Region:Global

Author(s):Rebecca

Product Code:KRAD0203

Pages:81

Published On:August 2025

By Type:The air defense systems market can be segmented into land-based, sea-based, and air-based systems, as well as specific technologies such as surface-to-air missiles (SAMs), anti-aircraft artillery (AAA), command and control systems, radar and sensor systems, counter-unmanned aerial systems (C-UAS), integrated air and missile defense systems, and directed energy weapons. Among these, land-based air defense systems are particularly dominant due to their versatility and effectiveness in protecting ground assets from aerial threats. The market is also witnessing a rapid increase in demand for counter-unmanned aerial systems and directed energy weapons, reflecting the evolving nature of aerial threats and the need for multi-layered defense solutions.

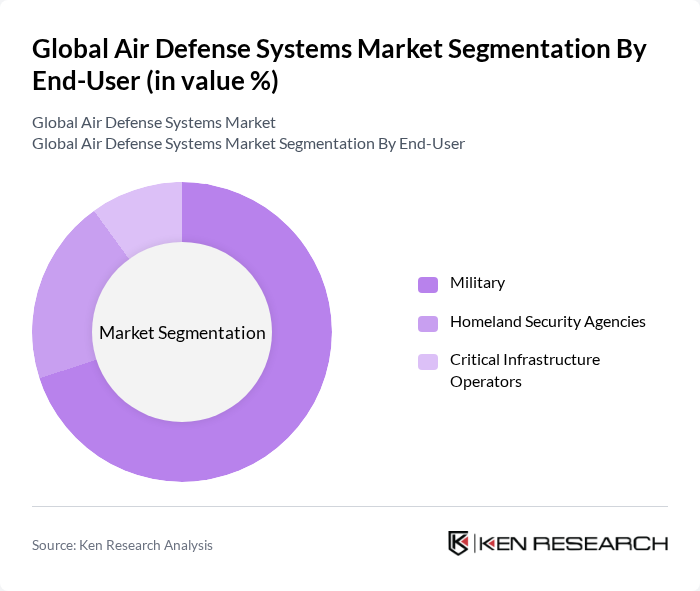

By End-User:The end-user segmentation of the air defense systems market includes military, homeland security agencies, and critical infrastructure operators. The military segment is the most significant, driven by the increasing defense budgets of various nations and the need for advanced air defense capabilities to protect against evolving threats. Homeland security agencies are increasingly adopting air defense technologies to counter drone incursions and safeguard national borders, while critical infrastructure operators are investing in integrated systems to protect sensitive assets from aerial attacks.

The Global Air Defense Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lockheed Martin Corporation, RTX Corporation (Raytheon Technologies), Northrop Grumman Corporation, BAE Systems plc, Thales Group, Leonardo S.p.A., Saab AB, General Dynamics Corporation, Elbit Systems Ltd., Rheinmetall AG, MBDA, Kongsberg Gruppen ASA, L3Harris Technologies, Inc., Hanwha Aerospace Co., Ltd., Israel Aerospace Industries Ltd., Boeing Defense, Space & Security, Almaz-Antey Concern, Bharat Electronics Limited (BEL), China North Industries Group Corporation Limited (NORINCO), Rafael Advanced Defense Systems Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the air defense systems market is poised for significant transformation, driven by technological advancements and evolving defense strategies. As nations increasingly adopt multi-domain operations, the integration of artificial intelligence and machine learning into defense systems will enhance operational efficiency. Furthermore, the growing emphasis on cybersecurity will necessitate robust defense solutions that can protect against emerging threats, ensuring that air defense systems remain a critical component of national security strategies in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Land-Based Air Defense Systems Sea-Based Air Defense Systems Air-Based Air Defense Systems Surface-to-Air Missiles (SAMs) Anti-Aircraft Artillery (AAA) Command and Control Systems Radar and Sensor Systems Counter-Unmanned Aerial Systems (C-UAS) Integrated Air and Missile Defense Systems Directed Energy Weapons |

| By End-User | Military Homeland Security Agencies Critical Infrastructure Operators |

| By Component | Hardware Software Services |

| By Application | National Defense Border Security Critical Infrastructure Protection Urban Area Defense |

| By Range | Short-Range Air Defense (SHORAD) Medium-Range Air Defense (MRAD) Long-Range Air Defense (LRAD) |

| By Distribution Mode | Domestic Distribution International Distribution |

| By Region | North America Europe Asia Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Air Defense Procurement | 100 | Defense Procurement Officers, Military Strategists |

| Air Defense System Manufacturers | 80 | Product Managers, R&D Engineers |

| Defense Technology Analysts | 50 | Market Analysts, Defense Consultants |

| Military Operations Personnel | 70 | Field Commanders, Tactical Operations Officers |

| Government Defense Policy Makers | 40 | Policy Advisors, Defense Economists |

The Global Air Defense Systems Market is valued at approximately USD 48 billion, reflecting a significant increase driven by geopolitical tensions, technological advancements, and the growing need for national security among nations investing in military modernization.