Region:North America

Author(s):Shubham

Product Code:KRAA8761

Pages:94

Published On:November 2025

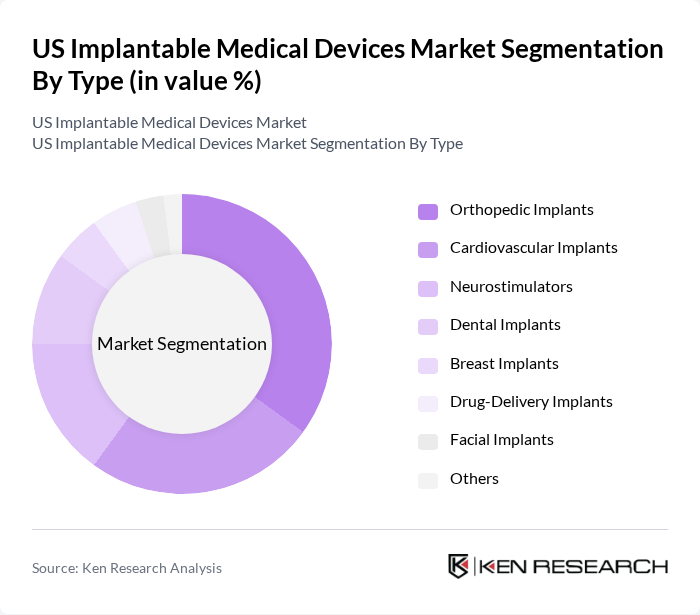

By Type:The market is segmented into various types of implantable medical devices, including orthopedic implants, cardiovascular implants, neurostimulators, dental implants, breast implants, drug-delivery implants, facial implants, and others. Among these, orthopedic implants are currently leading the market owing to the rising incidence of musculoskeletal disorders, an increasing number of joint replacement surgeries, and the growing demand for advanced materials such as titanium alloys and bioresorbable polymers. Technological advancements, including 3D printing and smart sensor integration, are driving innovation and expanding the application of orthopedic devices .

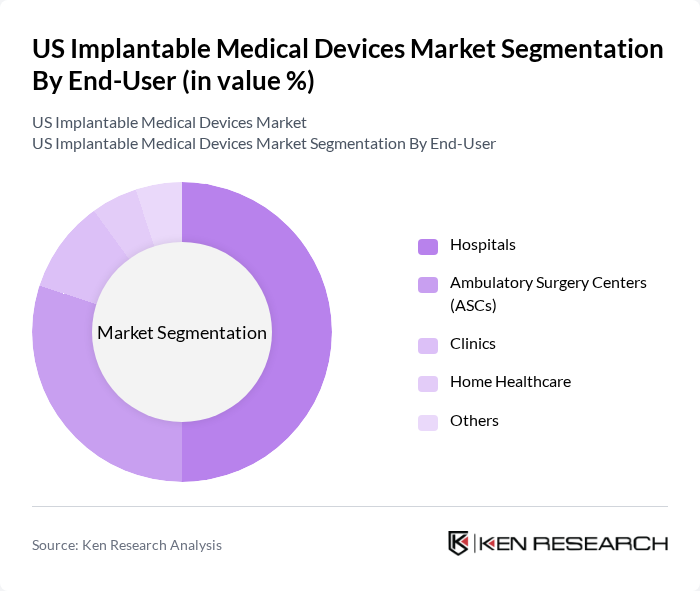

By End-User:The end-user segmentation includes hospitals, ambulatory surgery centers (ASCs), clinics, home healthcare, and others. Hospitals remain the dominant end-user segment, driven by the high volume of complex surgical procedures and the availability of advanced medical technologies and specialized staff. The increasing preference for outpatient procedures and minimally invasive surgeries is also contributing to the rapid growth of ASCs, which are becoming more popular for certain types of implant surgeries due to reduced recovery times and cost-effectiveness .

The US Implantable Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Johnson & Johnson (DePuy Synthes, Ethicon), Stryker Corporation, Zimmer Biomet Holdings, Inc., Edwards Lifesciences Corporation, B. Braun Melsungen AG, Cook Medical LLC, Terumo Corporation, Hologic, Inc., Intuitive Surgical, Inc., AtriCure, Inc., Nevro Corp., and Smith & Nephew plc contribute to innovation, geographic expansion, and service delivery in this space .

The future of the US implantable medical devices market appears promising, driven by ongoing technological innovations and an increasing focus on personalized medicine. As healthcare systems evolve, the integration of artificial intelligence and machine learning into device design and functionality is expected to enhance patient outcomes significantly. Additionally, the rise of home healthcare solutions will likely reshape the market landscape, providing patients with more accessible and convenient treatment options.

| Segment | Sub-Segments |

|---|---|

| By Type | Orthopedic Implants Cardiovascular Implants Neurostimulators Dental Implants Breast Implants Drug-Delivery Implants Facial Implants Others |

| By End-User | Hospitals Ambulatory Surgery Centers (ASCs) Clinics Home Healthcare Others |

| By Material | Metals Polymers Ceramics Biologics Composites Others |

| By Region | Northeast Midwest South West |

| By Application | Orthopedic Cardiovascular Neurology Dental Urology Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Regulatory Approval Type | Premarket Approval (PMA) (k) Clearance De Novo Classification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiovascular Implantable Devices | 60 | Cardiologists, Cardiac Surgeons |

| Orthopedic Implantable Devices | 50 | Orthopedic Surgeons, Hospital Procurement Officers |

| Neurostimulators and Pain Management Devices | 40 | Neurologists, Pain Management Specialists |

| Ophthalmic Implantable Devices | 40 | Ophthalmologists, Optometrists |

| Dental Implantable Devices | 45 | Dentists, Oral Surgeons |

The US Implantable Medical Devices Market is valued at approximately USD 58 billion, driven by technological advancements, the rising prevalence of chronic diseases, and an aging population seeking innovative healthcare solutions.