Region:Global

Author(s):Shubham

Product Code:KRAA2629

Pages:86

Published On:August 2025

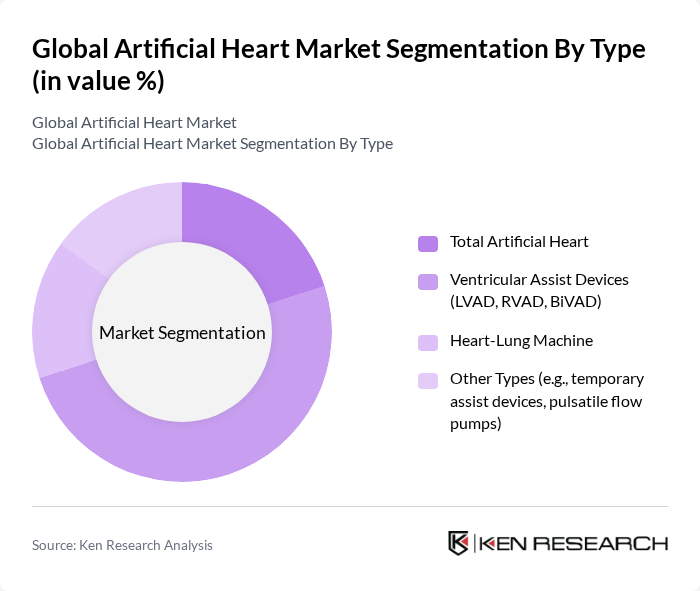

By Type:The market can be segmented into Total Artificial Heart, Ventricular Assist Devices (LVAD, RVAD, BiVAD), Heart-Lung Machine, and Other Types (e.g., temporary assist devices, pulsatile flow pumps). Among these, Ventricular Assist Devices (VADs) are currently dominating the market due to their effectiveness in managing heart failure, their increasing adoption in clinical settings, and their established use as both bridge-to-transplant and destination therapy.

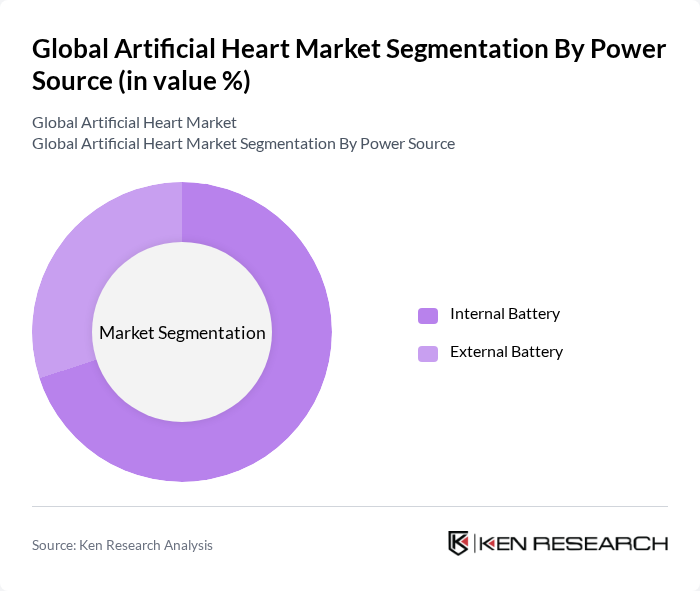

By Power Source:The market is categorized into Internal Battery and External Battery. The Internal Battery segment is leading the market due to its convenience, reliability, and ability to support patient mobility, making it the preferred choice for patients requiring long-term support.

The Global Artificial Heart Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, SynCardia Systems, LLC, CARMAT SA, Jarvik Heart, Inc., ReliantHeart, Inc., Terumo Corporation, LivaNova PLC, Abiomed, Inc., ELSA Medical, CorWave, AorTech International plc, BiVACOR, Inc., Xeltis, Realheart AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the artificial heart market appears promising, driven by ongoing technological advancements and an increasing focus on patient-centric care. As healthcare systems evolve, there is a growing emphasis on minimally invasive procedures and remote monitoring solutions. Additionally, the integration of artificial intelligence in device design is expected to enhance functionality and patient outcomes. These trends will likely foster a more robust market environment, encouraging innovation and improving access to life-saving technologies in the None region.

| Segment | Sub-Segments |

|---|---|

| By Type | Total Artificial Heart Ventricular Assist Devices (LVAD, RVAD, BiVAD) Heart-Lung Machine Other Types (e.g., temporary assist devices, pulsatile flow pumps) |

| By Power Source | Internal Battery External Battery |

| By End-User | Hospitals and Clinics Specialty Cardiac Centers Research Institutions Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Heart Failure Treatment Bridge to Transplantation Destination Therapy Bridge to Decision Others |

| By Patient Demographics | Adult Patients Pediatric Patients Geriatric Patients |

| By Price Range | Premium Mid-Range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiologists | 100 | Interventional Cardiologists, Electrophysiologists |

| Cardiac Surgeons | 80 | Cardiac Surgeons, Thoracic Surgeons |

| Hospital Administrators | 60 | Chief Medical Officers, Procurement Managers |

| Patients with Artificial Hearts | 50 | Post-operative Patients, Caregivers |

| Medical Device Experts | 40 | Biomedical Engineers, Regulatory Affairs Specialists |

The Global Artificial Heart Market is valued at approximately USD 3.6 billion, driven by the rising prevalence of cardiovascular diseases, advancements in medical technology, and an increasing geriatric population.