Region:Global

Author(s):Shubham

Product Code:KRAA2687

Pages:93

Published On:August 2025

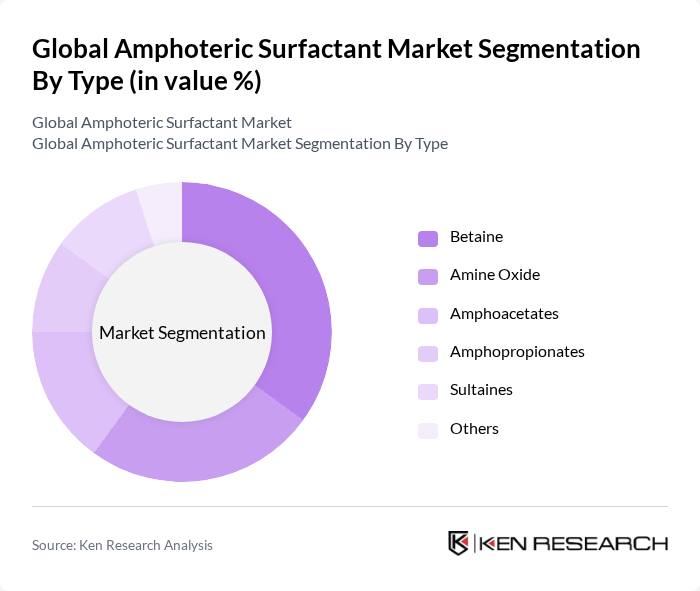

By Type:The amphoteric surfactant market is segmented into Betaine, Amine Oxide, Amphoacetates, Amphopropionates, Sultaines, and Others.Betaineremains the leading sub-segment, driven by its widespread use in personal care products such as shampoos and conditioners due to its mildness, excellent foam enhancement, and compatibility with sensitive skin. The growing consumer preference for gentle, sulfate-free, and natural ingredients continues to propel demand for Betaine-based surfactants. Amine Oxide and Sultaines also see significant adoption in household and institutional cleaning due to their effective cleaning and foaming properties .

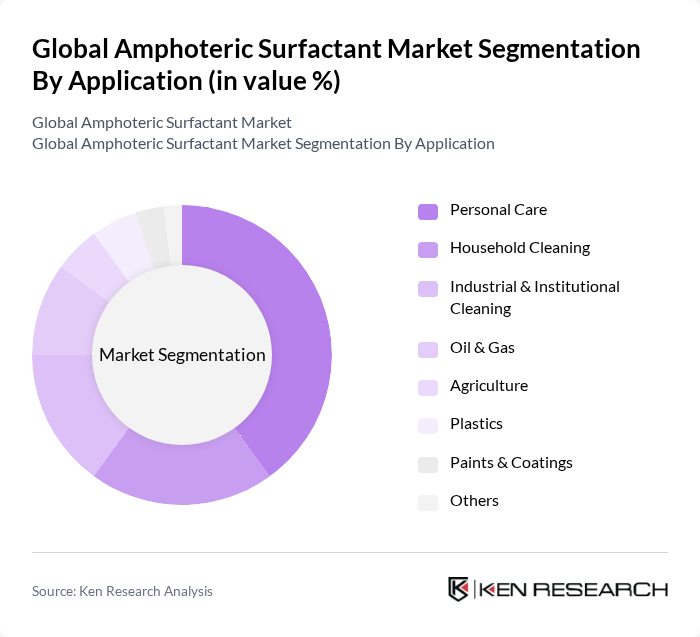

By Application:The amphoteric surfactant market is segmented by application into Personal Care, Household Cleaning, Industrial & Institutional Cleaning, Oil & Gas, Agriculture, Plastics, Paints & Coatings, and Others.Personal Careis the dominant segment, accounting for the largest share due to the increasing demand for mild, effective cleansing agents in shampoos, body washes, and facial cleansers. The shift towards natural and organic products, along with the adoption of sulfate-free formulations, continues to drive growth in this segment. Household and institutional cleaning also represent significant market shares, supported by the need for biodegradable and environmentally safe cleaning agents .

The Global Amphoteric Surfactant Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, Evonik Industries AG, Huntsman Corporation, Stepan Company, Croda International Plc, Solvay S.A., AkzoNobel N.V., Dow Chemical Company, Kao Corporation, Wilmar International Limited, Galaxy Surfactants Ltd., Oxiteno S.A., Innospec Inc., Lonza Group AG, Nouryon, The Lubrizol Corporation, ADEKA Corporation, Libra Speciality Chemicals Limited, STOCKMEIER Group, Sumitomo Corporation, Kensing LLC, Arkema S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The amphoteric surfactant market is poised for significant transformation, driven by the increasing demand for sustainable and biodegradable products. As consumer preferences shift towards natural ingredients, manufacturers are likely to invest in innovative formulations that align with these trends. Additionally, the expansion into emerging markets, particularly in Asia-Pacific, is expected to provide new growth avenues. Companies that adapt to these evolving market dynamics will be better positioned to capitalize on future opportunities and enhance their competitive edge.

| Segment | Sub-Segments |

|---|---|

| By Type | Betaine Amine Oxide Amphoacetates Amphopropionates Sultaines Others |

| By Application | Personal Care Household Cleaning Industrial & Institutional Cleaning Oil & Gas Agriculture Plastics Paints & Coatings Others (Food Industry, Leather, Metalworking) |

| By End-User | Cosmetics & Personal Care Household & Institutional Industrial Oil & Gas Agriculture Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Care Products | 100 | Product Development Managers, Brand Managers |

| Household Cleaning Products | 80 | Procurement Managers, R&D Specialists |

| Industrial Applications | 70 | Operations Managers, Chemical Engineers |

| Food and Beverage Industry | 50 | Quality Assurance Managers, Production Supervisors |

| Textile and Leather Processing | 40 | Process Engineers, Sustainability Officers |

The Global Amphoteric Surfactant Market is valued at approximately USD 4.9 billion, reflecting a significant growth trend driven by the increasing demand for eco-friendly and biodegradable surfactants across various applications, including personal care and household cleaning products.