Region:Middle East

Author(s):Dev

Product Code:KRAD3233

Pages:87

Published On:November 2025

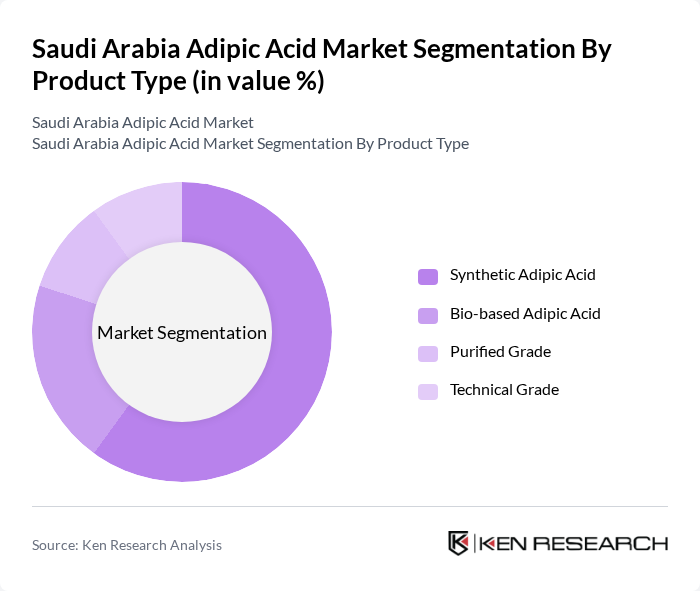

By Product Type:The adipic acid market in Saudi Arabia is segmented into four main product types: Synthetic Adipic Acid, Bio-based Adipic Acid, Purified Grade, and Technical Grade. Synthetic Adipic Acid remains the most widely used due to its cost efficiency and established production technology, primarily serving large-scale industrial applications. Bio-based Adipic Acid is gaining momentum as sustainability and environmental compliance become strategic priorities for manufacturers. Purified and Technical Grades address niche and specialized requirements, including high-purity applications in plastics, coatings, and adhesives .

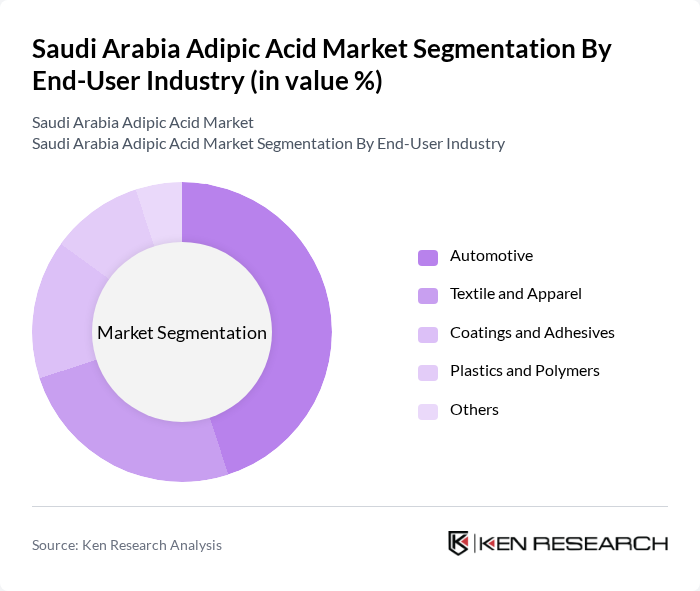

By End-User Industry:The adipic acid market is segmented by end-user industries, including Automotive, Textile and Apparel, Coatings and Adhesives, Plastics and Polymers, and Others. The Automotive sector is the largest consumer, driven by the extensive use of nylon 66 in vehicle components such as air bags, seat belts, and engine covers. The Textile and Apparel industry is a significant contributor, utilizing adipic acid in the production of synthetic fibers and performance textiles. Coatings, adhesives, and polymers represent additional demand centers, reflecting the versatility of adipic acid across industrial segments .

The Saudi Arabia Adipic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Aramco (Downstream Division), Al-Jubail Petrochemical Company (JUPC), Saudi International Petrochemical Company (Sipchem), Advanced Petrochemical Company (APC), Saudi Kayan Petrochemical Company, Tasnee (National Industrialization Company), Petro Rabigh, LANXESS (Regional Operations), Ascend Performance Materials (Regional Distribution), Solvay (Middle East Operations), INVISTA (Regional Partners), Al-Babtain Group, Gulf Chemical Industries, Arabian Chemical Company contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia adipic acid market is poised for significant transformation, driven by increasing demand from key sectors such as automotive and construction. As the government continues to promote industrial growth through initiatives like Vision 2030, the market is expected to adapt to evolving consumer preferences, particularly towards sustainable practices. Innovations in production processes and a focus on biodegradable alternatives will likely shape the future landscape, enhancing competitiveness and market resilience.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Synthetic Adipic Acid Bio-based Adipic Acid Purified Grade Technical Grade |

| By End-User Industry | Automotive Textile and Apparel Coatings and Adhesives Plastics and Polymers Others |

| By Application | Nylon 6,6 Fiber Production Nylon 6,6 Resin Production Adipate Ester (Plasticizers) Polyurethane Production Others |

| By Distribution Channel | Direct Sales to Manufacturers Chemical Distributors Trading Companies Others |

| By Geography (Saudi Arabia Regional) | Central Region (Riyadh) Eastern Region (Al Jubail, Yanbu) Western Region (Jeddah) Southern Region |

| By Production Process | Cyclohexane Oxidation (Synthetic) Biotechnological Methods Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 45 | Product Managers, Procurement Specialists |

| Textile Manufacturing Sector | 38 | Production Managers, Quality Control Officers |

| Food and Beverage Additives | 32 | Food Technologists, Regulatory Affairs Managers |

| Plastics and Polymers Industry | 42 | Research Scientists, Operations Managers |

| Research and Development in Chemicals | 28 | R&D Directors, Innovation Managers |

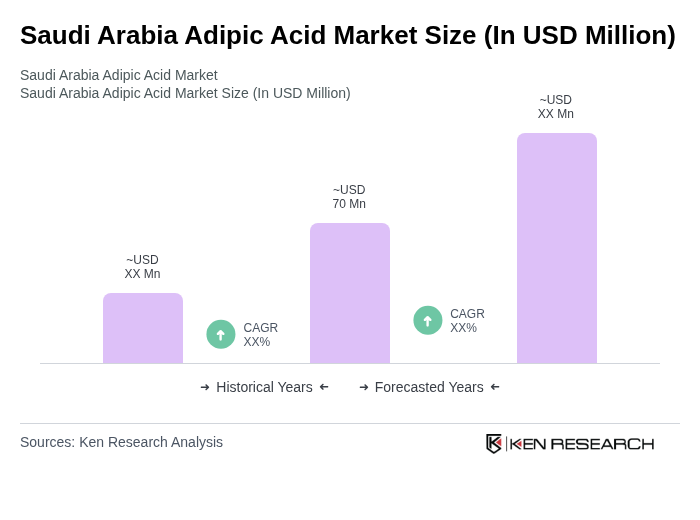

The Saudi Arabia Adipic Acid Market is valued at approximately USD 70 million, driven by increasing demand for nylon production in the automotive and textile industries, along with a growing interest in bio-based alternatives for sustainability.