Global Athletic Footwear Market Overview

- The Global Athletic Footwear Market is valued at USD 139 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness, the rise of athleisure fashion, and the growing popularity of sports and fitness activities among consumers. The demand for innovative and technologically advanced footwear, such as those featuring lightweight materials, enhanced cushioning, and sustainability attributes, has also contributed significantly to market expansion .

- Key players in this market include the United States, China, and Germany. The Asia Pacific region, led by China, currently dominates the market due to rising disposable incomes, urbanization, and the expanding reach of e-commerce platforms. The United States maintains a strong position with its robust consumer base, high disposable income, and a culture that promotes fitness and sports. Germany benefits from a robust manufacturing sector and a strong emphasis on quality and performance in athletic footwear .

- In 2023, the European Union introduced regulations aimed at reducing the environmental impact of footwear production. These regulations require that all athletic footwear sold within the EU meet specific sustainability criteria, including the use of recyclable materials and reduced carbon emissions during manufacturing. This initiative is part of a broader effort to promote eco-friendly practices in the fashion and footwear industries .

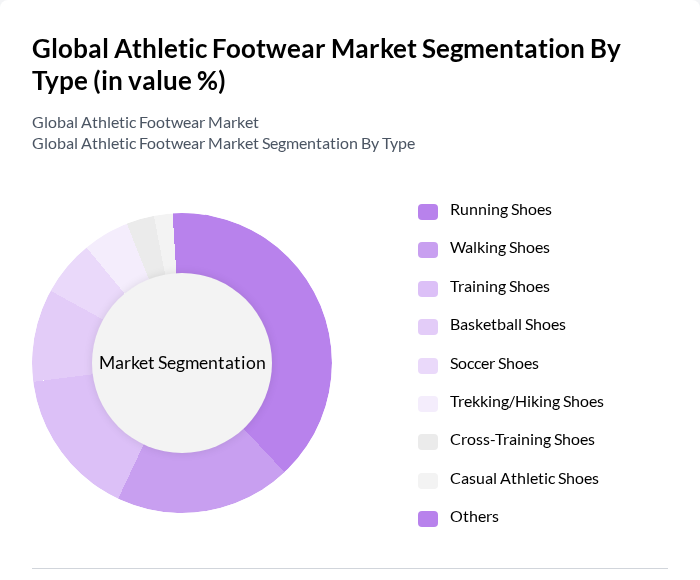

Global Athletic Footwear Market Segmentation

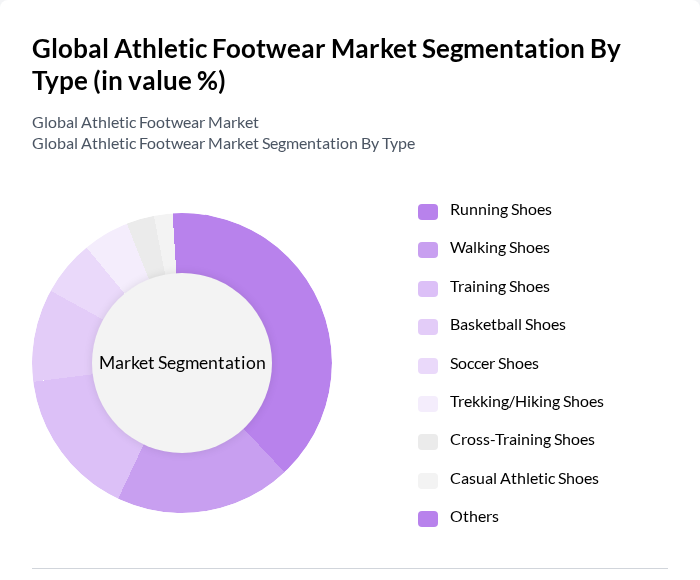

By Type:Among the various types of athletic footwear, running shoes hold the largest market share, driven by the increasing participation in running, jogging, and fitness activities worldwide. The trend toward health and wellness, as well as the popularity of marathons and running events, has led to heightened demand for specialized running shoes that offer enhanced comfort, support, and performance. There is also a growing consumer preference for shoes with advanced materials and sustainability features .

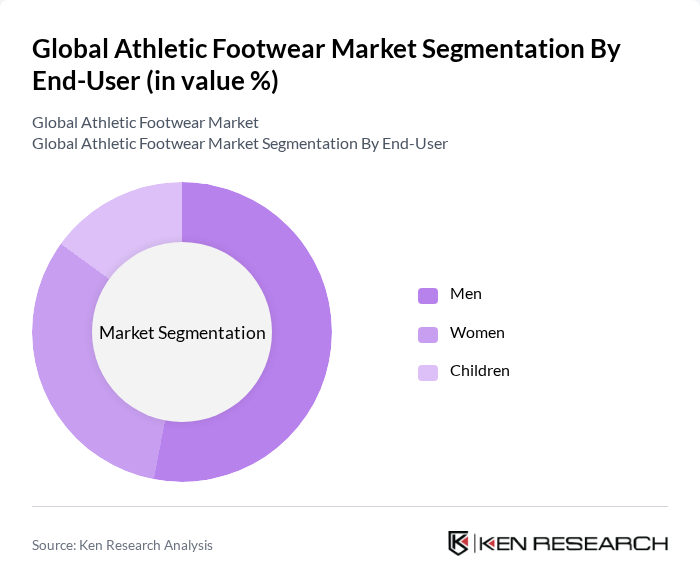

By End-User:The market is segmented by end-user into men, women, and children, with men accounting for the largest share. This is attributed to higher participation rates in sports and fitness activities among men, as well as increased spending on performance-oriented footwear. However, the women’s segment is experiencing notable growth, driven by rising female participation in fitness and sports, and targeted marketing campaigns. The children’s segment is also expanding, supported by increasing parental focus on health and physical activity for children .

Global Athletic Footwear Market Competitive Landscape

The Global Athletic Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., New Balance Athletics, Inc., ASICS Corporation, Reebok International Ltd., Skechers USA, Inc., Saucony, Merrell, Hoka One One, Brooks Sports, Inc., Salomon Group, Fila Holdings Corp., Li-Ning Company Limited, Wolverine World Wide, Inc., VF Corporation (Vans, The North Face), Anta Sports Products Limited, Mizuno Corporation, Decathlon S.A. contribute to innovation, geographic expansion, and service delivery in this space.

Global Athletic Footwear Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The global health and wellness market is projected to reach $4.2 trillion in future, driving demand for athletic footwear. As more individuals prioritize fitness, the number of gym memberships in the U.S. alone rose to 42 million in future. This trend correlates with a 16% increase in athletic footwear sales, as consumers seek appropriate footwear for their fitness activities, highlighting a direct link between health consciousness and footwear purchases.

- Rise in Sports Participation:According to the Sports & Fitness Industry Association, approximately 65% of Americans participated in sports or fitness activities in future, a significant increase from previous years. This surge in participation has led to a corresponding increase in athletic footwear sales, with the U.S. market alone generating $20 billion in revenue. The growing popularity of recreational sports and fitness events is expected to further boost demand for specialized footwear.

- Technological Advancements in Footwear:The athletic footwear industry is witnessing rapid innovation, with companies investing over $1.2 billion annually in R&D. Technologies such as 3D printing and smart footwear are gaining traction, enhancing performance and comfort. For instance, Nike's Flyknit technology has reduced material waste by 60%, appealing to environmentally conscious consumers. These advancements are expected to drive a 25% increase in sales of technologically enhanced footwear in future.

Market Challenges

- Intense Competition:The athletic footwear market is characterized by fierce competition, with major players like Nike, Adidas, and Puma dominating over 65% of the market share. This competitive landscape pressures companies to continuously innovate and reduce prices, impacting profit margins. In future, the average profit margin for athletic footwear brands fell to 9%, down from 15% in previous years, highlighting the challenges posed by aggressive pricing strategies and market saturation.

- Fluctuating Raw Material Prices:The volatility of raw material prices, particularly rubber and synthetic materials, poses a significant challenge for manufacturers. In future, the price of natural rubber surged by 35% due to supply chain disruptions and increased demand from the automotive sector. This fluctuation has led to increased production costs, forcing brands to either absorb costs or pass them onto consumers, which could negatively impact sales in a price-sensitive market.

Global Athletic Footwear Market Future Outlook

The future of the athletic footwear market appears promising, driven by ongoing trends in health consciousness and technological innovation. As consumers increasingly seek performance-enhancing footwear, brands are likely to invest more in R&D, leading to the introduction of advanced materials and smart technologies. Additionally, the rise of e-commerce is expected to facilitate broader market access, allowing brands to reach diverse consumer segments. This dynamic environment will foster growth and adaptation in the industry, ensuring its relevance in a rapidly changing marketplace.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia-Pacific, are witnessing a surge in disposable income, with a projected growth rate of 7% annually. This economic growth is expected to increase demand for athletic footwear, as more consumers prioritize fitness and leisure activities. Brands that strategically enter these markets can capitalize on this growing consumer base, potentially increasing their market share significantly.

- Sustainable Footwear Innovations:The demand for sustainable products is rising, with 75% of consumers willing to pay more for eco-friendly footwear. Brands that invest in sustainable materials and production processes can tap into this lucrative market segment. Innovations such as biodegradable materials and recycling programs are expected to attract environmentally conscious consumers, enhancing brand loyalty and driving sales growth in the coming years.