Region:Middle East

Author(s):Dev

Product Code:KRAA9486

Pages:80

Published On:November 2025

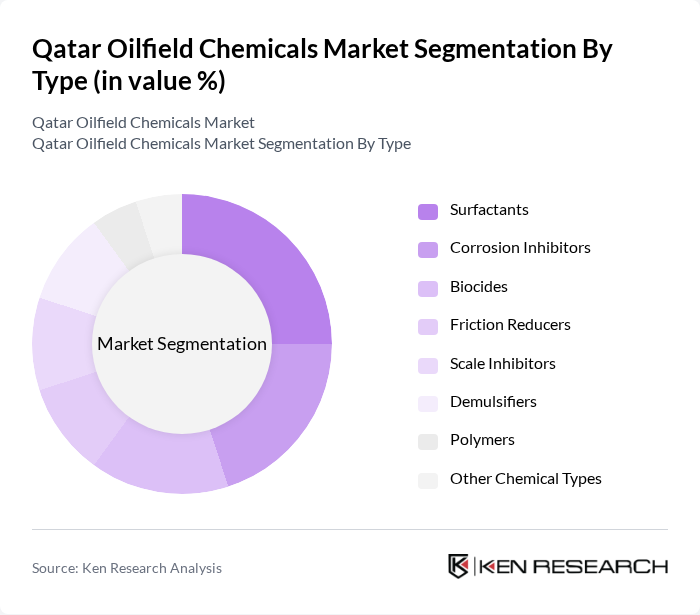

By Type:The market is segmented into various types of chemicals used in oilfield operations. The subsegments include Surfactants, Corrosion Inhibitors, Biocides, Friction Reducers, Scale Inhibitors, Demulsifiers, Polymers, and Other Chemical Types. Each of these plays a crucial role in enhancing oil recovery, preventing corrosion, and ensuring the efficiency of oilfield operations. Surfactants and polymers are particularly in demand due to their role in enhanced oil recovery and the ongoing expansion of mature field operations .

The Surfactants subsegment is currently dominating the market due to their essential role in reducing surface tension and enhancing the efficiency of oil recovery processes. The increasing focus on optimizing production techniques and the growing need for effective chemical solutions in challenging extraction environments have led to a higher demand for surfactants. Additionally, advancements in surfactant formulations that improve performance and reduce environmental impact are further driving their market leadership .

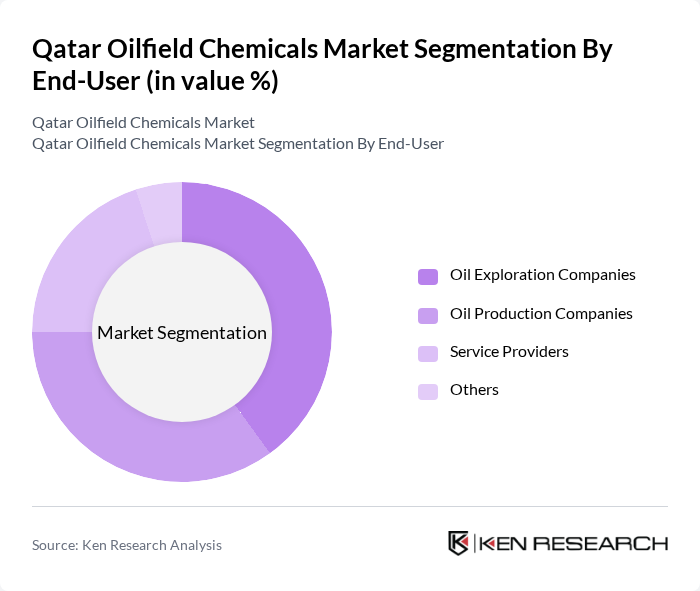

By End-User:The market is segmented based on end-users, which include Oil Exploration Companies, Oil Production Companies, Service Providers, and Others. Each segment has unique requirements and applications for oilfield chemicals, influencing the overall market dynamics. Oil Exploration Companies and Oil Production Companies are the leading end-users, driven by their investments in EOR and drilling activities .

Oil Exploration Companies are the leading end-users in the market, primarily due to their significant investments in exploration activities and the need for specialized chemicals to enhance oil recovery. The increasing complexity of oilfield operations and the demand for innovative chemical solutions to address specific challenges in exploration are driving the growth of this segment. Furthermore, the collaboration between exploration companies and chemical suppliers is fostering advancements in chemical technologies tailored for exploration needs .

The Qatar Oilfield Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Halliburton Company, Schlumberger Limited, Baker Hughes Company, Clariant AG, Ecolab Inc., AkzoNobel N.V., Huntsman Corporation, Solvay S.A., Nalco Champion (Ecolab), Chemours Company, Afton Chemical Corporation, Innospec Inc., Croda International Plc, Newpark Resources, Inc., Qatar Lubricants Company (QALCO), Salam Petroleum Services, Chevron Corporation, Dow Chemical Company, SABIC contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Qatar oilfield chemicals market appears promising, driven by ongoing investments in technology and infrastructure. As the country seeks to diversify its energy portfolio, the integration of digital solutions and smart chemical applications will enhance operational efficiency. Furthermore, the focus on sustainability will likely lead to increased demand for bio-based chemicals, aligning with global trends towards greener practices. This evolving landscape presents opportunities for innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Surfactants Corrosion Inhibitors Biocides Friction Reducers Scale Inhibitors Demulsifiers Polymers Other Chemical Types |

| By End-User | Oil Exploration Companies Oil Production Companies Service Providers Others |

| By Application | Drilling and Cementing Enhanced Oil Recovery Production Well Stimulation Workover and Completion Others |

| By Chemical Composition | Organic Chemicals Inorganic Chemicals Others |

| By Delivery Method | Bulk Delivery Packaged Delivery Others |

| By Region | North Field Ras Laffan Industrial City Doha Other Regions |

| By Market Segment | Onshore Offshore Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Drilling Fluids Market | 100 | Drilling Engineers, Procurement Managers |

| Production Chemicals Segment | 80 | Production Managers, Chemical Engineers |

| Enhanced Oil Recovery Chemicals | 60 | Reservoir Engineers, R&D Specialists |

| Corrosion Inhibitors Market | 50 | Maintenance Managers, Chemical Technologists |

| Fracturing Fluids Sector | 70 | Field Supervisors, Operations Managers |

The Qatar Oilfield Chemicals Market is valued at approximately USD 250 million, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for oil and gas production and the need for advanced chemical solutions to enhance extraction efficiency.