Region:Global

Author(s):Rebecca

Product Code:KRAC0220

Pages:94

Published On:August 2025

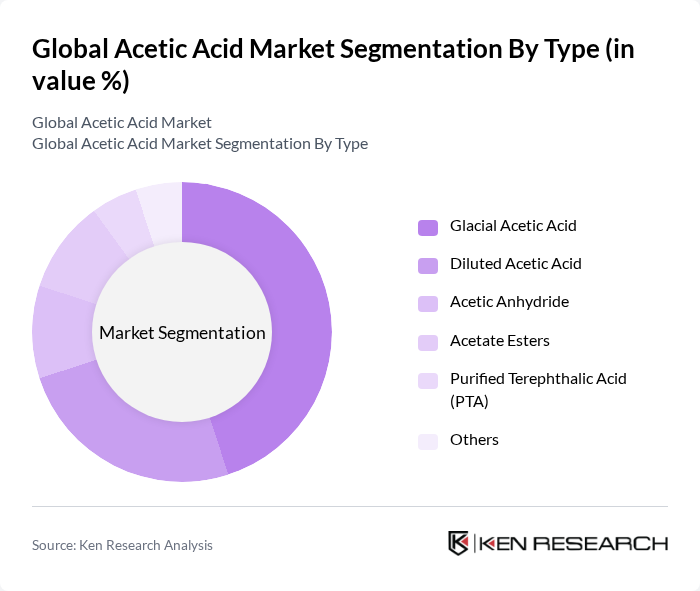

By Type:The acetic acid market is segmented into Glacial Acetic Acid, Diluted Acetic Acid, Acetic Anhydride, Acetate Esters, Purified Terephthalic Acid (PTA), and Others. Glacial Acetic Acid remains the most dominant segment due to its high purity and versatility, making it essential for chemical synthesis, industrial solvents, and food applications. The segment's dominance is reinforced by its critical role in VAM and PTA production, which are foundational for adhesives, paints, coatings, and polyester manufacturing.

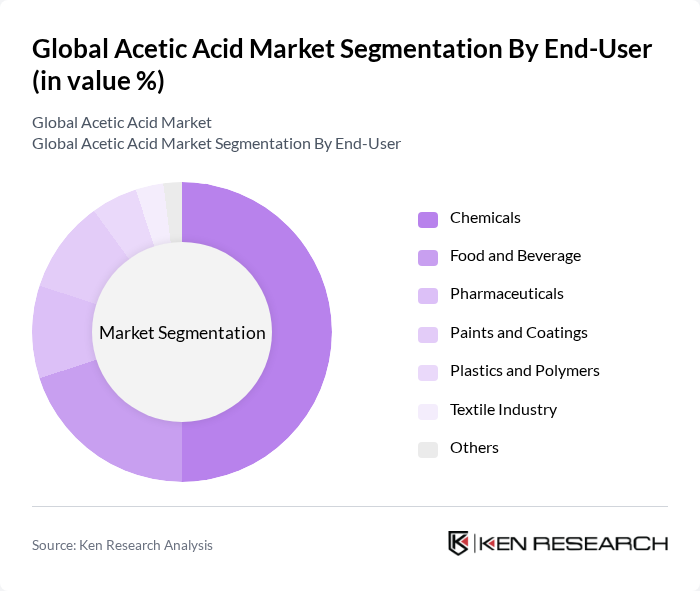

By End-User:The acetic acid market is further segmented by end-user industries: Chemicals, Food and Beverage, Pharmaceuticals, Paints and Coatings, Plastics and Polymers, Textile Industry, and Others. The Chemicals segment holds the largest share, driven by acetic acid’s essential role in producing vinyl acetate, acetic anhydride, and other intermediates. The Food and Beverage segment is expanding due to acetic acid’s use as a preservative and flavoring agent, while the Pharmaceuticals segment benefits from its application in drug synthesis and medical products.

The Global Acetic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eastman Chemical Company, Celanese Corporation, LyondellBasell Industries N.V., Mitsubishi Gas Chemical Company, Inc., Sinopec Limited, BASF SE, INEOS Group Limited, Formosa Plastics Corporation, Daicel Corporation, Jiangsu Sopo (Group) Co., Ltd., Wacker Chemie AG, The Chemours Company, AOC, LLC, Hanwha Solutions Corporation, Taminco Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the acetic acid market appears promising, driven by technological advancements and a shift towards sustainable production methods. As manufacturers adopt greener technologies, the market is likely to see a rise in biobased acetic acid production, which is projected to account for 10% of total production in future. Additionally, the integration of digital technologies in manufacturing processes is expected to enhance efficiency and reduce costs, positioning the industry for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Glacial Acetic Acid Diluted Acetic Acid Acetic Anhydride Acetate Esters Purified Terephthalic Acid (PTA) Others |

| By End-User | Chemicals Food and Beverage Pharmaceuticals Paints and Coatings Plastics and Polymers Textile Industry Others |

| By Application | Vinyl Acetate Monomer (VAM) Acetic Anhydride Acetate Esters Purified Terephthalic Acid (PTA) Solvent Intermediate in Chemical Synthesis Preservative Others |

| By Distribution Channel | Direct Company Sale Direct Import Distributors and Traders Retailers Online Sales Others |

| By Region | Asia-Pacific North America Europe South America Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Product Form | Liquid Solid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Acetic Acid Production Facilities | 100 | Plant Managers, Production Supervisors |

| End-User Industries (Plastics) | 80 | Procurement Managers, Product Development Leads |

| Food and Beverage Sector | 70 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Textile Manufacturing | 50 | Supply Chain Managers, R&D Directors |

| Chemical Distribution Networks | 60 | Logistics Coordinators, Sales Managers |

The Global Acetic Acid Market is valued at approximately USD 16 billion, driven by increasing demand across various applications such as chemicals, food preservation, and textiles, alongside the expansion of industrial activities and the chemical sector.