Region:Global

Author(s):Rebecca

Product Code:KRAA2396

Pages:80

Published On:August 2025

By Type:The market is segmented into various types of ammunition, including artillery, tank, mortar, naval, air-to-ground, training, and others.Artillery ammunitionis currently the leading sub-segment, driven by its extensive use in military operations and training exercises. The demand for high-precision artillery shells has increased significantly, reflecting advancements in technology and the need for effective long-range capabilities.Tank ammunitionfollows closely, as armored vehicles remain a critical component of modern warfare. The adoption of precision-guided munitions and smart ammunition is a notable trend, enhancing operational effectiveness and reducing collateral damage.

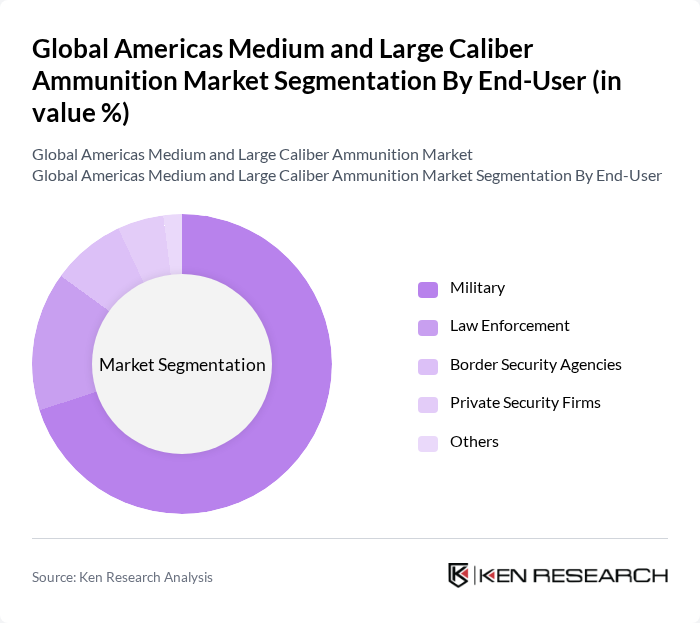

By End-User:The end-user segmentation includes military, law enforcement, border security agencies, private security firms, and others. Themilitary segmentdominates the market, driven by increasing defense budgets and modernization programs of various countries. Law enforcement agencies are also expanding their procurement of medium and large caliber ammunition for tactical operations, reflecting a growing emphasis on public safety and security. Demand from border security agencies is rising due to heightened concerns over national security and the need for advanced surveillance and response capabilities.

The Global Americas Medium and Large Caliber Ammunition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Northrop Grumman Corporation, General Dynamics Corporation, BAE Systems plc, Rheinmetall AG, Leonardo S.p.A., Thales Group, Lockheed Martin Corporation, Elbit Systems Ltd., Nammo AS, CBC Global Ammunition, American Ordnance LLC, Textron Inc., Vista Outdoor Inc., Olin Corporation, and IMI Systems (Israel Military Industries) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medium and large caliber ammunition market in the Americas appears promising, driven by ongoing military modernization efforts and increased defense spending. As nations prioritize advanced weaponry, the demand for innovative ammunition solutions is expected to rise. Additionally, the integration of digital technologies and eco-friendly practices will likely shape the market landscape, fostering growth and sustainability. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Artillery Ammunition Tank Ammunition Mortar Ammunition Naval Ammunition Air-to-Ground Ammunition Training Ammunition Others |

| By End-User | Military Law Enforcement Border Security Agencies Private Security Firms Others |

| By Application | Defense Operations Training Exercises Research and Development Peacekeeping and Counterinsurgency Others |

| By Distribution Channel | Direct Sales Distributors Government Procurement Others |

| By Region | North America South America Central America Caribbean Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Payload | High Explosive Armor-Piercing Incendiary Smoke/Illumination Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Departments | 100 | Procurement Officers, Defense Analysts |

| Ammunition Manufacturers | 80 | Production Managers, Quality Control Supervisors |

| Logistics and Supply Chain Firms | 60 | Logistics Managers, Supply Chain Directors |

| Defense Contractors | 50 | Project Managers, Business Development Executives |

| Regulatory Bodies and Associations | 40 | Policy Makers, Compliance Officers |

The Global Americas Medium and Large Caliber Ammunition Market is valued at approximately USD 2.5 billion, driven by increasing defense budgets and rising geopolitical tensions that necessitate enhanced military capabilities.