Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9192

Pages:84

Published On:November 2025

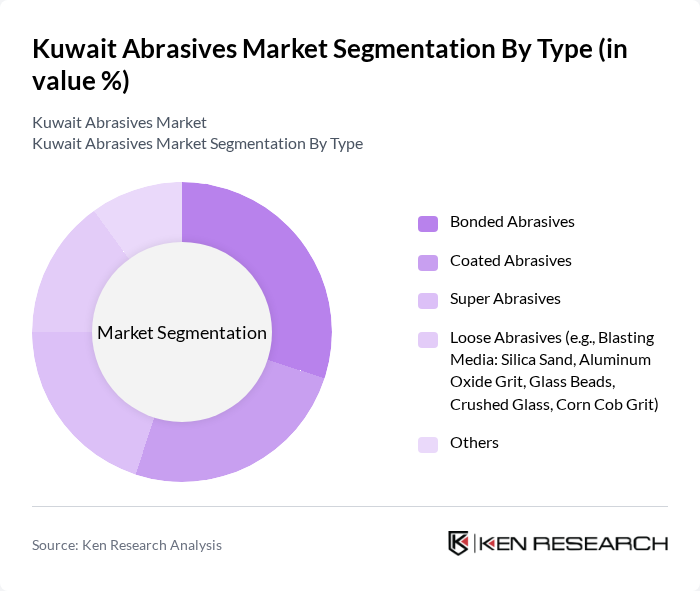

By Type:The abrasives market is segmented into bonded abrasives, coated abrasives, super abrasives, loose abrasives, and others. Each type serves distinct applications: bonded abrasives are widely used for grinding and cutting, coated abrasives for sanding and finishing, super abrasives for precision machining, and loose abrasives for blasting and polishing. These segments reflect the diverse requirements across construction, automotive, electronics, and metal fabrication industries.

The bonded abrasives segment leads the market, driven by their extensive use in grinding and cutting applications across construction, metal fabrication, and automotive industries. Their durability and high material removal rates make them the preferred choice for manufacturers and contractors. The rising adoption of precision engineering and advanced manufacturing processes further accelerates demand for bonded abrasives, reinforcing their market dominance.

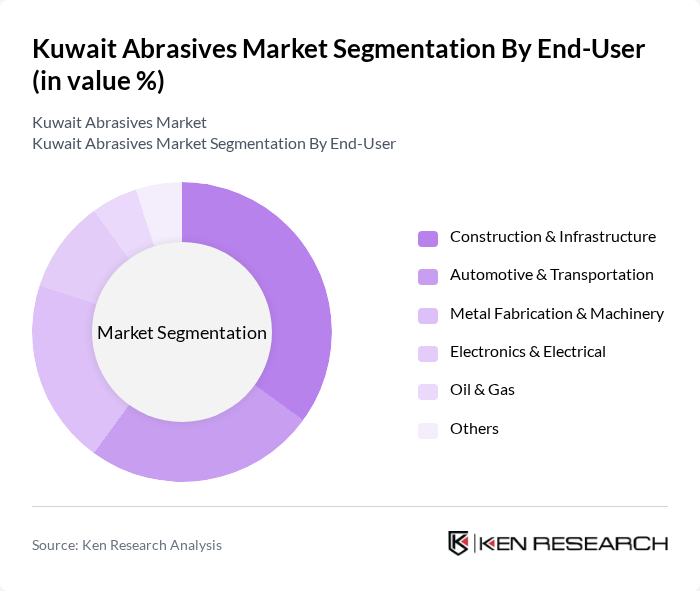

By End-User:The abrasives market is segmented by end-user industries, including construction & infrastructure, automotive & transportation, metal fabrication & machinery, electronics & electrical, oil & gas, and others. Each sector has unique requirements for abrasives, influencing the demand for specific types and grades. Construction and infrastructure require abrasives for surface preparation and finishing, automotive for bodywork and engine components, metal fabrication for grinding and deburring, electronics for precision polishing, and oil & gas for maintenance and refurbishment.

The construction and infrastructure segment is the leading end-user, propelled by ongoing and upcoming projects in Kuwait. Demand is fueled by the need for surface preparation, finishing, and maintenance of construction materials. Government investment in infrastructure, urbanization, and industrial expansion continues to drive abrasives consumption in this segment, supported by stringent quality standards and the adoption of advanced abrasive technologies.

The Kuwait Abrasives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain Abrasives, 3M Company, Norton Abrasives, Tyrolit Group, Klingspor AG, Mirka Ltd., Sia Abrasives (Bosch Group), Pferd Werkzeuge, VSM AG, Flexovit (Saint-Gobain), Dronco GmbH, Carborundum Universal Limited (CUMI), Fujairah Gold (local GCC supplier), Al Shabib Trading Est. (UAE-based, active in Kuwait), Gulf Abrasives Manufacturing LLC (regional supplier) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait abrasives market is poised for growth, driven by increasing demand from key sectors such as construction and manufacturing. As technological advancements continue to enhance product performance, local manufacturers are likely to adopt innovative solutions to remain competitive. Additionally, the government's commitment to infrastructure development will further stimulate market activity. However, companies must navigate challenges such as fluctuating raw material prices and intense competition to capitalize on emerging opportunities in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Bonded Abrasives Coated Abrasives Super Abrasives Loose Abrasives (e.g., Blasting Media: Silica Sand, Aluminum Oxide Grit, Glass Beads, Crushed Glass, Corn Cob Grit) Others |

| By End-User | Construction & Infrastructure Automotive & Transportation Metal Fabrication & Machinery Electronics & Electrical Oil & Gas Others |

| By Application | Surface Preparation & Cleaning Grinding & Deburring Polishing & Finishing Cutting & Drilling Others |

| By Material | Aluminum Oxide Silicon Carbide Diamond Cubic Boron Nitride Garnet Others |

| By Distribution Channel | Direct Sales Online Retail Industrial Distributors Wholesalers Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Eastern Kuwait Western Kuwait Others |

| By Customer Type | B2B (Industrial/Commercial) B2C (Retail/DIY) Government & Institutional Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Usage | 100 | Project Managers, Site Supervisors |

| Automotive Manufacturing Insights | 80 | Production Managers, Quality Control Engineers |

| Metalworking Sector Feedback | 70 | Machinists, Tooling Engineers |

| Retail Distribution Channels | 50 | Sales Managers, Supply Chain Coordinators |

| End-user Satisfaction Surveys | 60 | Purchasing Agents, Operations Managers |

The Kuwait Abrasives Market is valued at approximately USD 40 million, driven by increasing demand from sectors such as construction, automotive, and metal fabrication, which require high-quality abrasives for various applications.