Region:Global

Author(s):Geetanshi

Product Code:KRAA0118

Pages:94

Published On:August 2025

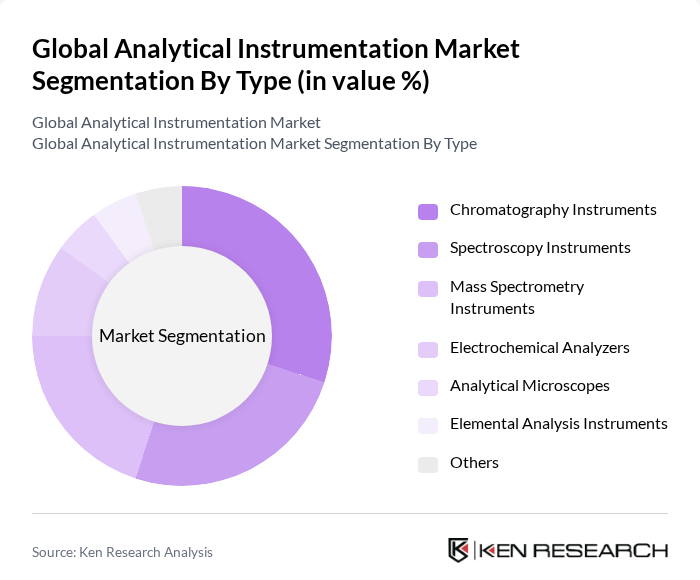

By Type:The analytical instrumentation market is segmented into Chromatography Instruments, Spectroscopy Instruments, Mass Spectrometry Instruments, Electrochemical Analyzers, Analytical Microscopes, Elemental Analysis Instruments, and Others. Chromatography and Spectroscopy Instruments are the leading segments, widely used in pharmaceuticals, environmental testing, and food safety due to their high accuracy, sensitivity, and versatility. The growing need for precise, real-time, and automated analysis in both laboratory and industrial settings continues to drive demand for these technologies .

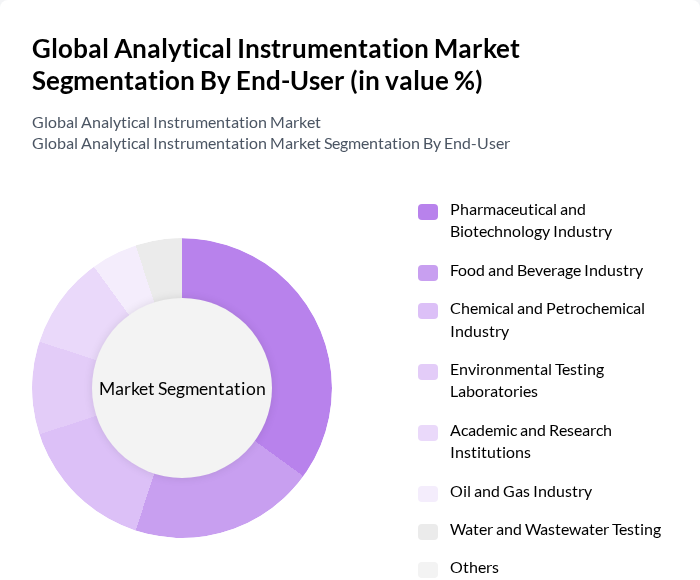

By End-User:End-users include the Pharmaceutical and Biotechnology Industry, Food and Beverage Industry, Chemical and Petrochemical Industry, Environmental Testing Laboratories, Academic and Research Institutions, Oil and Gas Industry, Water and Wastewater Testing, and Others. The Pharmaceutical and Biotechnology Industry remains the dominant segment, propelled by the increasing need for drug discovery, stringent regulatory compliance, and robust quality assurance requirements. Environmental testing, food safety, and chemical manufacturing are also significant end-user segments, reflecting the broadening application scope of analytical instrumentation .

The Global Analytical Instrumentation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Waters Corporation, Shimadzu Corporation, PerkinElmer, Inc., Bruker Corporation, Danaher Corporation, Mettler Toledo, ZEISS Group, Bio-Rad Laboratories, Inc., Sartorius AG, Eppendorf SE, F. Hoffmann-La Roche AG, Avantor, Inc., Illumina, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the analytical instrumentation market appears promising, driven by ongoing technological advancements and increasing regulatory requirements. As industries continue to prioritize quality control and compliance, the demand for sophisticated analytical tools is expected to rise. Furthermore, the integration of artificial intelligence and machine learning into analytical processes will enhance data analysis capabilities, leading to more efficient operations. Companies that invest in innovative technologies and skilled workforce development will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Chromatography Instruments Spectroscopy Instruments Mass Spectrometry Instruments Electrochemical Analyzers Analytical Microscopes Elemental Analysis Instruments Others |

| By End-User | Pharmaceutical and Biotechnology Industry Food and Beverage Industry Chemical and Petrochemical Industry Environmental Testing Laboratories Academic and Research Institutions Oil and Gas Industry Water and Wastewater Testing Others |

| By Application | Quality Control and Assurance Research and Development Clinical Diagnostics Environmental Monitoring Material Analysis Process Optimization Others |

| By Technology | Gas Chromatography Liquid Chromatography UV-Vis Spectroscopy NMR Spectroscopy Mass Spectrometry FTIR Spectroscopy Raman Spectroscopy Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Market Segment | Industrial Applications Laboratory Applications Field Applications Others |

| By Product Lifecycle Stage | New Products Mature Products Declining Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical R&D Laboratories | 100 | Laboratory Managers, R&D Directors |

| Environmental Testing Facilities | 60 | Quality Control Managers, Environmental Scientists |

| Food Safety Testing Labs | 40 | Food Safety Officers, Laboratory Technicians |

| Academic Research Institutions | 50 | Research Professors, Lab Coordinators |

| Industrial Manufacturing Quality Assurance | 50 | Quality Assurance Managers, Process Engineers |

The Global Analytical Instrumentation Market is valued at approximately USD 55 billion, driven by advancements in analytical technologies, automation, and the integration of AI and cloud-based analytics in laboratory workflows.