Region:Global

Author(s):Shubham

Product Code:KRAC0626

Pages:92

Published On:August 2025

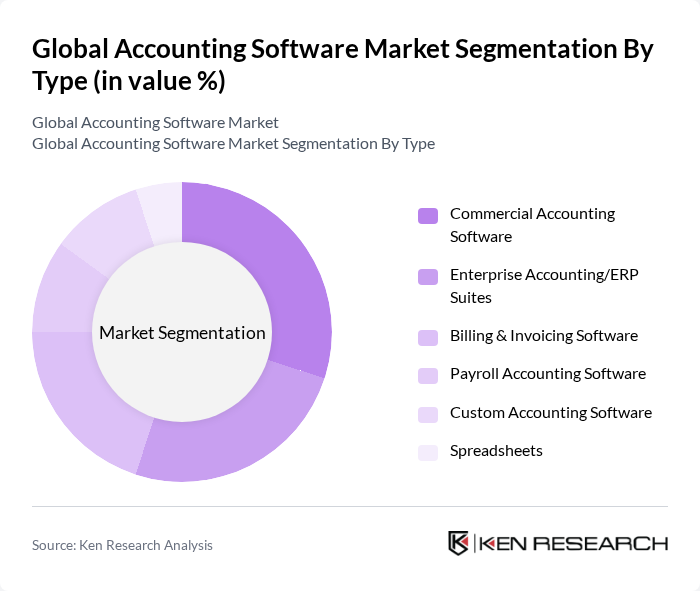

By Type:The accounting software market is segmented into various types, including Commercial Accounting Software, Enterprise Accounting/ERP Suites, Billing & Invoicing Software, Payroll Accounting Software, Custom Accounting Software, and Spreadsheets. Each of these sub-segments caters to different business needs and scales, with varying functionalities and deployment options .

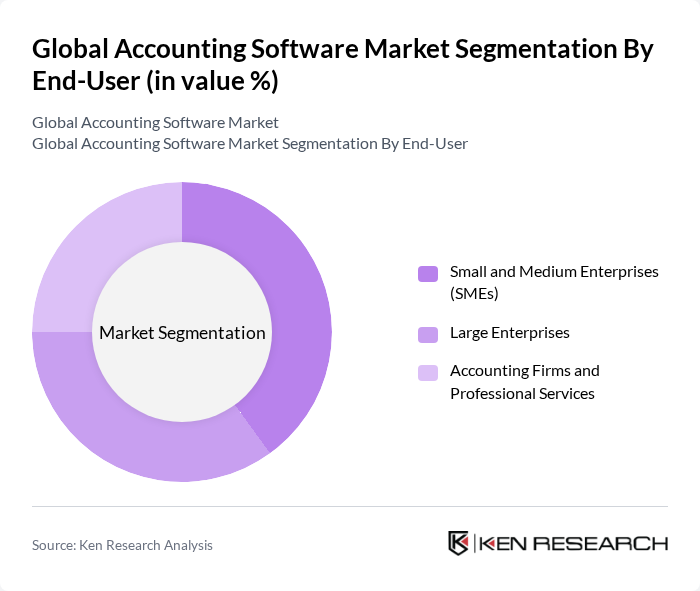

By End-User:The market is also segmented by end-users, which include Small and Medium Enterprises (SMEs), Large Enterprises, and Accounting Firms and Professional Services. Each segment has unique requirements and preferences for accounting solutions, influencing the overall market dynamics .

The Global Accounting Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intuit Inc. (QuickBooks), Sage Group plc, Xero Limited, FreshBooks, Zoho Corporation (Zoho Books), Microsoft Corporation (Dynamics 365 Finance), Oracle Corporation (NetSuite, Oracle Fusion Cloud ERP), SAP SE (SAP S/4HANA Finance, SAP Business One), Wave Financial Inc., BlackLine, Inc., MYOB Group Pty Ltd, Tally Solutions Pvt. Ltd., Sage Intacct, Inc., FreeAgent Holdings Ltd, KashFlow Software Ltd contribute to innovation, geographic expansion, and service delivery in this space.

Enhancements and Validation Notes:

The future of the accounting software market is poised for significant transformation, driven by technological advancements and evolving business needs. As companies increasingly prioritize real-time data analytics and user-friendly interfaces, the demand for innovative solutions will rise. Furthermore, the integration of artificial intelligence and machine learning is expected to enhance decision-making processes, allowing businesses to leverage data more effectively. This shift will create a dynamic landscape where adaptability and responsiveness are key to success in the accounting software sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Commercial Accounting Software Enterprise Accounting/ERP Suites Billing & Invoicing Software Payroll Accounting Software Custom Accounting Software Spreadsheets |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Accounting Firms and Professional Services |

| By Deployment Model | Cloud-Based On-Premise Mobile-First Solutions |

| By Functionality | General Ledger, AP/AR, and Financial Reporting Billing & Invoicing Payroll & Expense Management Tax Management & Compliance Budgeting, Forecasting & FP&A Inventory & Order Management |

| By Industry Vertical | BFSI Retail & Ecommerce Manufacturing IT & Telecom Government & Public Sector Healthcare & Life Sciences Professional Services Others (Energy & Utilities, Media & Entertainment) |

| By Sales Channel | Direct (Vendor) Sales Online/Digital Sales Value-Added Resellers (VARs) & System Integrators |

| By Pricing Model | Subscription (SaaS) – Monthly/Annual Perpetual License Freemium/Tiered Plans Usage-Based/Add-on Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Small Business Accounting Software | 150 | Small Business Owners, Accountants |

| Enterprise Resource Planning (ERP) Solutions | 100 | Finance Directors, IT Managers |

| Cloud-based Accounting Solutions | 120 | Finance Managers, IT Managers |

| Compliance and Regulatory Software | 80 | Compliance Officers, Risk Managers |

| Accounting Software for Non-profits | 70 | Non-profit Financial Officers, Program Managers |

The Global Accounting Software Market is valued at approximately USD 19 billion, reflecting a significant growth trend driven by the increasing adoption of cloud-based solutions and the demand for automation in financial processes.