Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8180

Pages:82

Published On:November 2025

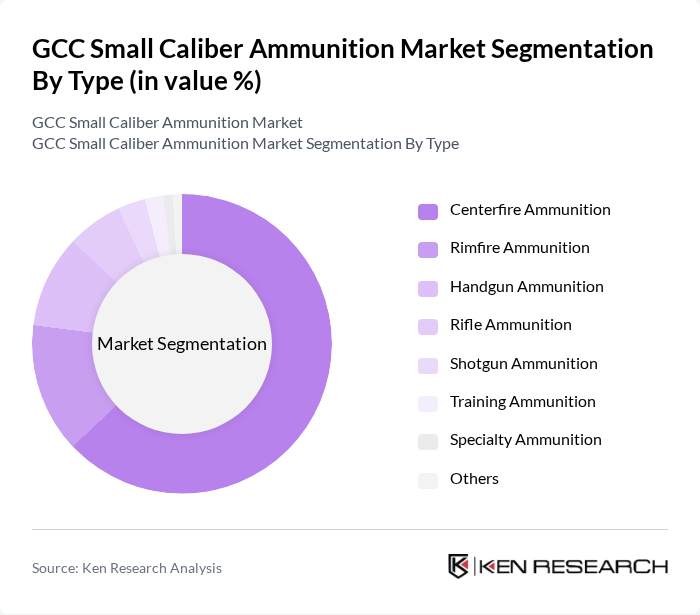

By Type:The market is segmented into various types of ammunition, including Centerfire Ammunition, Rimfire Ammunition, Handgun Ammunition, Rifle Ammunition, Shotgun Ammunition, Training Ammunition, Specialty Ammunition, and Others. Among these, Centerfire Ammunition is the leading subsegment due to its widespread use in military and law enforcement applications. The reliability and performance of centerfire cartridges make them the preferred choice for tactical operations and training exercises. The growing popularity of shooting sports and the adoption of high-performance ammunition by security agencies have further boosted demand for this type of ammunition .

By Caliber:The market is segmented by caliber into 5.56mm, 7.62mm, 9mm, .22LR, .308, 12 Gauge (Shotgun Shells), and Others. The 5.56mm caliber is the most dominant segment, primarily due to its extensive use in military applications and its popularity among civilian shooters for sport and self-defense. The versatility and availability of 5.56mm ammunition have made it a preferred choice for both tactical and recreational shooting, driving its market share significantly. The 7.62mm and 9mm calibers also hold substantial shares due to their adoption in military, police, and civilian markets .

The GCC Small Caliber Ammunition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Arabian Military Industries (SAMI), Barij Munitions (UAE), Caracal International (UAE), General Dynamics Ordnance and Tactical Systems, Northrop Grumman, BAE Systems, Winchester Ammunition (Olin Corporation), Federal Premium Ammunition (Vista Outdoor Inc.), Remington Ammunition (Vista Outdoor Inc.), Hornady Manufacturing Company, Sellier & Bellot, Magtech Ammunition (CBC Global Ammunition), PMC Ammunition (Poongsan Corporation), Fiocchi Munizioni, Tula Cartridge Works, MEN Metallwerk Elisenhütte GmbH, Ruag Ammotec, and Aguila Ammunition (Industrias Tecnos S.A. de C.V.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC small caliber ammunition market appears promising, driven by ongoing defense investments and a growing civilian interest in shooting sports. As regional tensions persist, defense budgets are likely to remain robust, fostering demand for advanced ammunition. Additionally, the trend towards eco-friendly production methods and smart ammunition technology is expected to gain traction, aligning with global sustainability goals and enhancing operational effectiveness in military applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Centerfire Ammunition Rimfire Ammunition Handgun Ammunition Rifle Ammunition Shotgun Ammunition Training Ammunition Specialty Ammunition Others |

| By Caliber | mm mm mm LR Gauge (Shotgun Shells) Others |

| By End-User | Military Law Enforcement / Homeland Security Civilian (Sport Shooting, Hunting, Self-Defense) Security Services Others |

| By Application | Defense Hunting Sports Shooting Training Law Enforcement Operations Others |

| By Distribution Channel | Direct Procurement (Government Contracts) Distributors Online Retail Offline Retail Others |

| By Material | Brass Steel Aluminum Polymer Lead-Free / Eco-Friendly Materials Others |

| By Payload | Full Metal Jacket Hollow Point Soft Point Non-Lethal / Training Rounds Others |

| By Region | Saudi Arabia United Arab Emirates (UAE) Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Departments | 45 | Procurement Officers, Defense Analysts |

| Law Enforcement Agencies | 38 | Police Chiefs, Tactical Unit Leaders |

| Ammunition Manufacturers | 32 | Production Managers, R&D Directors |

| Distributors and Retailers | 42 | Sales Managers, Inventory Specialists |

| Defense Industry Experts | 28 | Consultants, Market Analysts |

The GCC Small Caliber Ammunition Market is valued at approximately USD 1.2 billion, driven by increased defense budgets, security concerns, and growing civilian interest in shooting sports and hunting activities across the region.