Region:Middle East

Author(s):Rebecca

Product Code:KRAD1557

Pages:90

Published On:November 2025

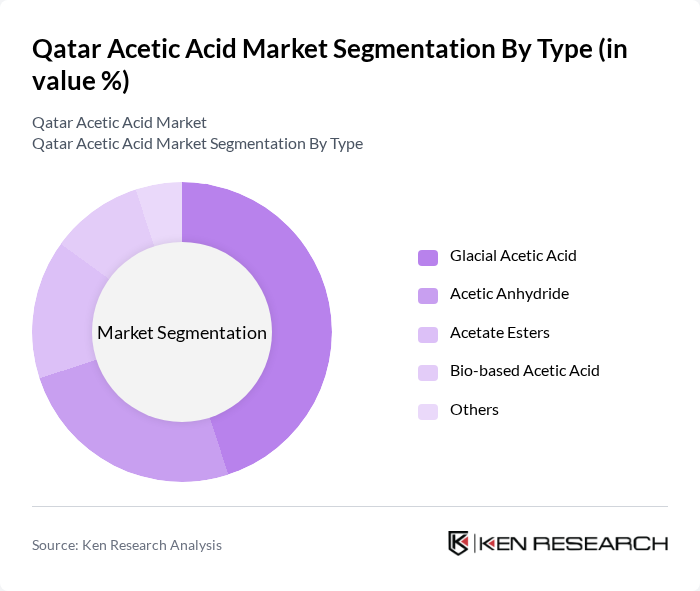

By Type:The acetic acid market can be segmented into various types, including Glacial Acetic Acid, Acetic Anhydride, Acetate Esters, Bio-based Acetic Acid, and Others. Among these, Glacial Acetic Acid is the most widely used due to its extensive application in the production of various chemicals and as a solvent. The demand for Acetic Anhydride is also significant, primarily driven by its use in the production of pharmaceuticals and other chemical intermediates. The growing trend towards sustainability has led to an increase in the production and consumption of Bio-based Acetic Acid, which is gaining traction in the market. The bio-acetic acid segment specifically is expected to reach USD 3 million by 2030, reflecting the market's shift toward sustainable production methods.

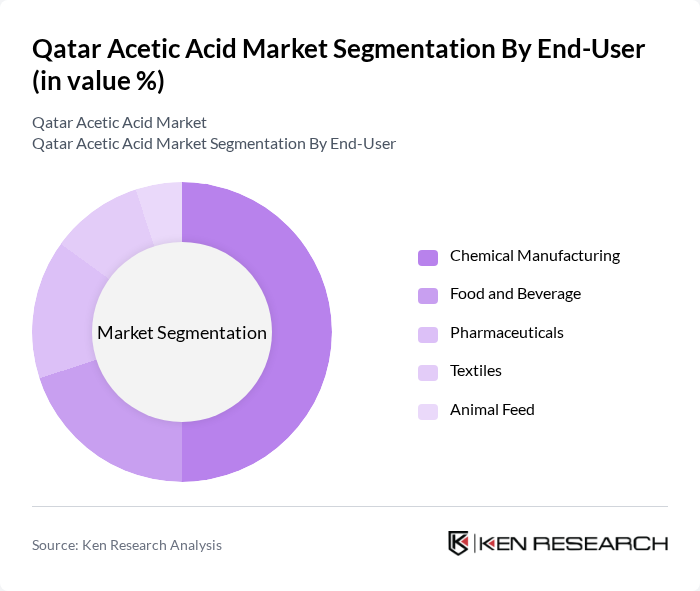

By End-User:The acetic acid market serves various end-user industries, including Chemical Manufacturing, Food and Beverage, Pharmaceuticals, Textiles, Animal Feed, and Others. The Chemical Manufacturing sector is the largest consumer of acetic acid, utilizing it as a key raw material in the production of various chemicals and polymers. The Food and Beverage industry also represents a significant portion of the market, where acetic acid is used as a preservative and flavoring agent, with vinegar production being particularly important in Qatari culinary traditions. The Pharmaceuticals sector is growing steadily, driven by the increasing demand for acetic acid in drug formulation and production.

The Qatar Acetic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Petrochemical Company (QAPCO), Qatar Chemical Company (Q-Chem), Industries Qatar, Gulf Chemicals and Industrial Oils Company (GulfCO), Qatar Vinyl Company (QVC), Qatar Fertilizer Company (QAFCO), Qatar National Chemical Company (QNCC), Qatar Industrial Manufacturing Company (QIMC), Qatar Gas Transport Company (Nakilat), QatarEnergy, Qatar International Petroleum Marketing Company (Tasweeq), BASF Qatar, SABIC Qatar, Dow Chemicals Qatar, Celanese Corporation Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the acetic acid market in Qatar appears promising, driven by the ongoing industrial growth and increasing applications across various sectors. The focus on sustainable production methods and the integration of green chemistry practices are expected to shape the market landscape. Additionally, advancements in production technologies will likely enhance efficiency and reduce costs, positioning Qatar as a competitive player in the regional acetic acid market in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Glacial Acetic Acid Acetic Anhydride Acetate Esters Bio-based Acetic Acid Others |

| By End-User | Chemical Manufacturing Food and Beverage Pharmaceuticals Textiles Animal Feed Others |

| By Application | Solvent Production Intermediate in Chemical Synthesis Production of Acetic Acid Derivatives (e.g., Vinyl Acetate Monomer, Purified Terephthalic Acid) Food Preservatives Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Doha Al Rayyan Umm Salal Al Wakrah Others |

| By Production Method | Methanol Carbonylation Ethanol Oxidation Bio-based Fermentation Others |

| By Policy Support | Subsidies for Local Production Tax Incentives for Export Environmental Compliance Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Applications of Acetic Acid | 40 | Production Managers, Chemical Engineers |

| Food and Beverage Sector Usage | 40 | Quality Control Managers, Product Development Specialists |

| Textile Industry Consumption | 40 | Procurement Managers, Operations Directors |

| Pharmaceutical Applications | 40 | Regulatory Affairs Managers, R&D Scientists |

| Consumer Goods Sector Insights | 40 | Marketing Managers, Supply Chain Analysts |

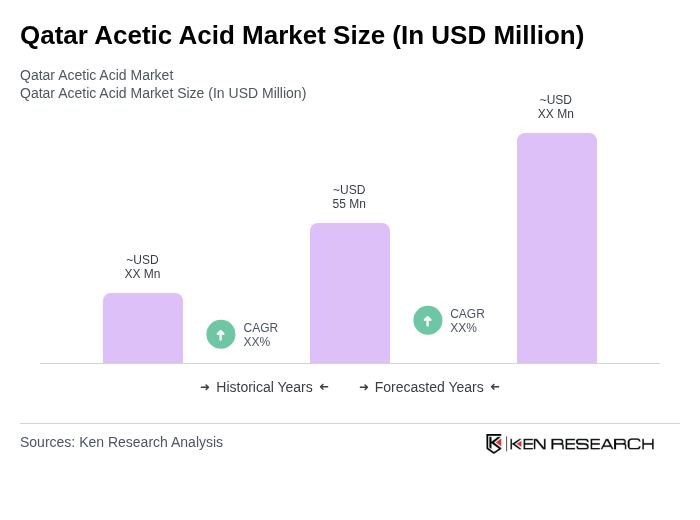

The Qatar Acetic Acid Market is valued at approximately USD 55 million, reflecting a five-year historical analysis. This valuation is driven by increasing demand across various sectors, including chemical manufacturing, food preservation, and textiles.