Region:Asia

Author(s):Rebecca

Product Code:KRAC9743

Pages:80

Published On:November 2025

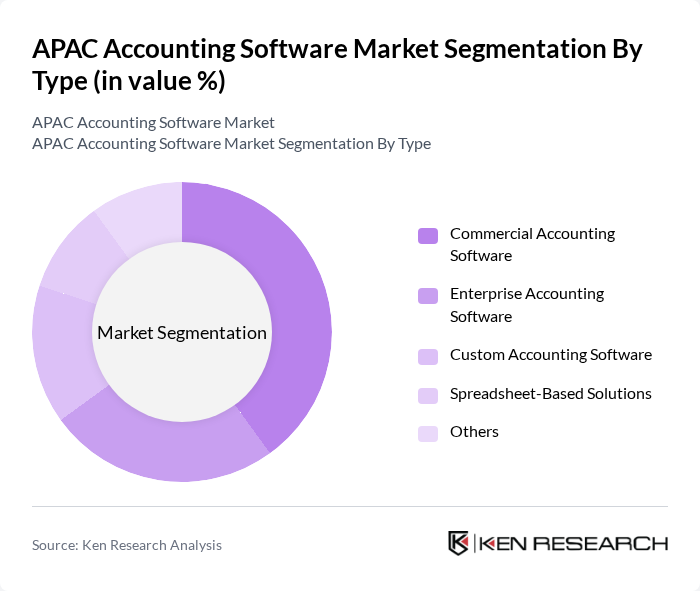

By Type:The APAC Accounting Software Market is segmented into various types, including Commercial Accounting Software, Enterprise Accounting Software, Custom Accounting Software, Spreadsheet-Based Solutions, and Others. Among these, Commercial Accounting Software is the most widely adopted due to its user-friendly interfaces and comprehensive features that cater to the needs of small and medium-sized enterprises. The increasing trend of digitalization in businesses has led to a surge in the adoption of these solutions, as they offer scalability and flexibility to meet diverse accounting needs. The market continues to see innovation in cloud-based and mobile-first platforms, enhancing accessibility and integration with other business tools .

By Component:This segmentation includes Solutions and Services. The Solutions segment is leading the market due to the increasing demand for software that automates accounting processes and enhances operational efficiency. Businesses are increasingly investing in comprehensive solutions that integrate various accounting functions, such as invoicing, payroll, and tax management, into a single platform. This trend is driven by the need for streamlined operations and improved financial visibility. The rise of SaaS-based models and API integrations is further supporting the dominance of the Solutions segment .

The APAC Accounting Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intuit Inc., Xero Limited, FreshBooks, Zoho Corporation, Sage Group plc, MYOB Group Pty Ltd, Oracle Corporation, SAP SE, Microsoft Corporation, Wave Financial Inc., Tally Solutions Pvt. Ltd., Reckon Limited, Kingdee International Software Group Company Limited, Yonyou Network Technology Co., Ltd., Ramco Systems Limited contribute to innovation, geographic expansion, and service delivery in this space.

The APAC accounting software market is poised for transformative growth, driven by technological advancements and evolving business needs. As organizations increasingly embrace digital transformation, the demand for innovative solutions that enhance efficiency and compliance will rise. The integration of artificial intelligence and machine learning into accounting software is expected to streamline processes and improve decision-making. Additionally, the focus on sustainability will shape product development, as companies seek solutions that align with their environmental goals, creating a dynamic and competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Commercial Accounting Software Enterprise Accounting Software Custom Accounting Software Spreadsheet-Based Solutions Others |

| By Component | Solution Services |

| By Deployment Model | On-Premise Cloud-Based Hybrid Others |

| By Organization Size | Large Enterprises Small & Medium-sized Enterprises (SMEs) |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Non-Profit Organizations Government Agencies Others |

| By Industry Vertical | BFSI (Banking, Financial Services, and Insurance) Manufacturing Government & Public Sector Telecom & IT Media & Entertainment Healthcare & Life Sciences Energy & Utilities Retail & Ecommerce Others |

| By Functionality | Financial Management Inventory Management Payroll Management Tax Management Others |

| By Geographic Presence | China Japan India South Korea Singapore Malaysia Australia Rest of Asia Pacific |

| By Pricing Model | Subscription-Based Pricing One-Time License Fee Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Accounting Software Users | 100 | Finance Managers, Business Owners |

| Enterprise Accounting Software Users | 60 | CFOs, IT Directors |

| Accounting Software Vendors | 40 | Product Managers, Sales Directors |

| End-User Experience Feedback | 80 | Accountants, Bookkeepers |

| Industry Experts and Analysts | 40 | Market Analysts, Financial Consultants |

The APAC Accounting Software Market is valued at approximately USD 15 billion, driven by the increasing adoption of cloud-based solutions, automation in financial processes, and the demand for real-time financial reporting.