Region:Global

Author(s):Geetanshi

Product Code:KRAB0124

Pages:92

Published On:August 2025

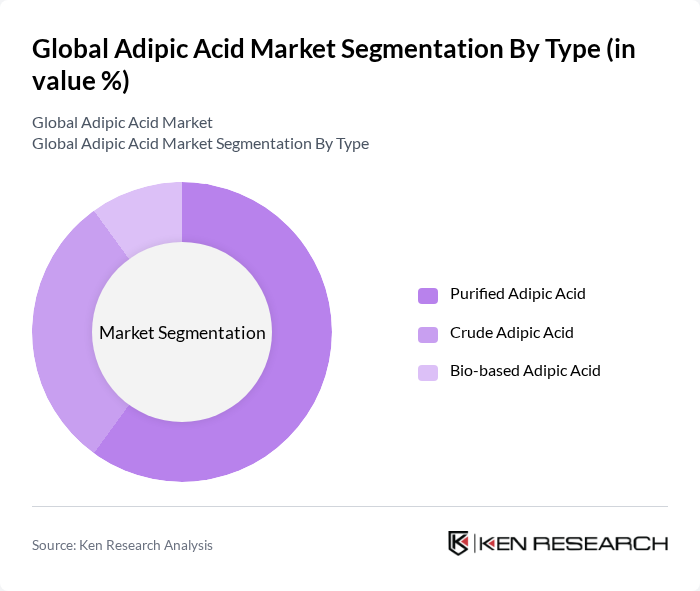

By Type:The adipic acid market is segmented into three main types: purified adipic acid, crude adipic acid, and bio-based adipic acid. Purified adipic acid is the most widely used due to its high purity and quality, making it suitable for applications in the production of nylon and other high-performance materials. Crude adipic acid, while less refined, is often utilized in lower-end industrial applications such as lubricants and certain plasticizers. Bio-based adipic acid is gaining traction due to increasing environmental concerns, regulatory support for sustainable materials, and advancements in green chemistry that are making bio-based production more commercially viable.

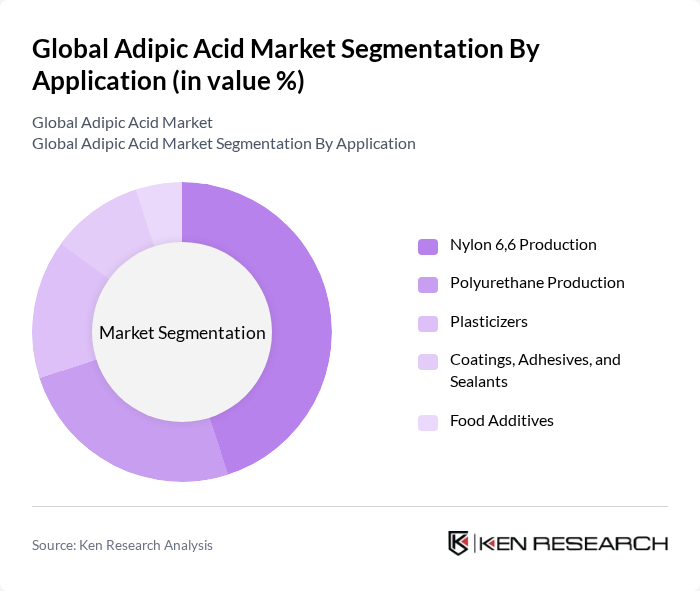

By Application:The applications of adipic acid are diverse, including nylon 6,6 production, polyurethane production, plasticizers, coatings, adhesives, sealants, and food additives. The nylon 6,6 production segment dominates the market due to its extensive use in the automotive and textile industries, where high-performance materials are required. Polyurethane production is also significant, driven by its applications in insulation, cushioning materials, and flexible foams. Adipic acid is further used in the manufacture of plasticizers to enhance polymer flexibility, in coatings and adhesives for durability, and as a food additive for flavor and gelling properties.

The Global Adipic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., INVISTA, Asahi Kasei Corporation, Mitsubishi Chemical Group Corporation, Solvay S.A., LANXESS AG, Ascend Performance Materials LLC, Ube Corporation, PetroChina Company Limited, Evonik Industries AG, DSM (Royal DSM N.V.), SABIC (Saudi Basic Industries Corporation), Eastman Chemical Company, Toray Industries, Inc., Radici Partecipazioni SpA, Shandong Haili Chemical Industry Co., Ltd., Tangshan Zhonghao Chemical Co., Ltd., Hongye Chemical Co., Ltd., Sumitomo Chemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the adipic acid market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in production methods, such as bio-based adipic acid, are gaining traction, potentially reducing environmental impact. Additionally, the expansion into emerging markets, particularly in Asia-Pacific, is expected to create new opportunities for growth. As industries increasingly prioritize sustainable practices, the demand for eco-friendly alternatives will likely shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Purified Adipic Acid Crude Adipic Acid Bio-based Adipic Acid |

| By Application | Nylon 6,6 Production Polyurethane Production Plasticizers Coatings, Adhesives, and Sealants Food Additives |

| By End-User | Automotive Construction Textile & Apparel Electrical & Electronics Consumer Goods |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, U.K., Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Saudi Arabia, South Africa, Rest of MEA) |

| By Price Range | Low Price Medium Price High Price |

| By Others | Specialty Applications Research and Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nylon Production Facilities | 100 | Production Managers, Chemical Engineers |

| Plasticizer Manufacturers | 80 | Product Development Managers, Procurement Officers |

| Coatings and Adhesives Producers | 70 | R&D Managers, Quality Control Specialists |

| Automotive Industry Users | 50 | Supply Chain Managers, Product Engineers |

| Consumer Goods Manufacturers | 90 | Marketing Managers, Operations Directors |

The Global Adipic Acid Market is valued at approximately USD 6.1 billion, driven by increasing demand in sectors such as automotive, textiles, and construction, as well as the rise of bio-based alternatives and technological innovations in production efficiency.