Region:Middle East

Author(s):Rebecca

Product Code:KRAC3320

Pages:84

Published On:October 2025

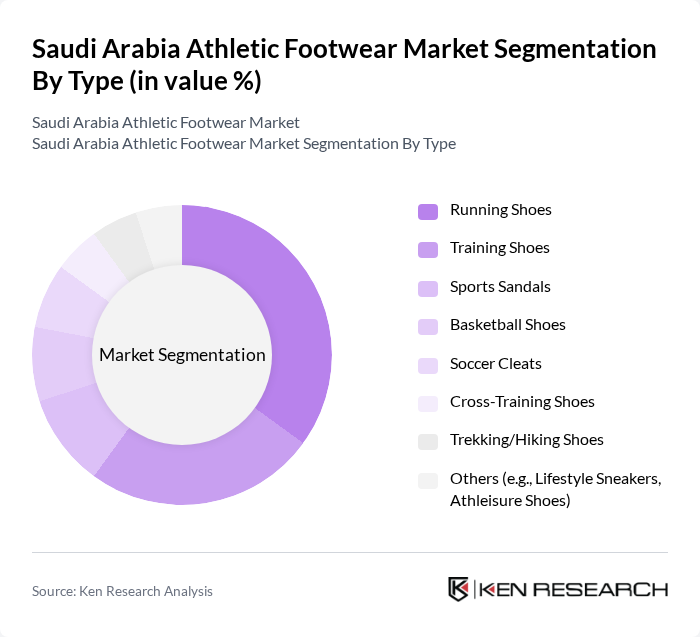

By Type:The athletic footwear market can be segmented into various types, including running shoes, training shoes, sports sandals, basketball shoes, soccer cleats, cross-training shoes, trekking/hiking shoes, and others such as lifestyle sneakers and athleisure shoes. Among these, running shoes are currently the most popular segment, driven by the increasing number of running events and a growing focus on fitness. Training shoes also hold a significant share, appealing to consumers engaged in gym workouts and fitness classes. The demand for sports sandals and other types is growing, particularly in warmer regions, as consumers seek versatile and breathable options for both casual and athletic use .

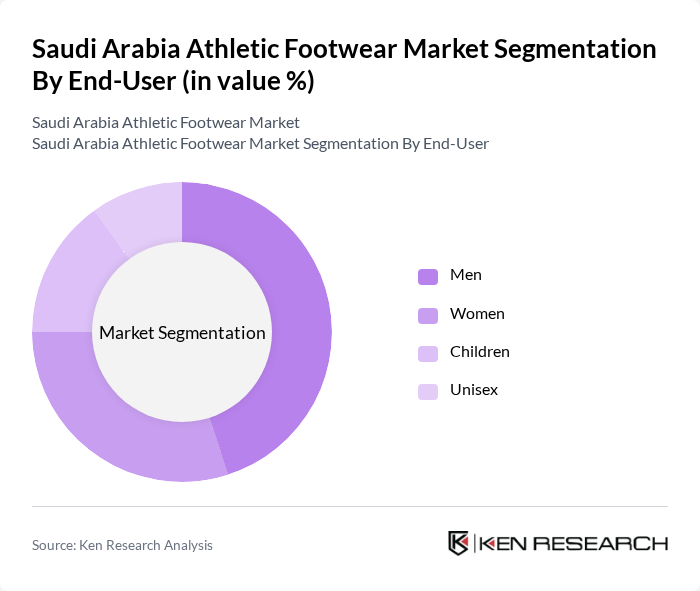

By End-User:The market can also be segmented by end-user demographics, including men, women, children, and unisex categories. Men represent the largest segment, driven by a higher participation rate in sports and fitness activities. Women are increasingly becoming a significant consumer group, particularly in the athleisure segment, as they seek stylish yet functional footwear. The children’s segment is also growing, fueled by the rising trend of youth sports and active lifestyles, supported by government and school-level initiatives to promote physical activity .

The Saudi Arabia Athletic Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., New Balance Athletics, Inc., ASICS Corporation, Skechers USA, Inc., Reebok International Ltd., Saucony, Mizuno Corporation, Hoka One One (Deckers Brands), On Holding AG (On Running), Li-Ning Company Limited, Anta Sports Products Limited, Decathlon S.A., Alhokair Group (Fawaz Abdulaziz Alhokair Co.), Sun & Sand Sports (Gulf Marketing Group), Sports Corner, RedTag, Centrepoint (Landmark Group) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabian athletic footwear market is poised for significant growth, driven by increasing health consciousness and a rising trend in sports participation. As e-commerce continues to expand, brands will need to adapt their strategies to meet the evolving preferences of consumers. Innovations in sustainable materials and technology will likely play a crucial role in attracting environmentally conscious buyers. Overall, the market is expected to evolve, presenting new opportunities for both established and emerging brands in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Running Shoes Training Shoes Sports Sandals Basketball Shoes Soccer Cleats Cross-Training Shoes Trekking/Hiking Shoes Others (e.g., Lifestyle Sneakers, Athleisure Shoes) |

| By End-User | Men Women Children Unisex |

| By Sales Channel | Online Retail Specialty Stores Supermarkets & Hypermarkets Direct Sales Others (e.g., Department Stores) |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Trend-Focused Customers |

| By Occasion | Casual Wear Sports Events Gym and Fitness Outdoor Activities |

| By Material | Synthetic Leather Mesh Others |

| By Region | Riyadh Jeddah Dammam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Athletic Footwear | 120 | Active Individuals, Fitness Enthusiasts |

| Retail Insights from Footwear Stores | 60 | Store Managers, Sales Associates |

| Market Trends from E-commerce Platforms | 50 | E-commerce Managers, Digital Marketing Specialists |

| Brand Perception Studies | 70 | Brand Managers, Marketing Directors |

| Distribution Channel Analysis | 40 | Logistics Managers, Supply Chain Analysts |

The Saudi Arabia Athletic Footwear Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increased health consciousness, sports participation, and the popularity of athleisure wear among consumers.