Region:Global

Author(s):Geetanshi

Product Code:KRAD0027

Pages:94

Published On:August 2025

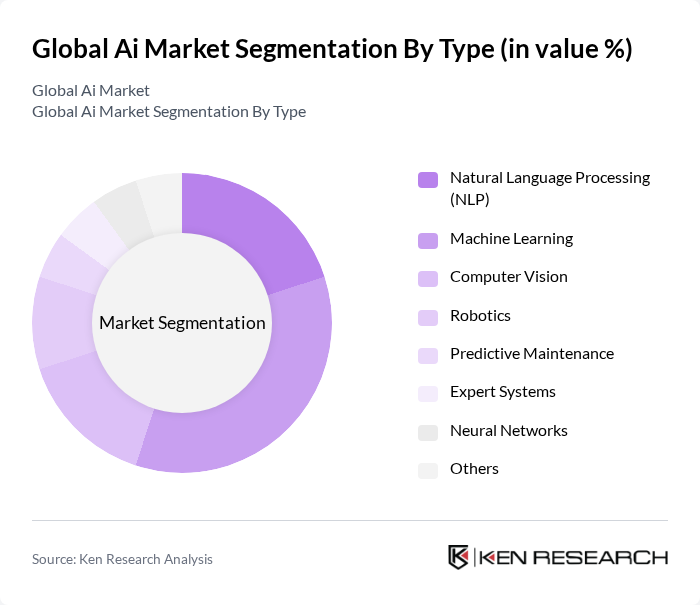

By Type:The AI market can be segmented into various types, including Natural Language Processing (NLP), Machine Learning, Computer Vision, Robotics, Predictive Maintenance, Expert Systems, Neural Networks, and Others. Among these,Machine Learningremains the most dominant segment, driven by its wide-ranging applications in predictive analytics, customer service automation, fraud detection, and generative AI. The increasing availability of large datasets, advances in deep learning algorithms, and the integration of AI into enterprise software have significantly contributed to the growth of this segment .

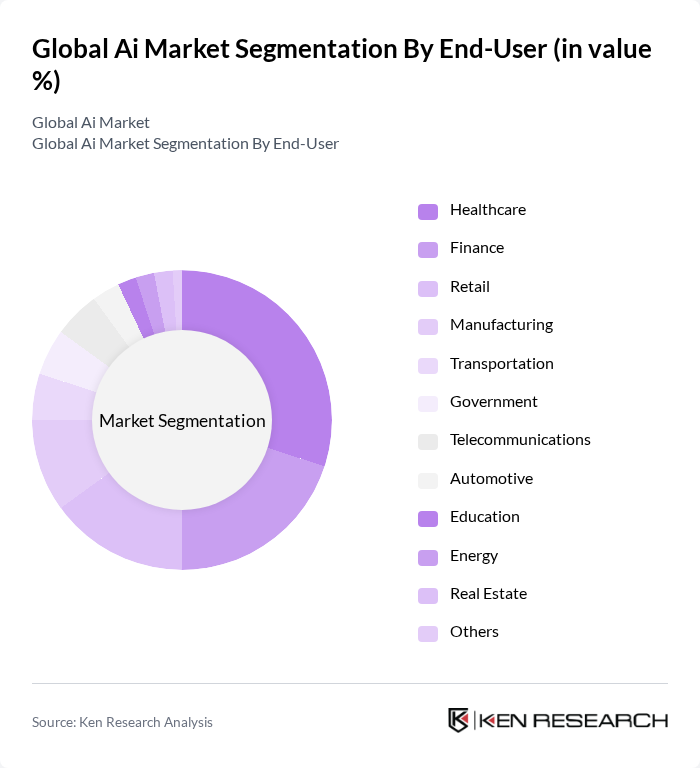

By End-User:The AI market is also segmented by end-users, including Healthcare, Finance, Retail, Manufacturing, Transportation, Government, Telecommunications, Automotive, Education, Energy, Real Estate, and Others. TheHealthcaresector is currently the leading end-user, driven by increasing adoption of AI in diagnostics, medical imaging, patient management, and personalized medicine. The sector benefits from the need to improve patient outcomes, operational efficiency, and the integration of AI in drug discovery, telemedicine, and hospital workflow automation .

The Global AI Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, IBM Corporation, Microsoft Corporation, Amazon Web Services, Inc., NVIDIA Corporation, Salesforce, Inc., Oracle Corporation, SAP SE, Intel Corporation, Baidu, Inc., Tencent Holdings Limited, Alibaba Group Holding Limited, Accenture plc, Adobe Inc., OpenAI, Inc., Meta Platforms, Inc., Siemens AG, Palantir Technologies Inc., ServiceNow, Inc., UiPath Inc., SenseTime Group Inc., iFLYTEK Co., Ltd., Mistral AI, Anthropic PBC, Databricks, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI market appears promising, driven by continuous technological advancements and increasing integration across industries. As organizations prioritize digital transformation, the demand for AI solutions is expected to rise significantly. Furthermore, the focus on ethical AI practices and regulatory compliance will shape the development of AI technologies, ensuring they align with societal values. Companies that adapt to these trends will likely gain a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Language Processing (NLP) Machine Learning Computer Vision Robotics Predictive Maintenance Expert Systems Neural Networks Others |

| By End-User | Healthcare Finance Retail Manufacturing Transportation Government Telecommunications Automotive Education Energy Real Estate Others |

| By Application | Predictive Analytics Customer Service Automation Fraud Detection Supply Chain Optimization Personalization Recommendation Engines Autonomous Vehicles AI Copilots (Productivity/Enterprise) Others |

| By Deployment Model | Cloud-Based On-Premises Hybrid |

| By Industry Vertical | Automotive Telecommunications Education Energy Real Estate Public Sector Entertainment & Media Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Applications | 100 | Healthcare IT Managers, Clinical Data Analysts |

| Financial Services AI Integration | 75 | Chief Technology Officers, Risk Management Officers |

| Retail AI Solutions | 85 | Retail Operations Managers, E-commerce Directors |

| Manufacturing AI Automation | 60 | Production Managers, Supply Chain Analysts |

| AI in Telecommunications | 50 | Network Engineers, Product Development Managers |

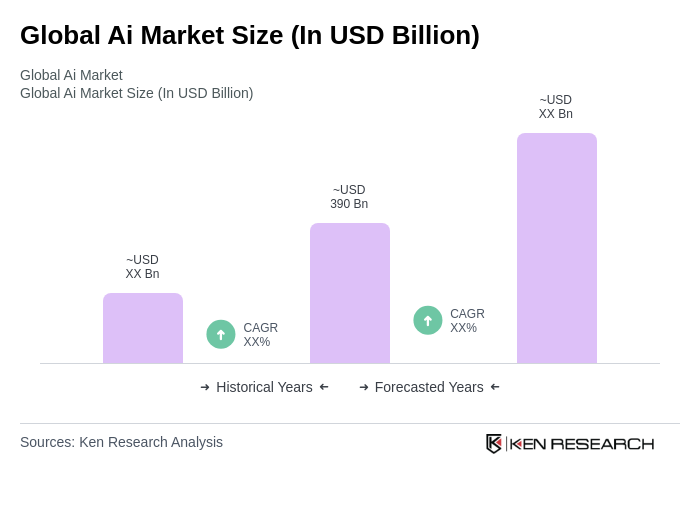

The Global AI Market is valued at approximately USD 390 billion, driven by advancements in machine learning, natural language processing, and increased adoption across various sectors such as healthcare, finance, and retail.