Region:Asia

Author(s):Rebecca

Product Code:KRAC3895

Pages:90

Published On:October 2025

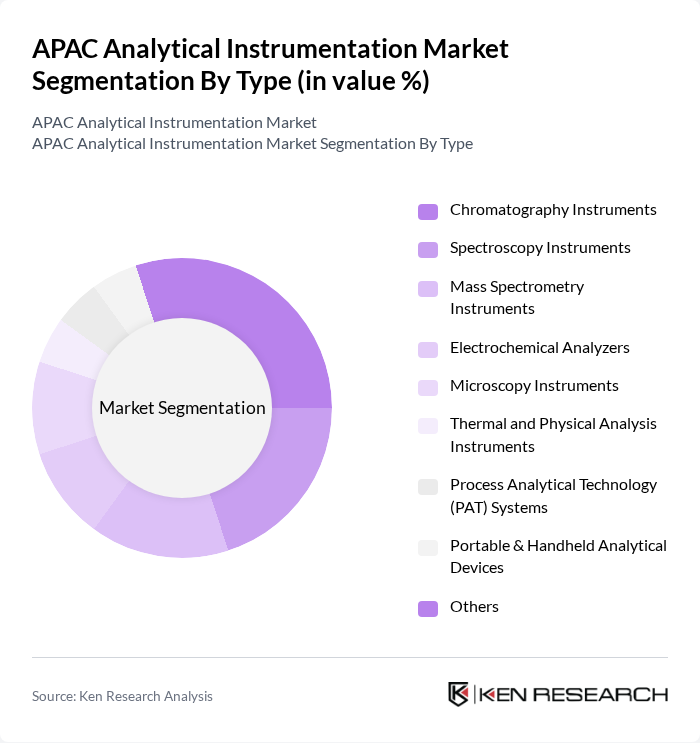

By Type:The analytical instrumentation market is segmented into Chromatography Instruments, Spectroscopy Instruments, Mass Spectrometry Instruments, Electrochemical Analyzers, Microscopy Instruments, Thermal and Physical Analysis Instruments, Process Analytical Technology (PAT) Systems, Portable & Handheld Analytical Devices, and Others. Chromatography and spectroscopy instruments represent the largest segments, driven by their widespread use in pharmaceutical, environmental, and industrial applications. The market is witnessing increased demand for portable and handheld devices, as well as PAT systems, due to the need for real-time monitoring and on-site analysis in manufacturing and field applications.

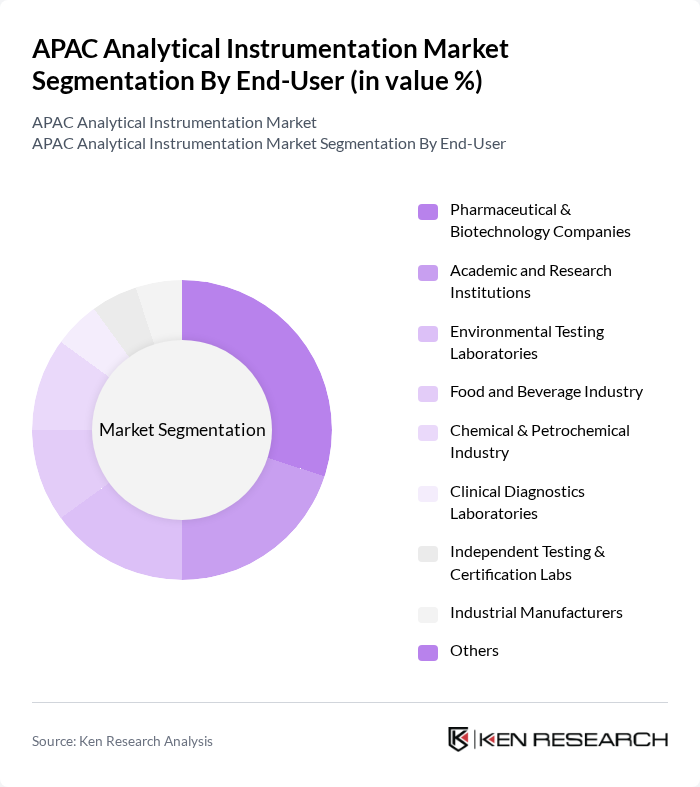

By End-User:The end-user segmentation includes Pharmaceutical & Biotechnology Companies, Academic and Research Institutions, Environmental Testing Laboratories, Food and Beverage Industry, Chemical & Petrochemical Industry, Clinical Diagnostics Laboratories, Independent Testing & Certification Labs, Industrial Manufacturers, and Others. Pharmaceutical and biotechnology companies are the largest end-users, driven by the need for precision in drug development and quality control. Academic and research institutions follow, supported by increasing R&D expenditures and government funding. Environmental testing laboratories and the food and beverage industry are significant segments due to regulatory mandates for safety and quality.

The APAC Analytical Instrumentation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agilent Technologies, Inc., Thermo Fisher Scientific Inc., PerkinElmer, Inc., Waters Corporation, Shimadzu Corporation, Bruker Corporation, HORIBA, Ltd., Merck KGaA, Mettler-Toledo International Inc., Hitachi High-Tech Corporation, JASCO Corporation, Bio-Rad Laboratories, Inc., Sartorius AG, Anton Paar GmbH, JEOL Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC analytical instrumentation market is poised for significant transformation, driven by technological advancements and evolving industry needs. The integration of AI and machine learning into analytical processes is expected to enhance efficiency and accuracy, while the shift towards sustainable practices will influence product development. Additionally, the growing emphasis on real-time data analytics will facilitate quicker decision-making, positioning companies to respond effectively to market demands and regulatory changes, ultimately shaping the future landscape of the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Chromatography Instruments Spectroscopy Instruments Mass Spectrometry Instruments Electrochemical Analyzers Microscopy Instruments Thermal and Physical Analysis Instruments Process Analytical Technology (PAT) Systems Portable & Handheld Analytical Devices Others |

| By End-User | Pharmaceutical & Biotechnology Companies Academic and Research Institutions Environmental Testing Laboratories Food and Beverage Industry Chemical & Petrochemical Industry Clinical Diagnostics Laboratories Independent Testing & Certification Labs Industrial Manufacturers Others |

| By Application | Quality Control and Assurance Research and Development Environmental Monitoring Clinical Diagnostics Food & Beverage Testing Chemical & Petrochemical Analysis Others |

| By Distribution Channel | Direct Sales Distributors and Resellers Online Sales Others |

| By Region | East Asia (China, Japan, South Korea) Southeast Asia (Singapore, Malaysia, Indonesia, Thailand, Vietnam, Philippines, etc.) South Asia (India, Bangladesh, Sri Lanka, etc.) Oceania (Australia, New Zealand, etc.) Rest of APAC |

| By Component | Hardware Software & Informatics Consumables & Reagents Services |

| By Price Range | Low-End Instruments Mid-Range Instruments High-End Instruments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical R&D Laboratories | 120 | R&D Managers, Lab Technicians |

| Environmental Testing Facilities | 90 | Quality Control Analysts, Environmental Scientists |

| Food Safety Testing Labs | 60 | Food Safety Inspectors, Lab Managers |

| Academic Research Institutions | 50 | Research Professors, Graduate Students |

| Industrial Manufacturing Plants | 70 | Process Engineers, Quality Assurance Managers |

The APAC Analytical Instrumentation Market is valued at approximately USD 15 billion, driven by increasing demand for advanced analytical techniques across various sectors, including pharmaceuticals, environmental monitoring, and food safety.