Region:Middle East

Author(s):Rebecca

Product Code:KRAD4384

Pages:84

Published On:December 2025

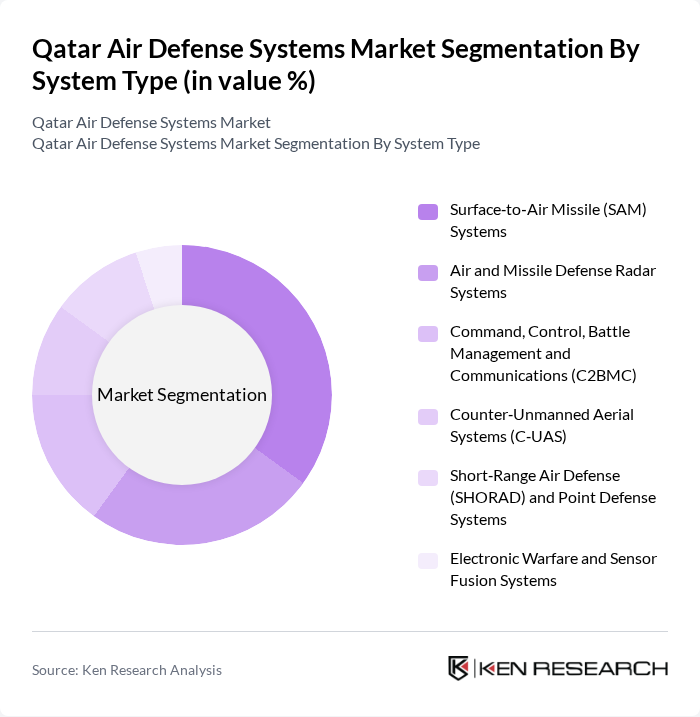

By System Type:The market is segmented into various system types, including Surface?to?Air Missile (SAM) Systems, Air and Missile Defense Radar Systems, Command, Control, Battle Management and Communications (C2BMC), Counter?Unmanned Aerial Systems (C?UAS), Short?Range Air Defense (SHORAD) and Point Defense Systems, and Electronic Warfare and Sensor Fusion Systems. This segmentation is consistent with global air defense system classifications, where missile systems and associated radars typically account for the largest portion of spending. Among these, Surface?to?Air Missile (SAM) Systems can reasonably be considered to dominate the Qatar market in value terms because high?end missile batteries, interceptors, and associated launchers are capital?intensive and reflect the same pattern seen globally, where missile defense systems represent over half of air defense revenues. The increasing focus on integrated defense solutions and the need for multi?layered defense strategies, including the integration of SAMs with radar, C2BMC, and C?UAS nodes, has further propelled demand for these systems as Qatar responds to evolving missile and drone threats in the wider region.

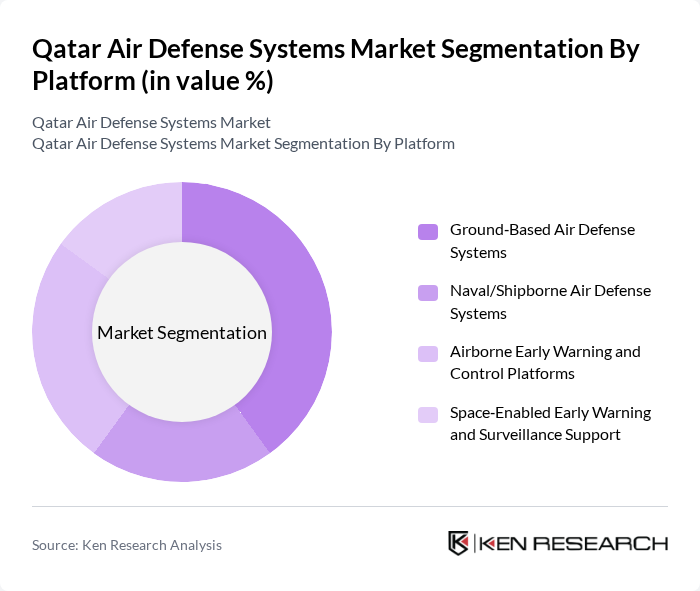

By Platform:The market is further segmented by platform, including Ground?Based Air Defense Systems, Naval/Shipborne Air Defense Systems, Airborne Early Warning and Control Platforms, and Space?Enabled Early Warning and Surveillance Support. This structure aligns with global practice, where land (ground?based) platforms hold the largest share of air defense spending. Ground?Based Air Defense Systems are plausibly the leading segment in Qatar, reflecting the importance of land?based missiles, SHORAD, radars, and C?UAS to protect energy facilities, population centers, and key bases, in line with global trends where land platforms are identified as the largest segment of the air defense system market. The increasing investment in ground?based systems also corresponds to the observed global emphasis on protecting ground forces and critical infrastructure against a wider range of aerial threats, including low?flying cruise missiles and drones.

The Qatar Air Defense Systems Market is characterized by participation from many of the same regional and international defense contractors that lead global air and missile defense programs, even though detailed, Qatar?specific revenue splits are not disclosed publicly. Leading global players such as Raytheon (RTX Corporation), Lockheed Martin, Northrop Grumman, BAE Systems, Thales, Rafael, MBDA, Elbit Systems, Leonardo, General Dynamics, Saab, L3Harris, Kongsberg, Rheinmetall, and Hanwha are all active in air and missile defense or related radar and C2 domains worldwide, and several of them appear in Qatar’s broader defense and aerospace ecosystem through Foreign Military Sales, cooperative programs, or industrial presence. In global air and missile defense and integrated air and missile defense markets, these companies drive innovation in areas such as advanced interceptors, networked sensors, digital command?and?control, and counter?UAS, and similar technologies are relevant to Qatar’s objective of building a modern, layered, and integrated air defense architecture.

The future of Qatar's air defense systems market appears promising, driven by ongoing investments in advanced technologies and strategic partnerships. As the nation continues to enhance its defense capabilities, the focus will likely shift towards integrated systems that leverage artificial intelligence and unmanned aerial vehicles. Additionally, increased collaboration with allied nations will facilitate knowledge transfer and technology sharing, further strengthening Qatar's defense posture in a rapidly evolving geopolitical landscape.

| Segment | Sub-Segments |

|---|---|

| By System Type | Surface-to-Air Missile (SAM) Systems Air and Missile Defense Radar Systems Command, Control, Battle Management and Communications (C2BMC) Counter-Unmanned Aerial Systems (C-UAS) Short-Range Air Defense (SHORAD) and Point Defense Systems Electronic Warfare and Sensor Fusion Systems |

| By Platform | Ground-Based Air Defense Systems Naval/Shipborne Air Defense Systems Airborne Early Warning and Control Platforms Space-Enabled Early Warning and Surveillance Support |

| By Range | Short-Range Air Defense (up to 20 km) Medium-Range Air Defense (20–100 km) Long-Range Air and Missile Defense (beyond 100 km) |

| By Threat Type | Ballistic and Cruise Missile Defense Fixed-Wing and Rotary-Wing Aircraft Defense Unmanned Aerial Systems and Loitering Munitions Defense Rocket, Artillery and Mortar (C-RAM) Defense |

| By Procurement Category | New System Acquisition System Upgrades and Life-Extension Programs Maintenance, Repair and Overhaul (MRO) Training, Simulation and Support Services |

| By Contracting/Funding Entity | Ministry of Defense – Qatar Armed Forces Ministry of Interior and National Security Agencies Joint Programs with Allied Nations Offsets and Industrial Participation Programs |

| By Deployment Environment | Protection of Critical National Infrastructure Air and Missile Defense of Urban Areas Base and Forward Operating Site Defense Maritime and Offshore Asset Defense |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Officers | 100 | Defense Procurement Managers, Budget Analysts |

| Defense Contractors | 80 | Business Development Managers, Technical Sales Engineers |

| Defense Analysts | 60 | Market Research Analysts, Policy Advisors |

| Military Strategy Experts | 50 | Strategic Planners, Military Advisors |

| Government Officials | 70 | Defense Ministry Officials, Security Policy Makers |

The Qatar Air Defense Systems Market is valued at approximately USD 2.5 billion, driven by increased defense spending and a focus on advanced air and missile defense systems in response to regional security threats.