Region:Middle East

Author(s):Rebecca

Product Code:KRAD1355

Pages:97

Published On:November 2025

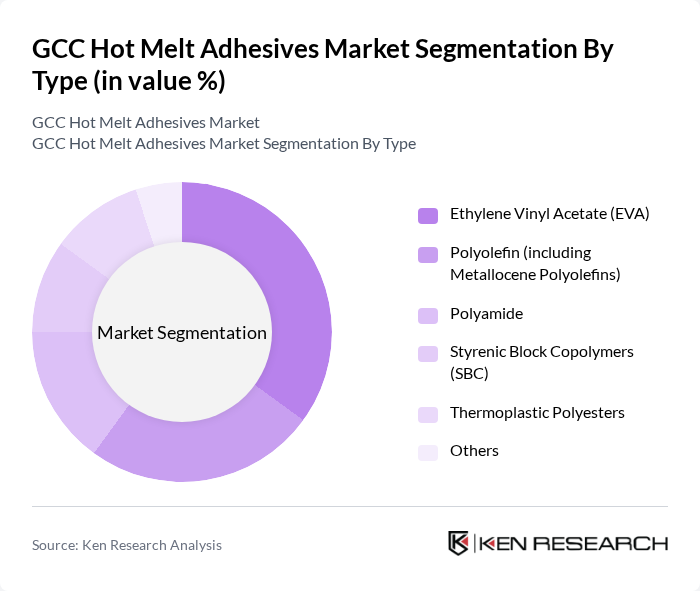

By Type:The hot melt adhesives market in the GCC is segmented into Ethylene Vinyl Acetate (EVA), Polyolefin (including Metallocene Polyolefins), Polyamide, Styrenic Block Copolymers (SBC), Thermoplastic Polyesters, and Others. Ethylene Vinyl Acetate (EVA) remains the leading subsegment due to its versatility, strong bonding properties, and suitability for a wide range of applications, particularly in packaging and automotive sectors .

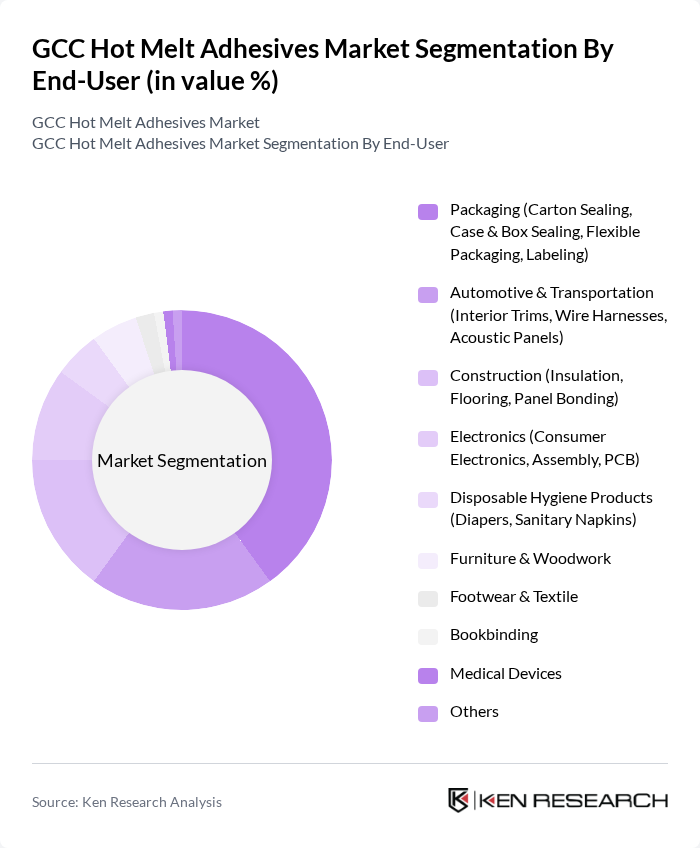

By End-User:The end-user segmentation of the hot melt adhesives market includes Packaging, Automotive & Transportation, Construction, Electronics, Disposable Hygiene Products, Furniture & Woodwork, Footwear & Textile, Bookbinding, Medical Devices, and Others. The Packaging segment is the largest contributor, driven by the rapid expansion of e-commerce, demand for secure packaging, and the need for efficient logistics solutions in the region .

The GCC Hot Melt Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, Bostik SA (Arkema Group), Sika AG, H.B. Fuller Company, Avery Dennison Corporation, Dow Inc., Huntsman Corporation, Ashland Global Holdings Inc., RPM International Inc., ITW Performance Polymers (Illinois Tool Works Inc.), Momentive Performance Materials Inc., Mapei S.p.A., Jowat SE, Beardow Adams, National Adhesives (A part of HB Fuller), Gulf Adhesives Manufacturing LLC (UAE), Al Muqarram Group (UAE), Falcon Chemicals LLC (UAE), Saudi Adhesives Factory Co. (SAFCO) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC hot melt adhesives market appears promising, driven by technological advancements and a shift towards sustainable practices. As manufacturers innovate to create eco-friendly formulations, the demand for these products is expected to rise. Additionally, the integration of smart adhesive technologies, which enhance performance and application efficiency, will likely reshape the market landscape. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in various sectors, including packaging and automotive.

| Segment | Sub-Segments |

|---|---|

| By Type | Ethylene Vinyl Acetate (EVA) Polyolefin (including Metallocene Polyolefins) Polyamide Styrenic Block Copolymers (SBC) Thermoplastic Polyesters Others |

| By End-User | Packaging (Carton Sealing, Case & Box Sealing, Flexible Packaging, Labeling) Automotive & Transportation (Interior Trims, Wire Harnesses, Acoustic Panels) Construction (Insulation, Flooring, Panel Bonding) Electronics (Consumer Electronics, Assembly, PCB) Disposable Hygiene Products (Diapers, Sanitary Napkins) Furniture & Woodwork Footwear & Textile Bookbinding Medical Devices Others |

| By Application | Furniture Assembly Bookbinding Labeling Medical Devices Product Assembly Others |

| By Formulation | Hot Melt Pressure Sensitive Adhesives (HMPSA) Hot Melt Structural Adhesives Reactive Hot Melts Thermoplastic Hot Melts Others |

| By Packaging Type | Bulk Packaging (Pellets, Blocks) Cartridge Packaging Stick Packaging Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Adhesive Usage | 100 | Production Managers, Quality Control Supervisors |

| Automotive Adhesive Applications | 60 | Design Engineers, Procurement Managers |

| Construction Sector Adhesive Demand | 50 | Project Managers, Site Supervisors |

| Consumer Goods Adhesive Preferences | 40 | Product Development Managers, Marketing Executives |

| Industrial Adhesive Trends | 45 | Operations Managers, Supply Chain Analysts |

The GCC Hot Melt Adhesives Market is valued at approximately USD 110 million, driven by demand from sectors such as packaging, automotive, and construction, alongside rising disposable income and consumer spending in the region.