Global Antacids Market Overview

- The Global Antacids Market is valued at USD 7.6 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of gastrointestinal disorders such as gastroesophageal reflux disease (GERD), a rising geriatric population, and heightened consumer awareness regarding digestive health and wellness. The market has seen a notable uptick in sales due to the convenience and accessibility of antacid products, which are widely used to alleviate symptoms of heartburn and acid reflux. E-commerce channels have further accelerated growth, with double-digit increases in online antacid purchases reported by major brands.

- Key players in this market include the United States, Germany, and China, which dominate due to their large populations, high healthcare expenditure, and well-established pharmaceutical industries. North America holds the largest revenue share, accounting for approximately 46% of global antacid sales, driven by high prevalence of gastrointestinal disorders and robust OTC sales. Asia Pacific is experiencing the fastest expansion, attributed to rapid urbanization, changing dietary habits, and increased healthcare awareness.

- In 2023, the U.S. Food and Drug Administration (FDA) implemented updated regulations requiring clearer labeling on over-the-counter antacid products. These regulations are designed to enhance consumer safety by ensuring that all active ingredients and potential side effects are prominently displayed, promoting informed usage and reducing the risk of adverse reactions.

Global Antacids Market Segmentation

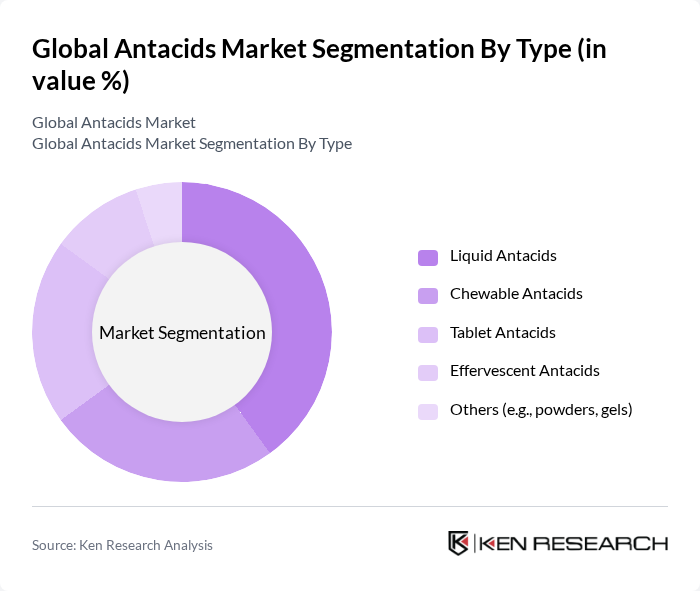

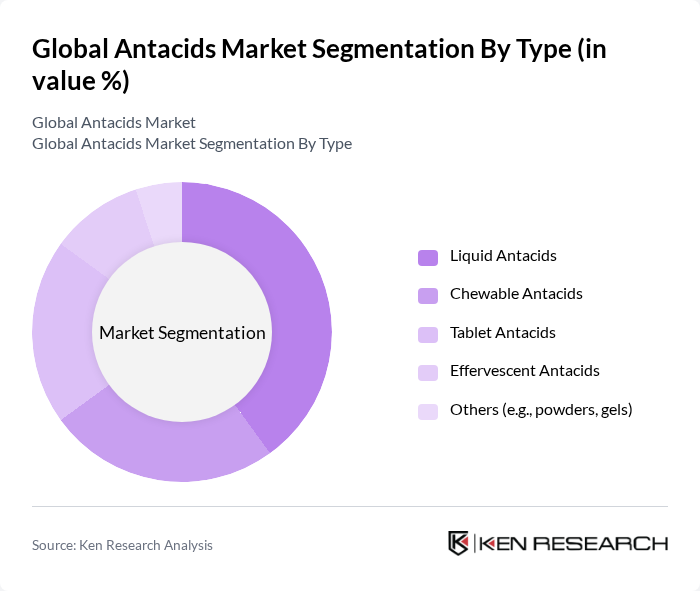

By Type:The antacids market can be segmented into various types, including Liquid Antacids, Chewable Antacids, Tablet Antacids, Effervescent Antacids, and Others (e.g., powders, gels). Among these, Liquid Antacids are currently leading the market due to their rapid onset of action and ease of consumption, especially among individuals seeking immediate relief from heartburn. Chewable Antacids hold a significant share, appealing to consumers who prefer a more palatable and convenient option. Effervescent forms are gaining traction, driven by their effectiveness and ease of use, particularly among younger demographics and those seeking fast relief.

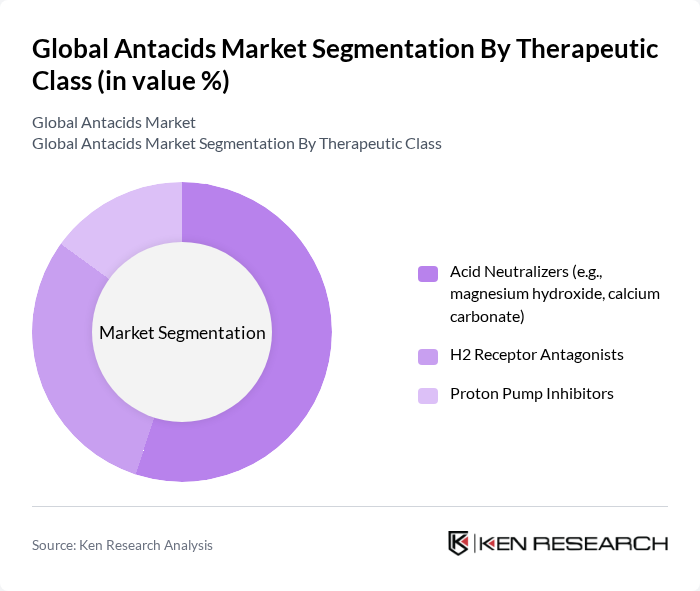

By Therapeutic Class:The therapeutic class segmentation includes Acid Neutralizers (e.g., magnesium hydroxide, calcium carbonate), H2 Receptor Antagonists, and Proton Pump Inhibitors. Acid Neutralizers continue to dominate the market due to their widespread use and rapid effectiveness in neutralizing stomach acid. H2 Receptor Antagonists are popular for providing longer-lasting relief, while Proton Pump Inhibitors are generally reserved for more severe or chronic conditions, resulting in a smaller market share.

Global Antacids Market Competitive Landscape

The Global Antacids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson, GlaxoSmithKline plc, Bayer AG, Procter & Gamble Co., Pfizer Inc., Sanofi S.A., Reckitt Benckiser Group plc, Takeda Pharmaceutical Company Limited, Merck & Co., Inc., Abbott Laboratories, AstraZeneca plc, Boehringer Ingelheim International GmbH, Dr. Reddy’s Laboratories Ltd., Sun Pharmaceutical Industries Ltd., and HRA Pharma contribute to innovation, geographic expansion, and service delivery in this space.

Global Antacids Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Gastrointestinal Disorders:The rise in gastrointestinal disorders, affecting approximately 60 million individuals in the None region, is a significant growth driver for the antacids market. Conditions such as acid reflux and gastritis are becoming more common, leading to a higher demand for antacid products. The World Health Organization reported that gastrointestinal diseases account for nearly 10% of global health expenditures, emphasizing the need for effective over-the-counter solutions to manage these conditions.

- Rising Consumer Awareness about Health and Wellness:In None, consumer awareness regarding health and wellness has surged, with 78% of the population actively seeking preventive healthcare solutions. This trend is reflected in the increasing sales of antacids, as consumers prioritize digestive health. The global health and wellness market is projected to reach $4.8 trillion in future, indicating a robust shift towards self-medication and preventive measures, further driving the demand for antacid products.

- Growth in the Geriatric Population:The geriatric population in None is expected to reach 22 million in future, significantly impacting the antacids market. Older adults are more susceptible to gastrointestinal issues, leading to increased consumption of antacids. According to the United Nations, the aging population is projected to grow by 3.2% annually, creating a sustained demand for digestive health products. This demographic shift presents a lucrative opportunity for antacid manufacturers to cater to the needs of older consumers.

Market Challenges

- Intense Competition Among Key Players:The antacids market in None is characterized by intense competition, with over 55 brands vying for market share. This saturation leads to price wars and reduced profit margins, making it challenging for new entrants to establish themselves. Major players like Johnson & Johnson and GlaxoSmithKline dominate the market, controlling approximately 42% of the total share, which further complicates the competitive landscape for smaller companies.

- Regulatory Hurdles and Compliance Issues:Navigating regulatory frameworks poses a significant challenge for antacid manufacturers in None. Compliance with stringent FDA regulations, which require extensive clinical testing and safety evaluations, can delay product launches. In future, the FDA is expected to increase scrutiny on over-the-counter medications, necessitating additional investments in compliance and quality assurance, which can strain resources for smaller firms in the industry.

Global Antacids Market Future Outlook

The future of the antacids market in None appears promising, driven by evolving consumer preferences and technological advancements. The shift towards over-the-counter medications is expected to continue, with a growing emphasis on convenience and accessibility. Additionally, the rise of online pharmacies is likely to enhance distribution channels, making antacids more readily available. As consumers increasingly seek personalized medicine, manufacturers will need to innovate and adapt their product offerings to meet these changing demands effectively.

Market Opportunities

- Development of Innovative Formulations:There is a significant opportunity for manufacturers to develop innovative antacid formulations that cater to specific consumer needs. For instance, creating products that combine antacids with probiotics could appeal to health-conscious consumers. The global probiotics market is projected to reach $80 billion in future, indicating a growing interest in products that promote digestive health.

- Expansion into Emerging Markets:Emerging markets in None present a lucrative opportunity for antacid manufacturers. With increasing disposable incomes and a rising middle class, the demand for healthcare products is expected to grow. The World Bank estimates that the middle-class population in None will increase by 18 million in future, creating a larger consumer base for antacid products and enhancing market potential.