Region:Global

Author(s):Shubham

Product Code:KRAD0694

Pages:95

Published On:August 2025

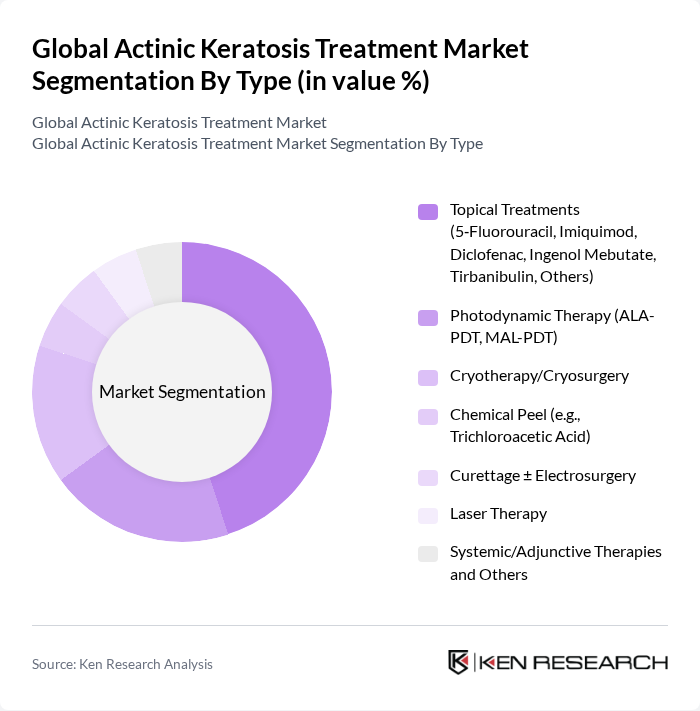

By Type:The market is segmented into various treatment types, including topical treatments, photodynamic therapy, cryotherapy, chemical peels, curettage, laser therapy, and systemic therapies. Among these, topical treatments are the most widely used due to their ease of application and effectiveness in managing actinic keratosis, supported by established agents such as 5?fluorouracil, imiquimod, diclofenac, and the more recent tirbanibulin. The increasing preference for non?invasive treatment options and field?directed therapy has led to a surge in the adoption of topical therapies, making them the dominant segment in the market.

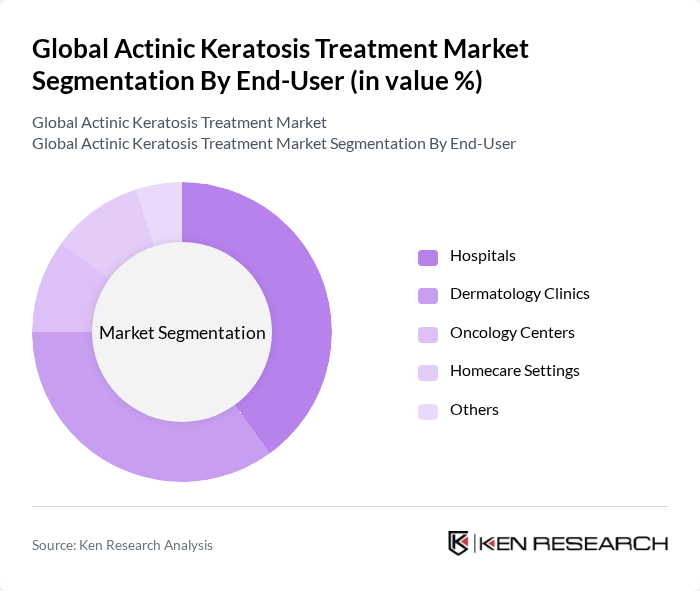

By End-User:The market is categorized based on end-users, including hospitals, dermatology clinics, oncology centers, homecare settings, and others. Hospitals and dermatology clinics are the primary end-users, as they provide specialized care and have the necessary infrastructure for advanced treatments such as photodynamic therapy and cryosurgery. The increasing number of dermatology clinics and the growing trend of outpatient procedures are contributing to the dominance of these segments in the market.

The Global Actinic Keratosis Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Galderma S.A., Bausch Health Companies Inc. (incl. Ortho Dermatologics), Sun Pharmaceutical Industries Ltd., LEO Pharma A/S, Almirall, S.A., Novartis AG (Sandoz for generics), Perrigo Company plc, 3M Health Care, Biofrontera AG, Viatris Inc. (Mylan legacy), Nestlé Skin Health (legacy brand; Galderma lineage), Fotofinder Systems GmbH, Alma Lasers Ltd. (Sisram Medical), Cutera, Inc., Cantabria Labs (IFC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the actinic keratosis treatment market appears promising, driven by ongoing advancements in treatment modalities and increasing public awareness of skin health. As the geriatric population continues to grow, the demand for effective therapies is expected to rise. Additionally, the integration of telemedicine in dermatology is likely to enhance patient access to care, facilitating timely diagnosis and treatment. These trends indicate a robust market evolution, with potential for innovative solutions to emerge in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Topical Treatments (5?Fluorouracil, Imiquimod, Diclofenac, Ingenol Mebutate, Tirbanibulin, Others) Photodynamic Therapy (ALA-PDT, MAL-PDT) Cryotherapy/Cryosurgery Chemical Peel (e.g., Trichloroacetic Acid) Curettage ± Electrosurgery Laser Therapy Systemic/Adjunctive Therapies and Others |

| By End-User | Hospitals Dermatology Clinics Oncology Centers Homecare Settings Others |

| By Distribution Channel | Direct Sales (In-office Procedures/Devices) Online Pharmacies/Providers Retail Pharmacies Hospital Pharmacies and Clinics |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Demographics | Lesion Burden (Single Lesion, Multiple Lesions) Age Group (Adults, Seniors) Gender (Male, Female) Skin Phototype (I–VI) |

| By Treatment Setting | Outpatient Inpatient |

| By Pricing Tier | Premium Mid-range Economy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 120 | Dermatologists, Nurse Practitioners |

| Pharmaceutical Distributors | 90 | Sales Managers, Distribution Coordinators |

| Patient Experience Surveys | 140 | Patients diagnosed with actinic keratosis |

| Healthcare Policy Makers | 80 | Health Economists, Policy Analysts |

| Clinical Research Organizations | 70 | Clinical Researchers, Trial Coordinators |

The Global Actinic Keratosis Treatment Market is valued at approximately USD 6.7 billion, reflecting significant growth driven by increasing prevalence of actinic keratosis, advancements in treatment options, and heightened awareness of skin cancer risks.