Region:Global

Author(s):Geetanshi

Product Code:KRAD4048

Pages:96

Published On:December 2025

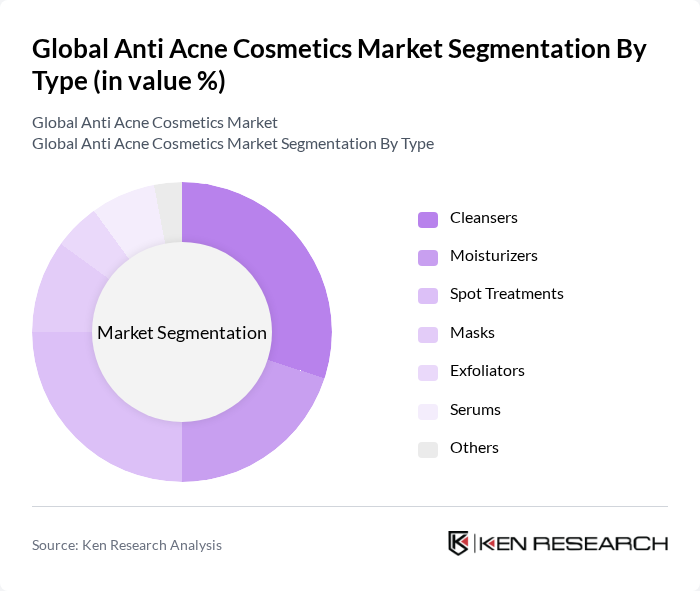

By Type:The market is segmented into various types of products, including cleansers, moisturizers, spot treatments, masks, exfoliators, serums, and others. Among these, cleansers and spot treatments are particularly popular due to their direct application and effectiveness in managing acne. The demand for these products is driven by consumer preferences for quick and visible results, leading to a significant market share for these segments.

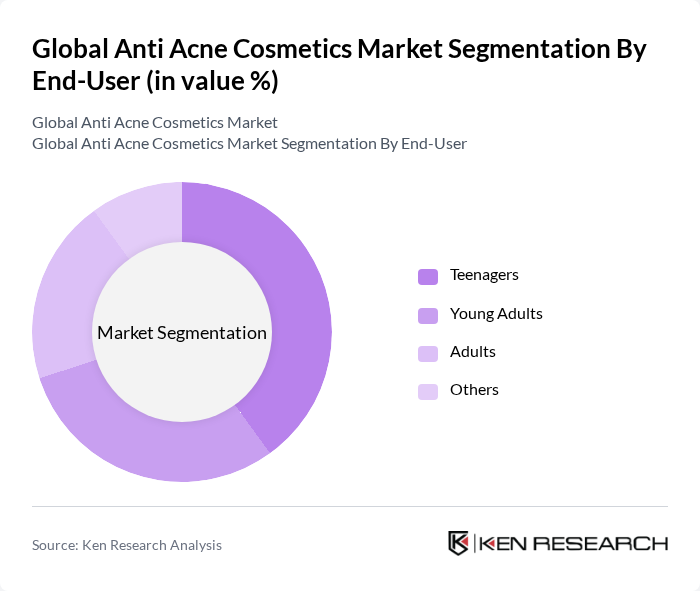

By End-User:The market is segmented based on end-users, including teenagers, young adults, adults, and others. Teenagers represent a significant portion of the market due to the high prevalence of acne during adolescence. Young adults also contribute to the market as they seek effective solutions for adult acne. The increasing awareness of skincare among these demographics drives the demand for targeted anti-acne products.

The Global Anti Acne Cosmetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Neutrogena, Proactiv, La Roche-Posay, Clinique, Clearasil, Paula's Choice, Murad, The Ordinary, CeraVe, Bioderma, SkinCeuticals, Kiehl's, Mario Badescu, Tatcha, L'Oréal Paris contribute to innovation, geographic expansion, and service delivery in this space.

The future of the anti-acne cosmetics market appears promising, driven by evolving consumer preferences and technological advancements. The trend towards cruelty-free and vegan products is expected to gain momentum, with consumers increasingly seeking ethical options. Additionally, the rise of personalized skincare solutions, supported by advancements in AI and data analytics, will likely enhance product offerings. Brands that adapt to these trends will be well-positioned to capture market share and meet the diverse needs of consumers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cleansers Moisturizers Spot Treatments Masks Exfoliators Serums Others |

| By End-User | Teenagers Young Adults Adults Others |

| By Product Formulation | Gel-based Products Cream-based Products Liquid Products Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Age Group | 20 Years 30 Years 40 Years Years and Above |

| By Skin Type | Oily Skin Dry Skin Combination Skin Sensitive Skin Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insights on Anti-Acne Products | 150 | Skincare Users, Acne Sufferers |

| Dermatologist Perspectives on Treatment Efficacy | 40 | Dermatologists, Skincare Specialists |

| Retailer Feedback on Product Demand | 90 | Beauty Retail Managers, Store Owners |

| Market Trends from Cosmetic Chemists | 40 | Cosmetic Chemists, Product Developers |

| Consumer Preferences in Online Shopping | 80 | Online Shoppers, E-commerce Users |

The Global Anti Acne Cosmetics Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by increased awareness of skincare and the rising prevalence of acne across various age groups.