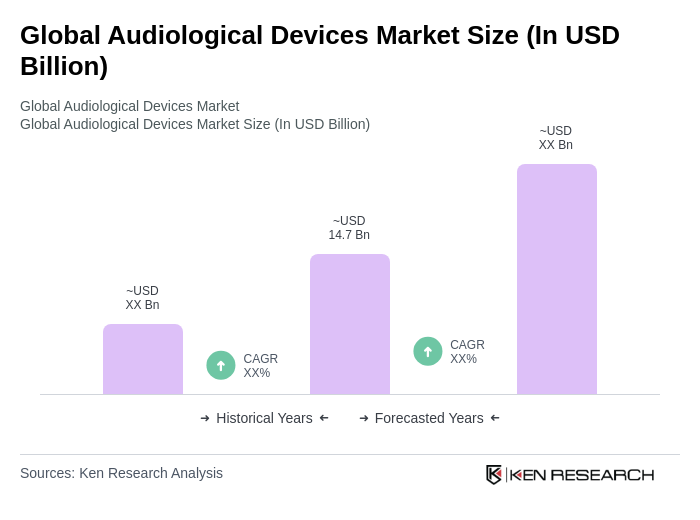

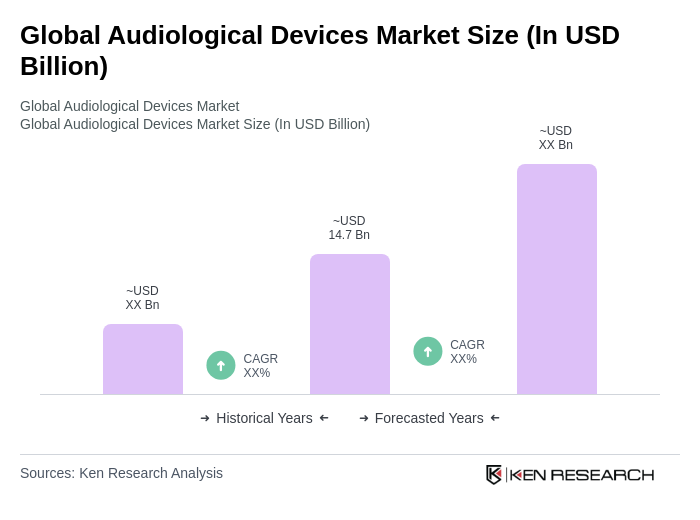

Global Audiological Devices Market Overview

- The Global Audiological Devices Market is valued at USD 14.7 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of hearing loss, rapid adoption of digital and Bluetooth-enabled hearing aids, and rising awareness regarding audiological health. The demand for innovative devices such as hearing aids and cochlear implants has surged, supported by a growing aging population, government-led hearing screening programs, and improved healthcare access.

- Key players in this market include the United States, Germany, and Japan, which dominate due to their strong healthcare infrastructure, high disposable incomes, and significant investments in research and development. These countries are at the forefront of technological advancements in audiological devices, leading to a higher adoption rate among consumers. Europe also leads the market, driven by advanced healthcare systems, robust government initiatives, and continuous R&D investment.

- In 2023, the U.S. Food and Drug Administration (FDA) implemented the "Medical Devices; Ear, Nose, and Throat Devices; Establishing Over-the-Counter Hearing Aids" Final Rule (2022) issued by the U.S. FDA, which streamlined the approval process for over-the-counter hearing aids. This regulation enhances accessibility for consumers, allowing them to purchase hearing aids without a prescription, thereby promoting self-management of hearing loss and increasing market penetration.

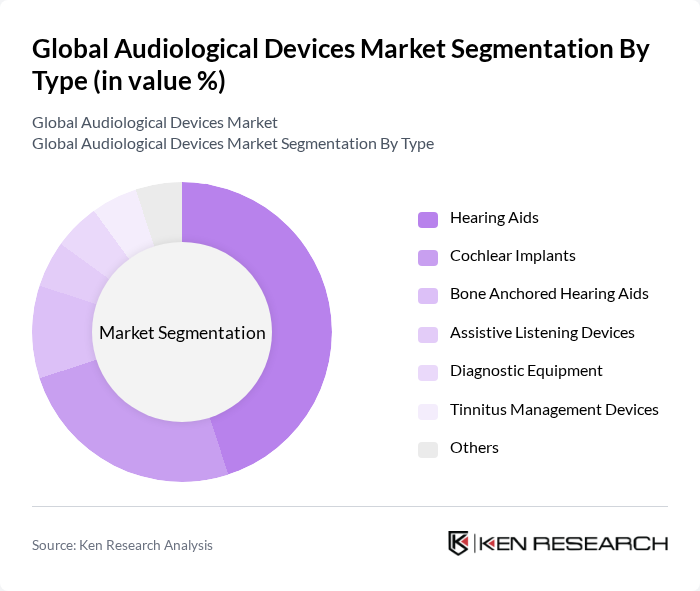

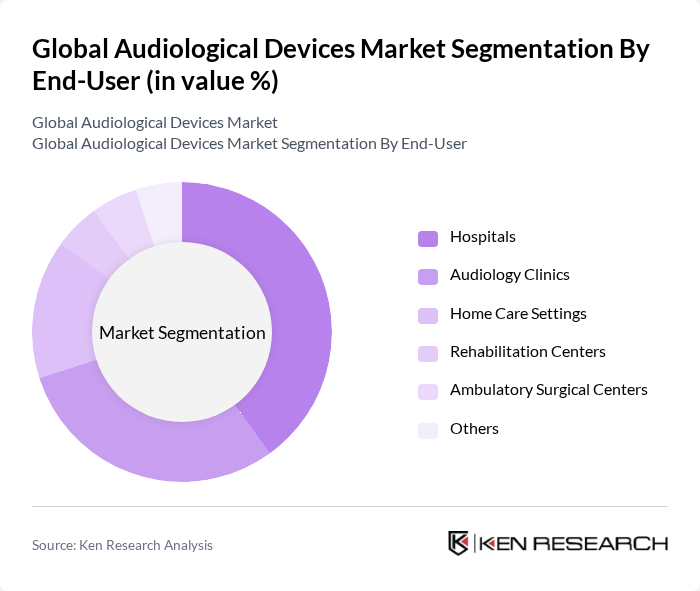

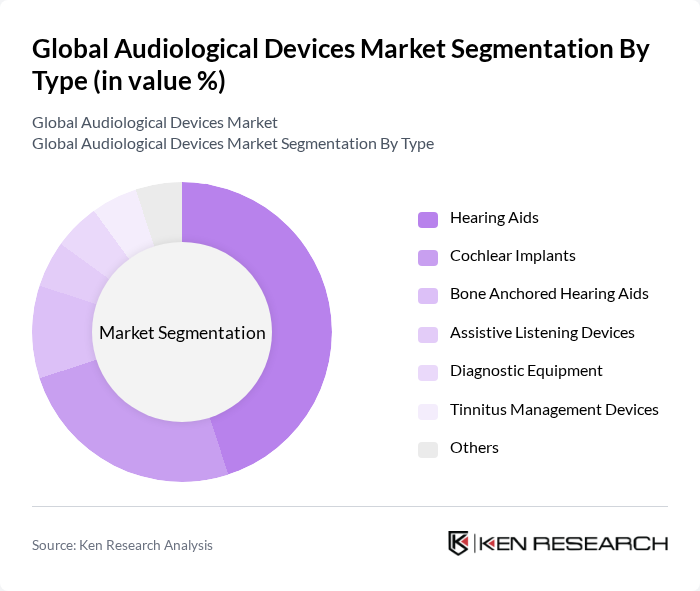

Global Audiological Devices Market Segmentation

By Type:The audiological devices market is segmented into various types, including Hearing Aids, Cochlear Implants, Bone Anchored Hearing Aids, Assistive Listening Devices, Diagnostic Equipment, Tinnitus Management Devices, and Others. Among these, Hearing Aids dominate the market due to their widespread use and continuous technological advancements, such as Bluetooth connectivity, digital signal processing, and integration with smartphones and other smart devices. The increasing awareness of hearing health and the growing elderly population further drive the demand for hearing aids, making them the leading subsegment in this category.

By End-User:The market is segmented by end-users, including Hospitals, Audiology Clinics, Home Care Settings, Rehabilitation Centers, Ambulatory Surgical Centers, and Others. Hospitals and Audiology Clinics are the leading end-users due to their comprehensive services and specialized care for hearing loss patients. The increasing number of audiology clinics and the growing trend of home healthcare are also contributing to the expansion of this segment, with hospitals being the primary providers of audiological services.

Global Audiological Devices Market Competitive Landscape

The Global Audiological Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sonova Holding AG, Demant A/S, GN Store Nord A/S, Cochlear Limited, Starkey Hearing Technologies, WS Audiology A/S, Amplifon S.p.A., Eargo, Inc., Sivantos Pte. Ltd., Rion Co., Ltd., MAICO Diagnostics GmbH, MED-EL Medical Electronics, Oticon Medical, Audicus, Hear.com, INVENTIS srl, Zounds Hearing, Inc., Arphi Electronics contribute to innovation, geographic expansion, and service delivery in this space.

Global Audiological Devices Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Hearing Loss:The World Health Organization estimates that by future, approximately 1.5 billion people will experience some degree of hearing loss, with over 430 million requiring rehabilitation. This rising prevalence is a significant driver for audiological devices, as more individuals seek solutions to manage their hearing impairments. The growing incidence of noise-induced hearing loss, particularly among younger populations, further emphasizes the urgent need for effective audiological interventions.

- Technological Advancements in Audiological Devices:The audiological devices sector is witnessing rapid technological innovations, with the global market for hearing aids projected to reach approximately $10 billion in future. Innovations such as digital signal processing, Bluetooth connectivity, and artificial intelligence are enhancing device functionality and user experience. These advancements not only improve sound quality but also facilitate better integration with smartphones and other devices, making hearing aids more appealing to consumers.

- Rising Geriatric Population:According to the United Nations, the global population aged 65 and older is expected to reach approximately 1.5 billion in future. This demographic shift is a crucial growth driver for audiological devices, as age-related hearing loss is prevalent among older adults. With increased life expectancy, the demand for hearing aids and other audiological solutions is anticipated to rise significantly, prompting manufacturers to innovate and expand their product offerings to cater to this growing market segment.

Market Challenges

- High Cost of Advanced Audiological Devices:The average cost of advanced hearing aids can range from approximately $1,000 to $4,000 per device, which poses a significant barrier for many potential users. This high price point limits access, particularly in low-income regions where disposable income is constrained. As a result, many individuals with hearing loss may forgo necessary treatment, leading to a growing unmet need in the market that challenges overall growth.

- Stigma Associated with Hearing Aids:Despite advancements in design and technology, a persistent stigma surrounding hearing aids remains a challenge. Many individuals associate hearing aids with aging and disability, which can deter them from seeking help. This social stigma is particularly pronounced in younger demographics, where the perception of hearing aids as unattractive or outdated can hinder market penetration and acceptance, ultimately affecting sales and growth potential.

Global Audiological Devices Market Future Outlook

The future of the audiological devices market appears promising, driven by ongoing technological advancements and an increasing focus on personalized healthcare solutions. As digital and connected devices become more prevalent, consumers will benefit from enhanced functionality and user experience. Additionally, the integration of tele-audiology services is expected to expand access to care, particularly in underserved areas, while sustainability initiatives in manufacturing will likely resonate with environmentally conscious consumers, shaping the market landscape positively.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present significant growth opportunities for audiological devices, with countries like India and Brazil experiencing rising disposable incomes and healthcare investments. In future, these markets are expected to see a surge in demand for affordable hearing solutions, driven by increased awareness and accessibility, creating a fertile ground for manufacturers to expand their reach and product offerings.

- Development of Smart Hearing Aids:The trend towards smart hearing aids, equipped with features like smartphone connectivity and health monitoring, is gaining traction. In future, the market for smart hearing aids is projected to grow significantly, appealing to tech-savvy consumers. This innovation not only enhances user experience but also opens new revenue streams for manufacturers, positioning them favorably in a competitive landscape.