Region:Global

Author(s):Shubham

Product Code:KRAA3136

Pages:89

Published On:August 2025

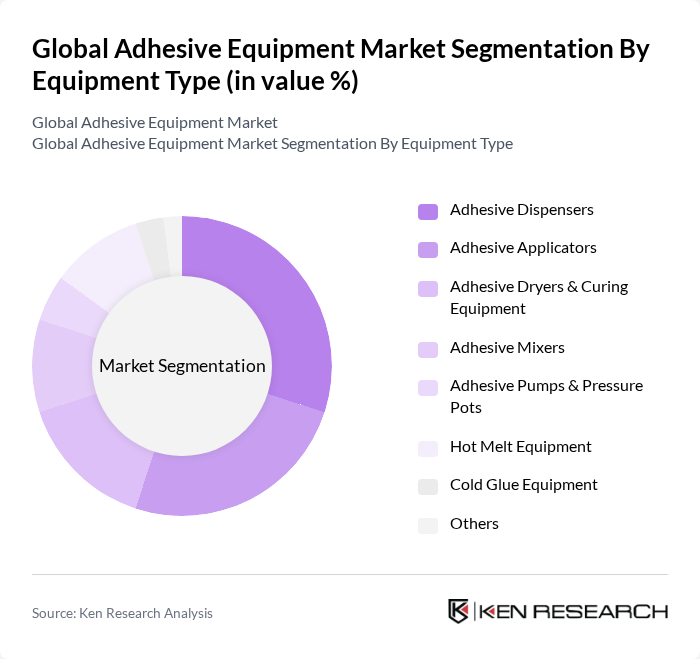

By Equipment Type:The equipment type segmentation includes adhesive dispensers, applicators, dryers & curing equipment, mixers, pumps & pressure pots, hot melt equipment, cold glue equipment, and others. Among these, adhesive dispensers and applicators lead the market due to their essential role in ensuring precise and efficient adhesive application across multiple industries. The trend toward automation in manufacturing and packaging, as well as the need for high-speed, accurate dispensing in electronics and automotive sectors, further boosts demand for these equipment types.

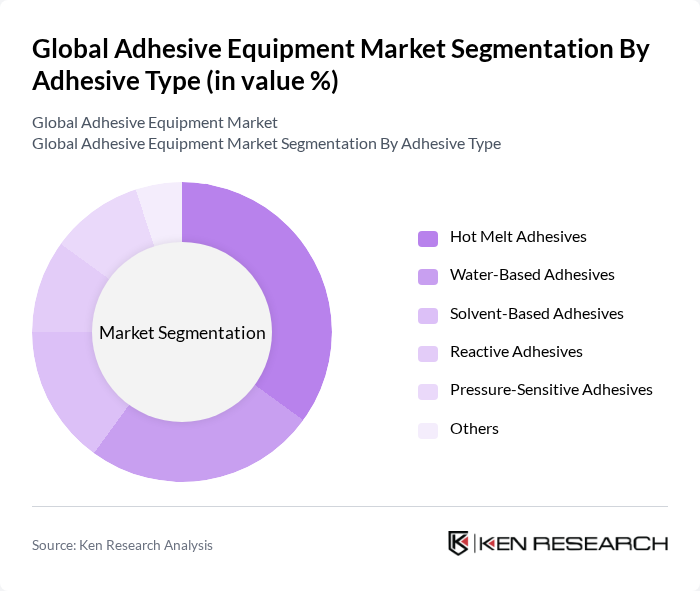

By Adhesive Type:The adhesive type segmentation includes hot melt adhesives, water-based adhesives, solvent-based adhesives, reactive adhesives, pressure-sensitive adhesives, and others. Hot melt adhesives remain the dominant segment due to their versatility, rapid setting times, and strong bonding capabilities, making them ideal for packaging, automotive, and electronics applications. The increasing preference for eco-friendly and low-VOC adhesives is also driving growth in water-based and reactive adhesive segments, as manufacturers respond to regulatory pressures and consumer demand for sustainable solutions.

The Global Adhesive Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, Sika AG, H.B. Fuller Company, Nordson Corporation, Graco Inc., Valco Melton, Robatech AG, ITW (Illinois Tool Works Inc.), Dymax Corporation, Bühnen GmbH & Co. KG, Meler Gluing Solutions, Ashland Global Holdings Inc., Nordson EFD, Valmont Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the adhesive equipment market appears promising, driven by the increasing emphasis on sustainability and technological innovation. As industries shift towards eco-friendly adhesives, the demand for bio-based and recyclable materials is expected to rise significantly. Furthermore, advancements in automation and smart technologies will enhance production efficiency and product performance. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for stakeholders to capitalize on emerging opportunities and navigate challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Adhesive Dispensers Adhesive Applicators Adhesive Dryers & Curing Equipment Adhesive Mixers Adhesive Pumps & Pressure Pots Hot Melt Equipment Cold Glue Equipment Others |

| By Adhesive Type | Hot Melt Adhesives Water-Based Adhesives Solvent-Based Adhesives Reactive Adhesives Pressure-Sensitive Adhesives Others |

| By Application | Packaging Construction Automotive Electronics Woodworking Consumer/DIY Others |

| By End-User Industry | Automotive Building & Construction Packaging Electronics & Electrical Woodworking & Furniture Transportation Consumer Goods Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Distribution Channel | Direct Sales Distributors Online Retail Specialty Stores Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Adhesive Equipment | 100 | Production Managers, Quality Control Engineers |

| Construction Adhesive Solutions | 60 | Project Managers, Site Supervisors |

| Packaging Adhesive Technologies | 75 | Packaging Engineers, Supply Chain Managers |

| Consumer Goods Adhesive Applications | 55 | Product Development Managers, Marketing Directors |

| Industrial Adhesive Equipment | 65 | Operations Managers, Maintenance Supervisors |

The Global Adhesive Equipment Market is valued at approximately USD 35 billion, driven by increasing demand across various industries such as automotive, construction, packaging, and electronics, along with advancements in adhesive technologies and automation.