Region:Asia

Author(s):Dev

Product Code:KRAD1775

Pages:91

Published On:November 2025

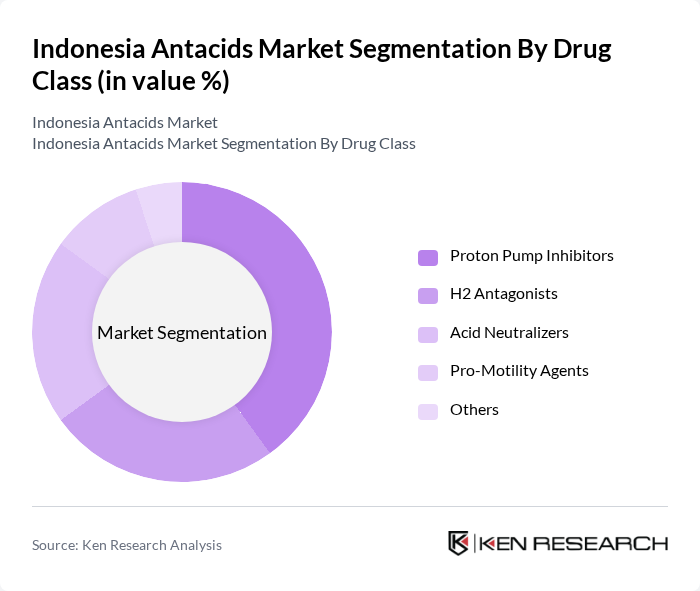

By Drug Class:The antacids market can be segmented into various drug classes, including Proton Pump Inhibitors, H2 Antagonists, Acid Neutralizers, Pro-Motility Agents, and Others. Among these, Proton Pump Inhibitors are gaining significant traction due to their effectiveness in treating severe acid-related disorders. The increasing awareness of gastrointestinal health, combined with a growing preference for prescription medications for chronic symptoms and OTC options for acute relief, is driving this trend.

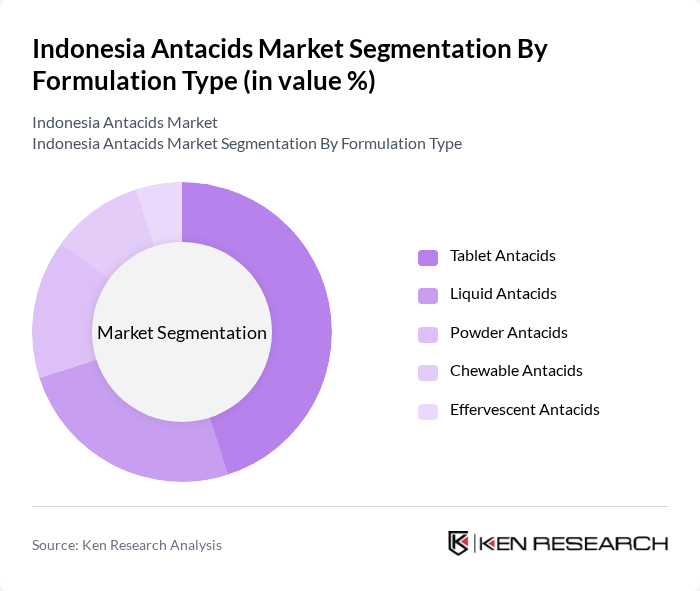

By Formulation Type:The market is also segmented by formulation type, which includes Tablet Antacids, Liquid Antacids, Powder Antacids, Chewable Antacids, Effervescent Antacids, and Others. Tablet Antacids are the most popular choice among consumers due to their convenience and ease of use. The growing trend of self-medication, preference for portable solutions, and the expansion of modern retail and e-commerce channels are contributing to the dominance of this segment.

The Indonesia Antacids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kalbe Farma, Kimia Farma, Sanofi Indonesia, Pfizer Indonesia, Johnson & Johnson Indonesia, Novartis Indonesia, Merck Sharp & Dohme Indonesia, Darya-Varia Laboratoria, Sido Muncul, Unilever Indonesia, Reckitt Benckiser Indonesia, Abbott Indonesia, Takeda Indonesia, Bayer Indonesia, Soho Global Health contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia antacids market is expected to evolve significantly, driven by increasing health awareness and a shift towards preventive healthcare. As disposable incomes rise, consumers are likely to invest more in health-related products, including antacids. The trend towards online purchasing will also reshape distribution channels, making products more accessible. Furthermore, the growing demand for natural and organic antacids will encourage innovation, leading to the development of new formulations that cater to health-conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Proton Pump Inhibitors H2 Antagonists Acid Neutralizers Pro-Motility Agents Others |

| By Formulation Type | Tablet Antacids Liquid Antacids Powder Antacids Chewable Antacids Effervescent Antacids Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Other Distribution Channels |

| By End-User | Hospitals Clinics Retail Pharmacies Online Retailers Others |

| By Packaging Type | Bottles Blister Packs Sachets Tubes Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Income Level (Low, Middle, High) Others |

| By Region | Java Sumatra Bali Kalimantan Others |

| By Product Formulation | Antacid Combinations Single-Ingredient Antacids Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Antacid Usage | 100 | General Consumers, Patients with Gastrointestinal Issues |

| Healthcare Professional Insights | 60 | Gastroenterologists, Pharmacists, General Practitioners |

| Retail Market Feedback | 50 | Pharmacy Owners, Retail Managers |

| Market Trends and Preferences | 40 | Health and Wellness Influencers, Nutritionists |

| Regulatory Impact Assessment | 40 | Regulatory Affairs Specialists, Health Policy Analysts |

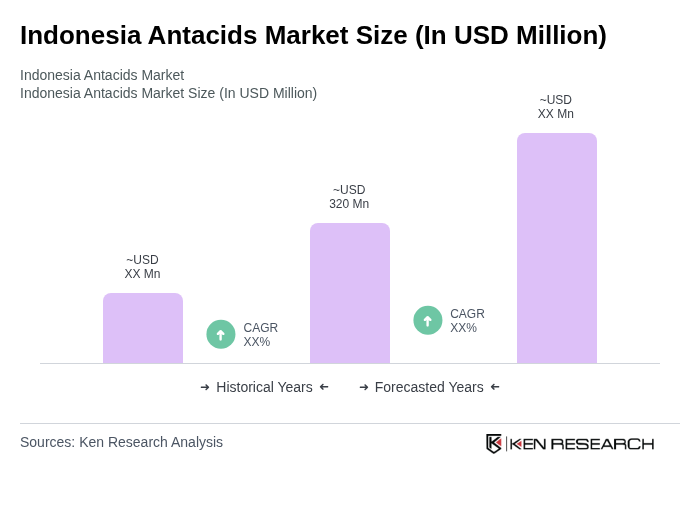

The Indonesia Antacids Market is valued at approximately USD 320 million, reflecting a steady growth driven by increasing gastrointestinal disorders, rising healthcare expenditure, and heightened consumer awareness regarding digestive health.