated abrasives, super abrasives, non-woven abrasives, specialty abrasives, and others.Bonded abrasivesare the most widely used, favored for their durability and effectiveness in grinding and cutting.Coated abrasivesalso hold a significant share, especially in automotive and woodworking, due to their versatility and performance. Demand forsuper abrasivesis rising, driven by their critical role in high-precision machining and advanced manufacturing applications .

By Material:The abrasives market is categorized into natural and synthetic abrasives.Synthetic abrasivesdominate due to their superior performance, consistency, and adaptability to a wide range of applications, including grinding, cutting, and polishing.Natural abrasivesare mainly used in niche applications where specific properties are required. The shift toward synthetic materials is propelled by manufacturing advancements and increasing demand for high-performance products .

The Global Abrasives Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Saint-Gobain Abrasives, Norton Abrasives (Saint-Gobain subsidiary), Tyrolit Group, Mirka Ltd., Klingspor AG, Abrasive Technology, Inc., Fujimi Incorporated, Robert Bosch GmbH, Sia Abrasives Industries AG, PFERD Inc., Carborundum Universal Limited (CUMI), VSM AG, ZEC S.p.A., Dronco GmbH, Cabot Microelectronics Corporation, and Flexovit (Saint-Gobain subsidiary) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the abrasives market in None appears promising, driven by technological advancements and increasing demand across various sectors. The shift towards automation in manufacturing processes is expected to enhance efficiency and reduce labor costs. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly abrasive products, aligning with global environmental goals. Companies that adapt to these trends will be well-positioned to capture market share and drive innovation in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Bonded Abrasives Coated Abrasives Super Abrasives Non-Woven Abrasives Specialty Abrasives Others |

| By Material | Natural Abrasives Synthetic Abrasives |

| By End-User | Automotive Aerospace Construction Metal Fabrication Electronics & Semiconductors Medical Devices Oil & Gas Others |

| By Application | Grinding Polishing Cutting Sanding Chemical Mechanical Planarization (CMP) Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Sheets Rolls Discs Blocks Wheels Pads Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Abrasives Usage | 100 | Manufacturing Engineers, Quality Control Managers |

| Construction Industry Abrasives | 60 | Project Managers, Site Supervisors |

| Metalworking Abrasives Applications | 75 | Production Managers, Tooling Specialists |

| Consumer Abrasives Market | 50 | Retail Buyers, Product Development Managers |

| Industrial Abrasives Supply Chain | 65 | Supply Chain Managers, Procurement Officers |

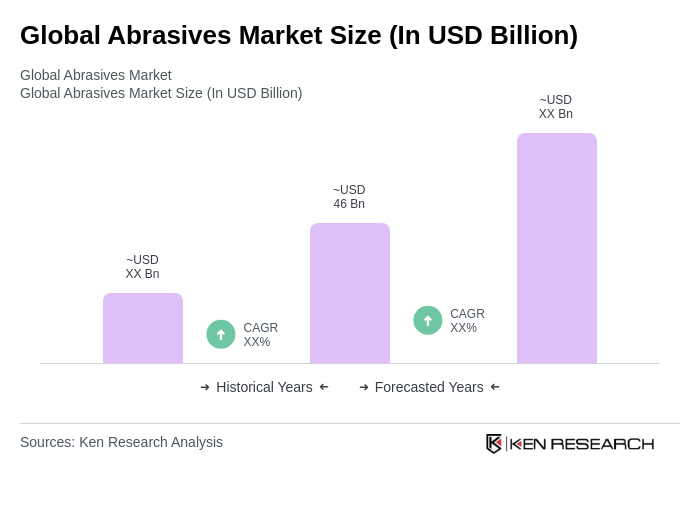

The Global Abrasives Market is valued at approximately USD 46 billion, based on a five-year historical analysis. This valuation reflects the increasing demand from various industries, including automotive, construction, and electronics, which require high-performance abrasives for manufacturing and finishing processes.